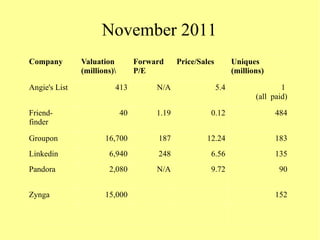

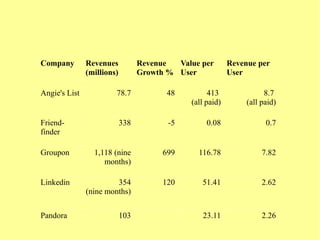

The document discusses the valuation of initial public offerings (IPOs) and highlights the importance of understanding how Wall Street underwriters assess IPO pricing. It provides a preliminary analysis of various companies' IPOs, focusing on metrics such as revenue growth and revenue per user as key drivers of valuation. Ultimately, it concludes that growth is essential for maximizing a company's offering price while minimizing dilution.