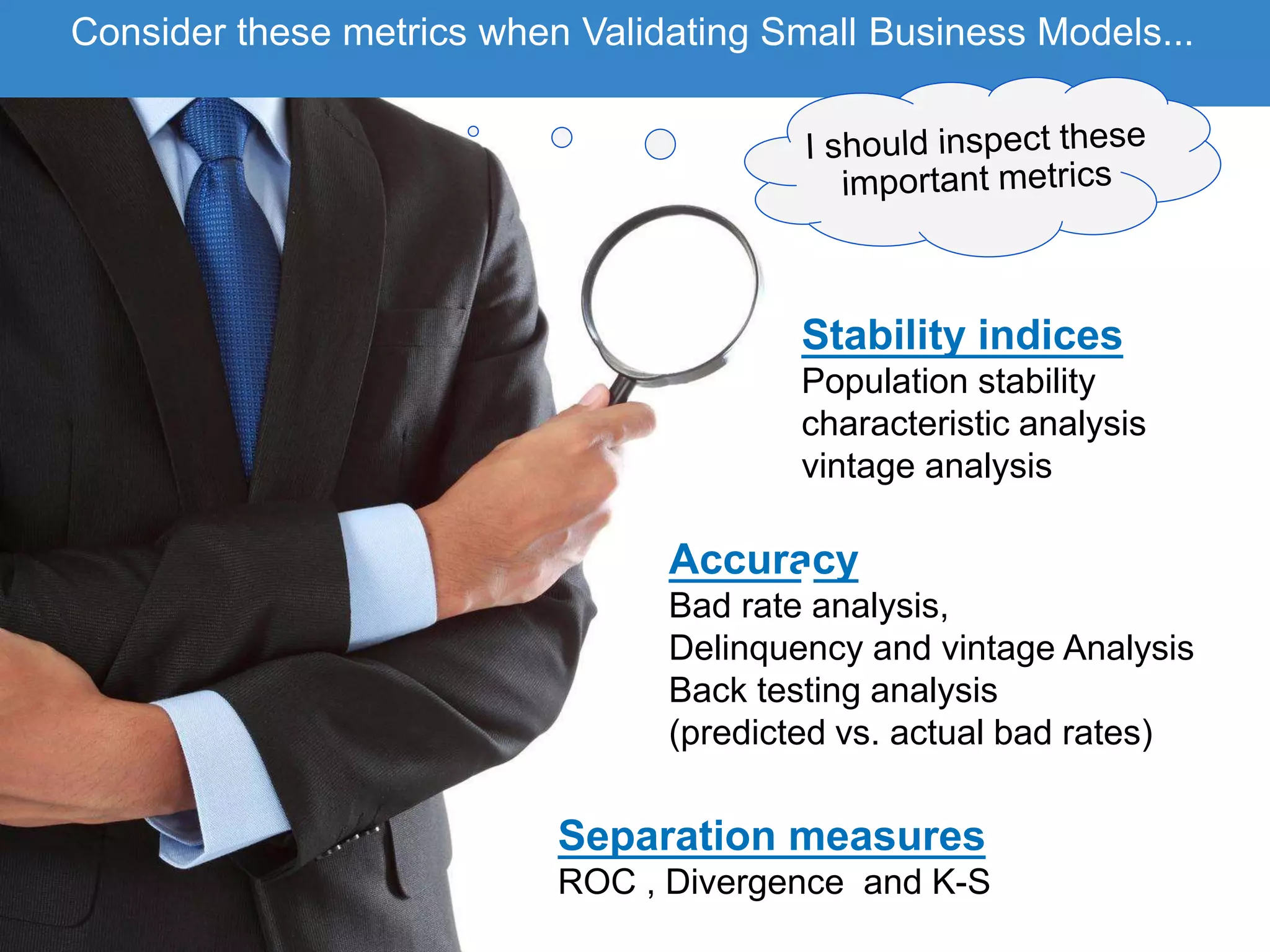

This document discusses common questions and challenges related to managing small and medium-sized enterprise (SME) lending portfolios. It provides answers and recommendations for validating small business models, ensuring lending rules are followed, convincing management to monitor SME portfolios, growing an SME portfolio quickly, maintaining margins without pricing out the market, and complying with regulations for SME lending. The document encourages treating SME portfolios similarly to retail portfolios and looking at profitability holistically, using risk-based pricing and automation to improve costs. It directs the reader to a blog and website for additional small business banking resources.