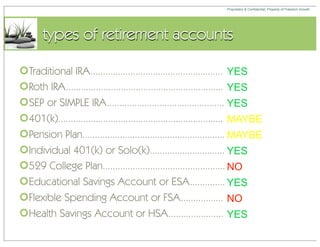

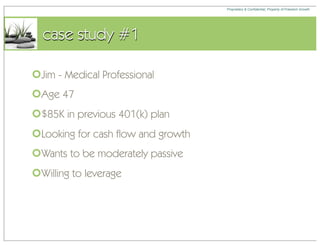

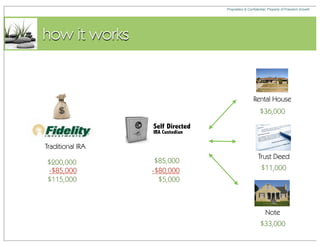

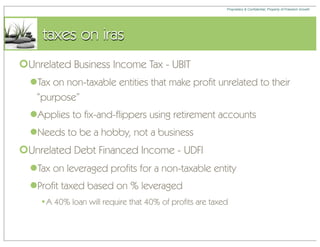

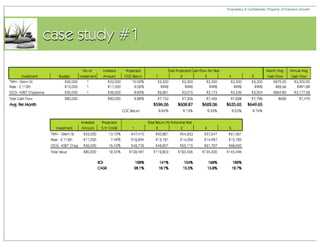

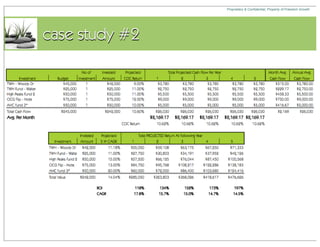

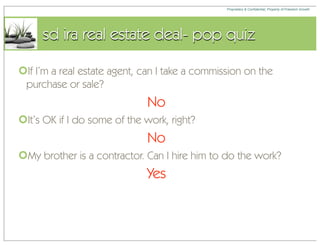

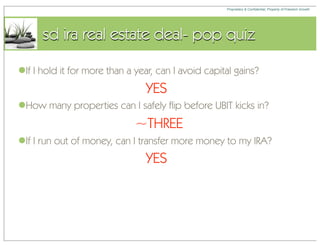

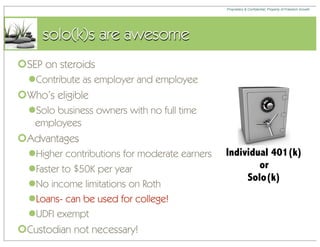

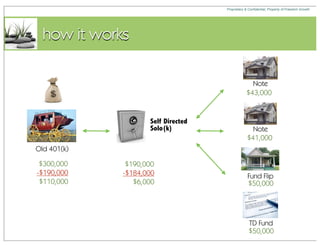

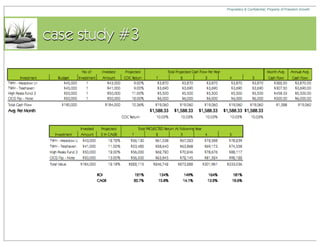

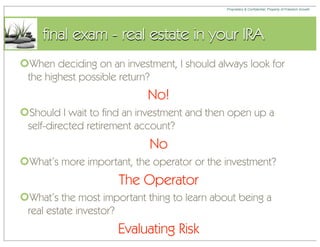

The document discusses using self-directed retirement accounts like IRAs to invest in real estate. It provides examples of clients who have used strategies like SD IRAs, special purchase LLCs, and Solo(k)s to purchase real estate investments and leverage their retirement funds. The key takeaways are that self-directed retirement accounts provide more investment options and flexibility than traditional retirement accounts, and allow using retirement funds to invest in real estate and other alternative assets.