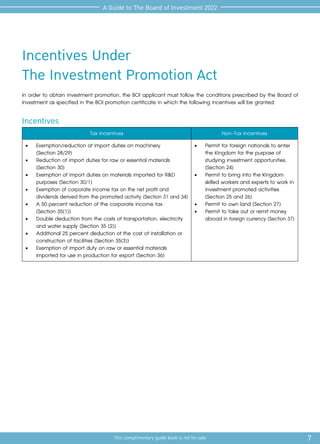

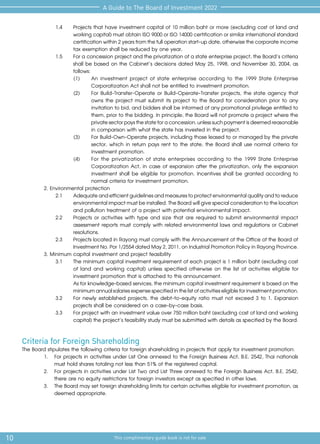

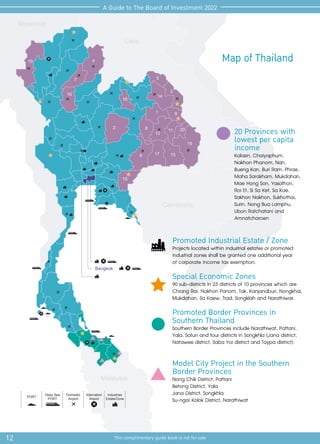

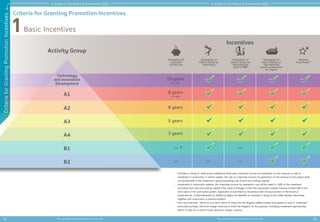

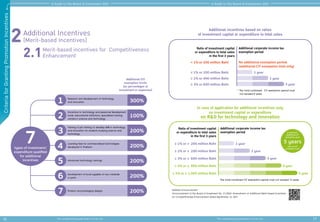

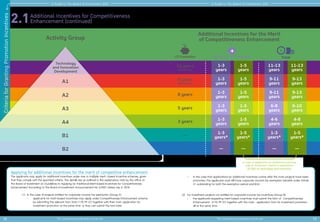

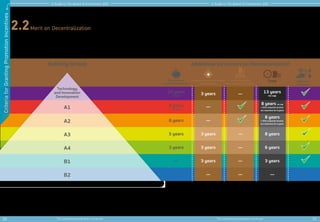

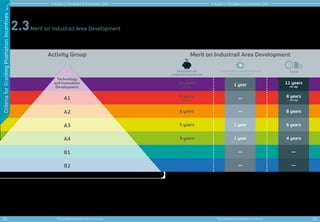

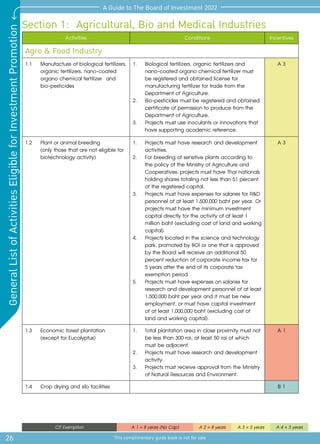

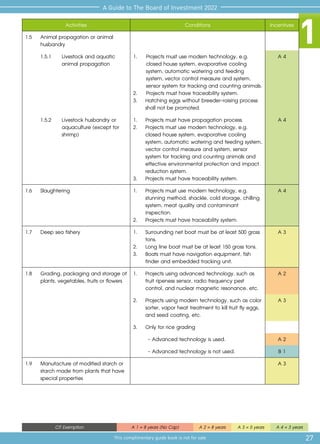

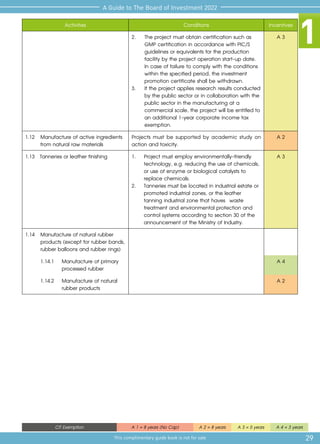

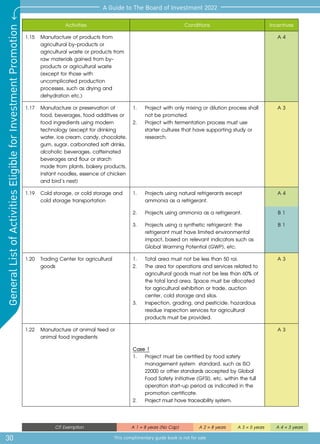

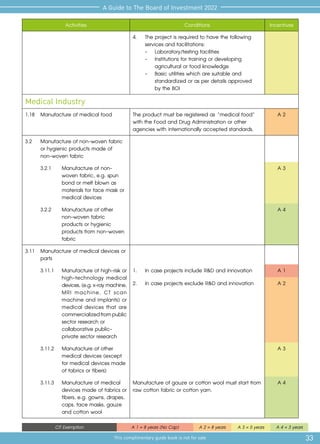

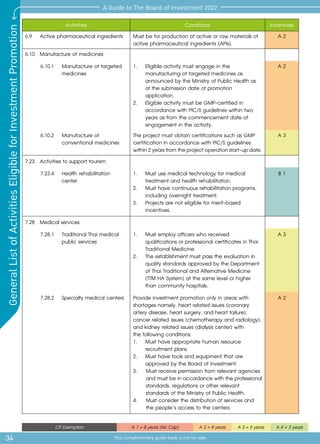

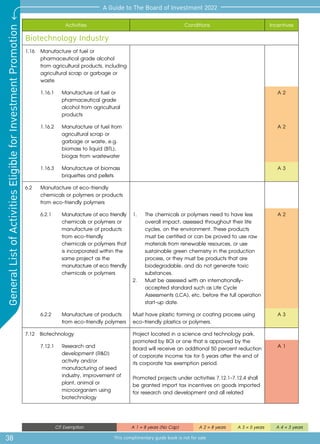

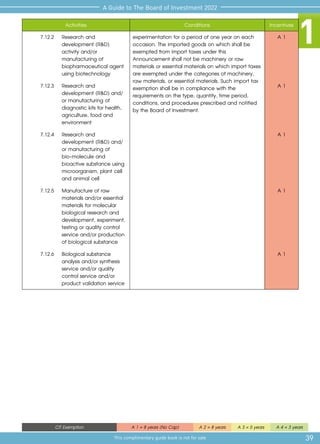

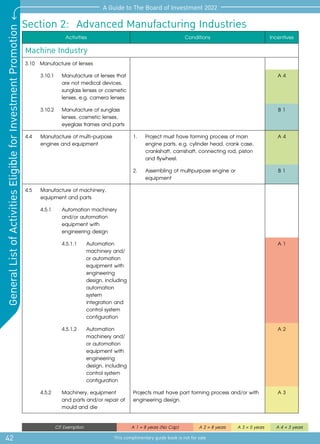

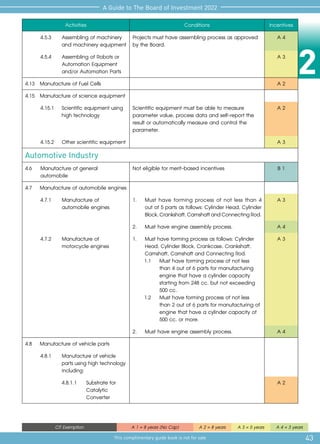

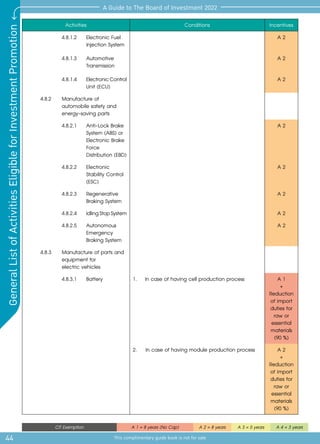

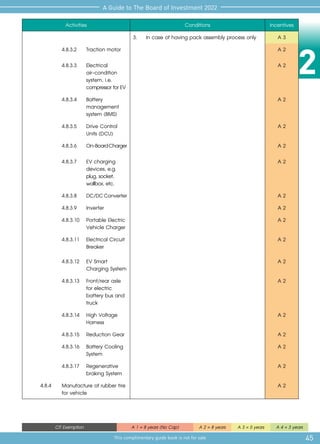

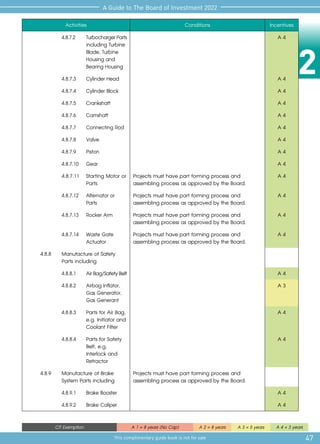

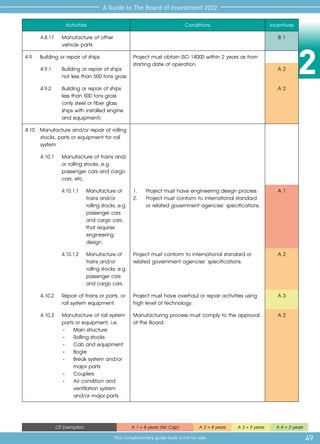

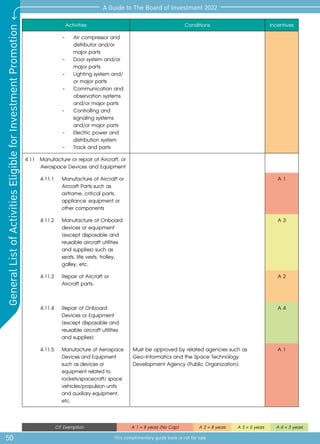

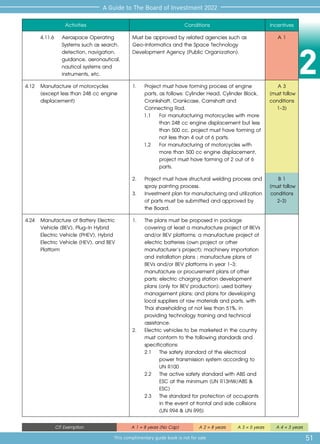

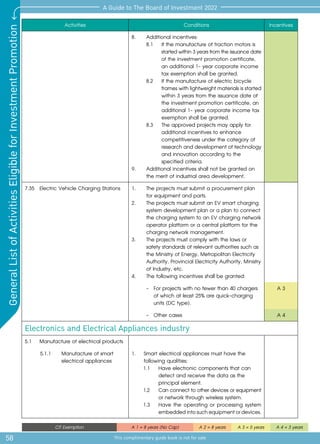

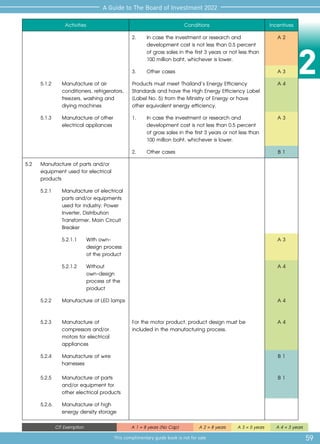

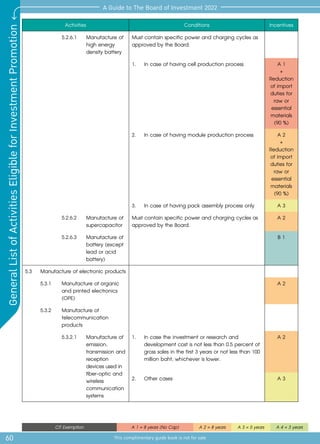

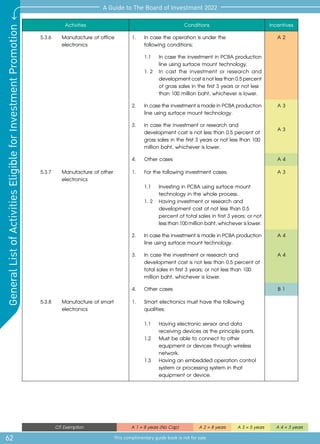

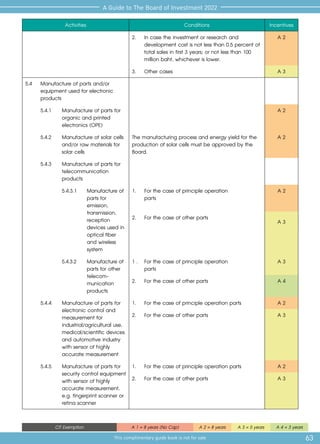

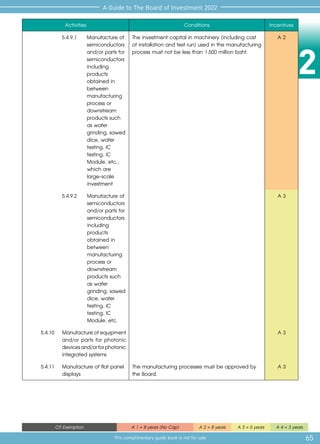

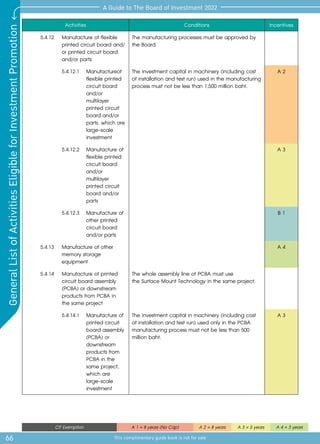

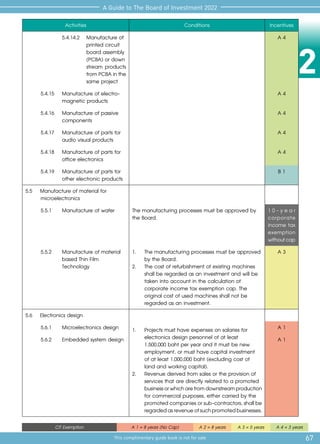

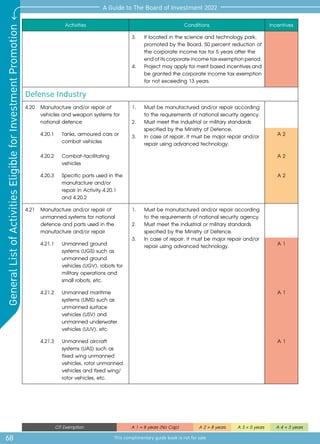

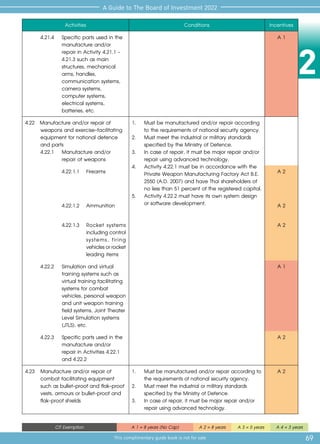

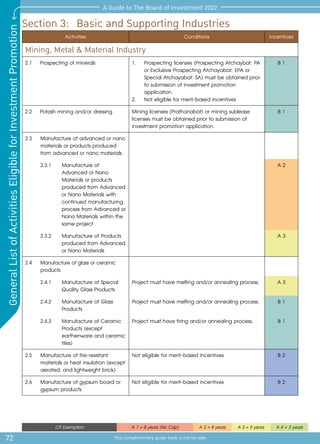

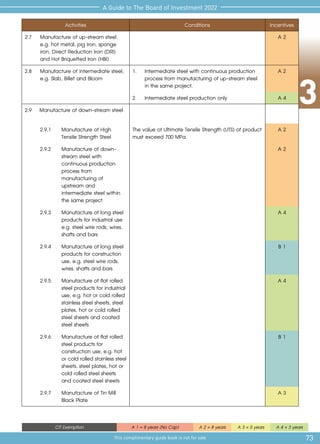

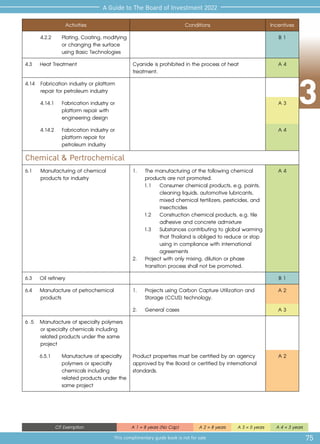

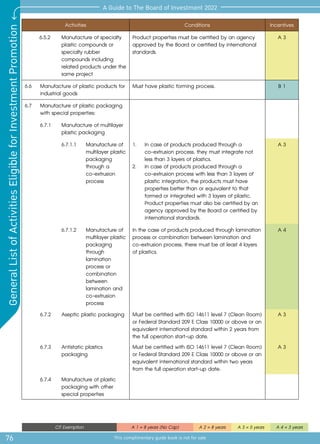

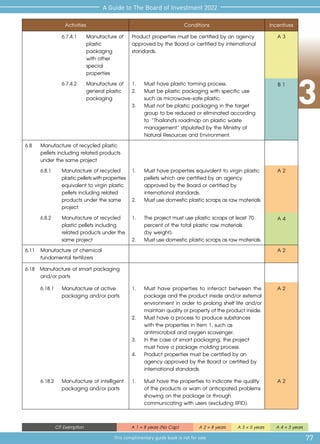

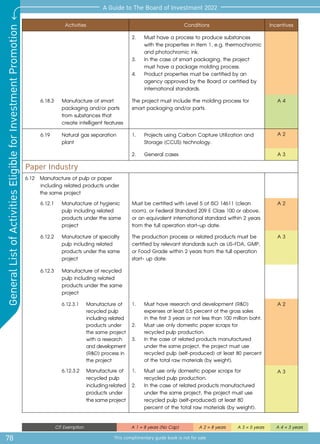

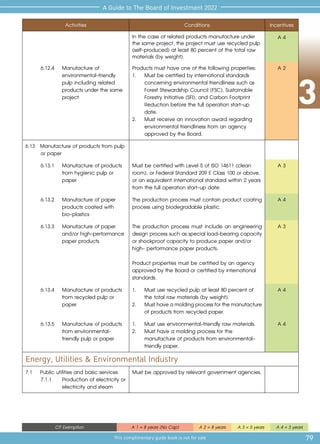

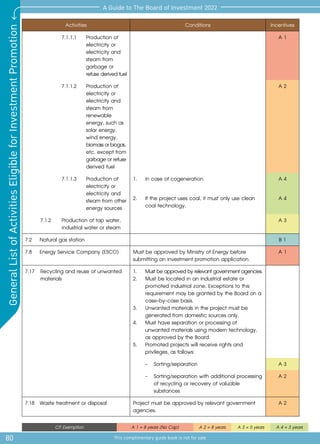

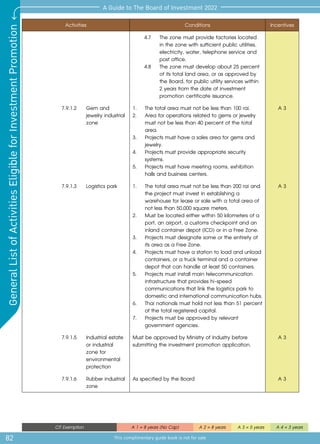

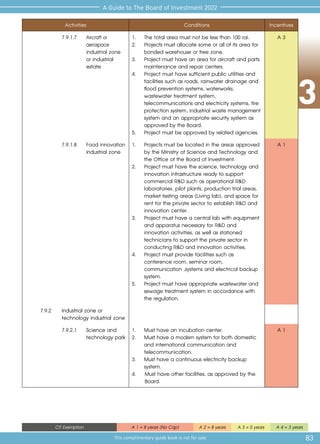

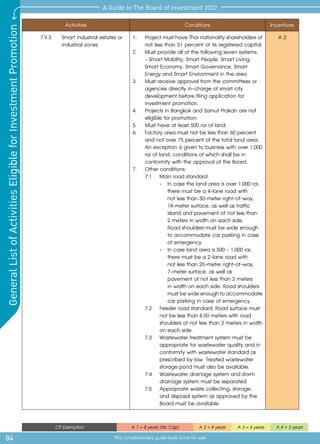

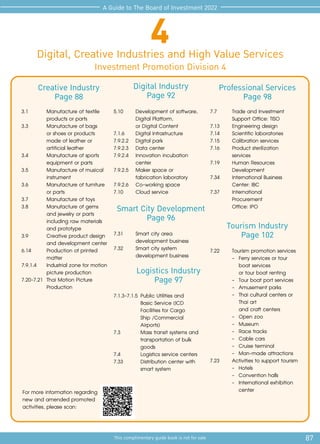

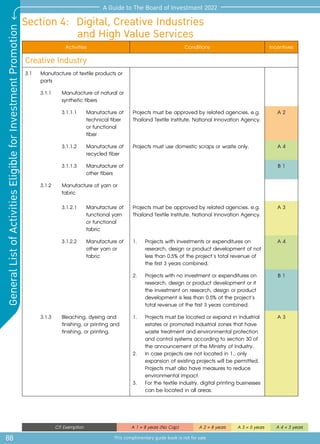

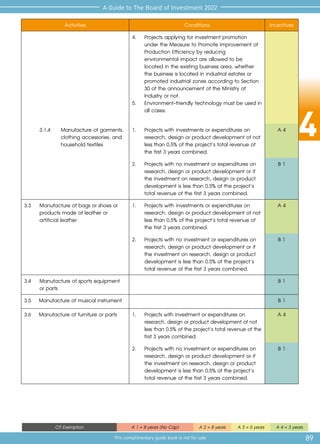

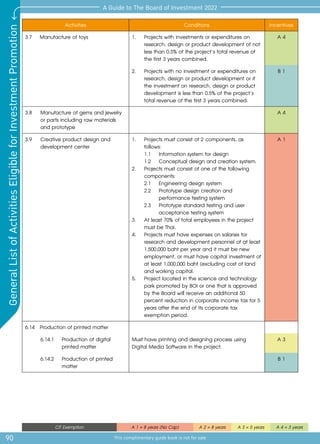

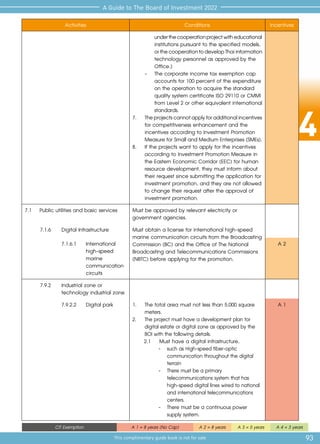

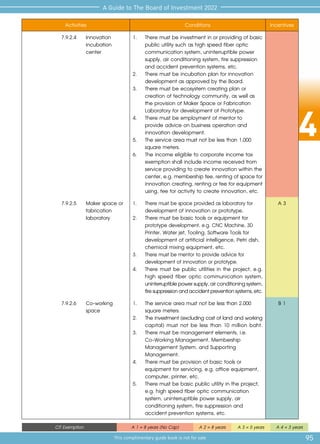

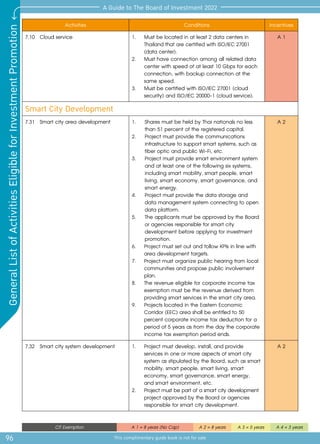

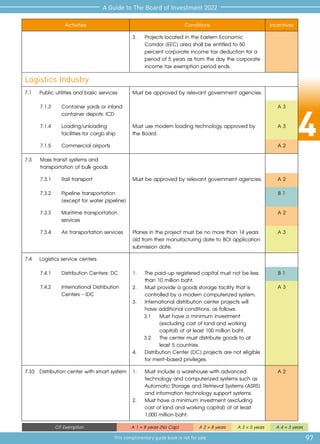

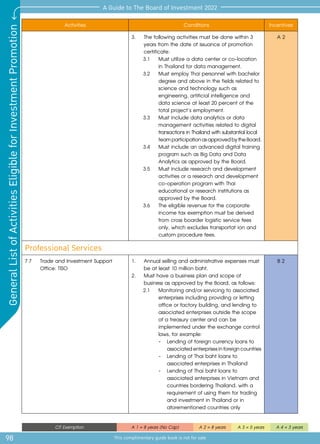

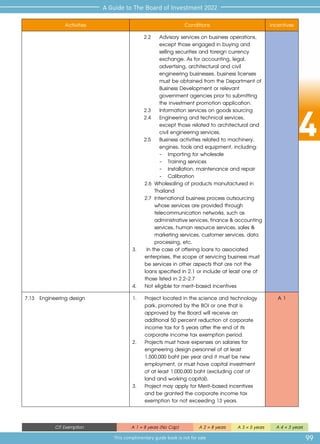

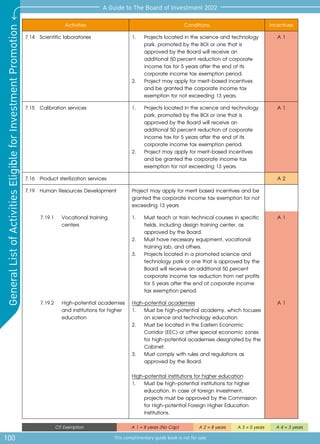

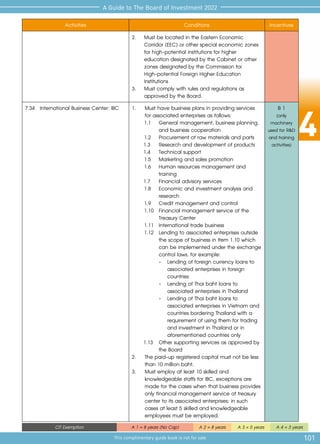

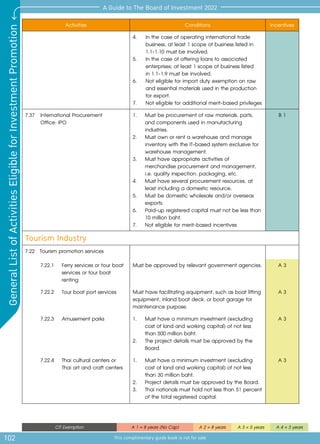

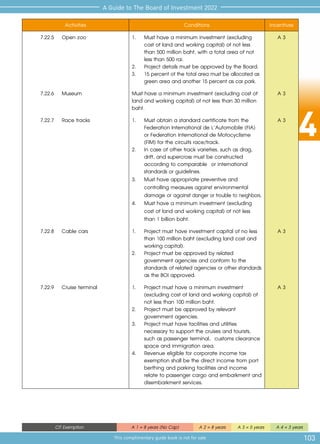

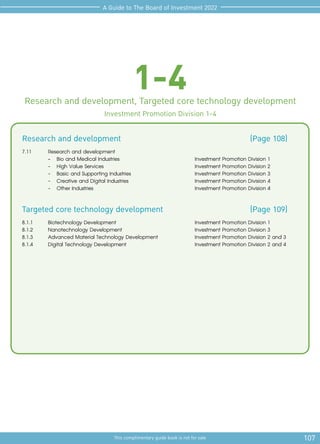

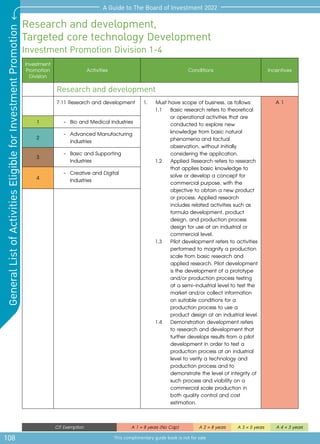

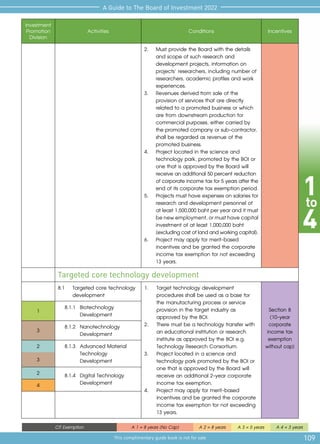

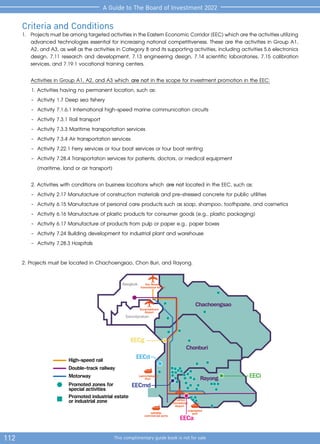

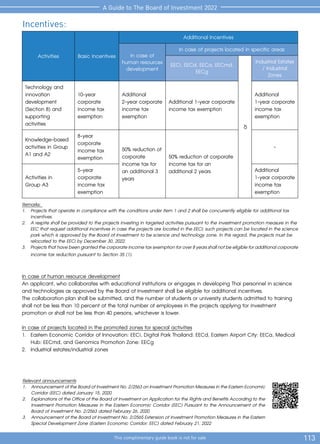

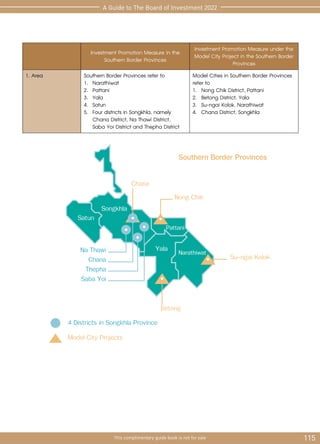

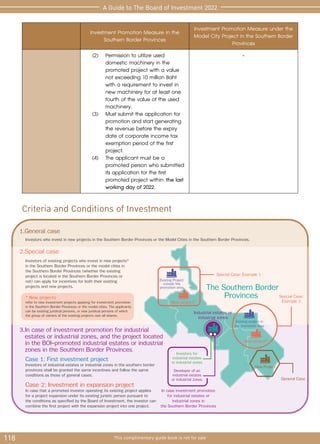

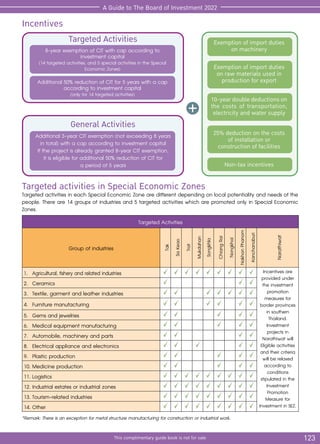

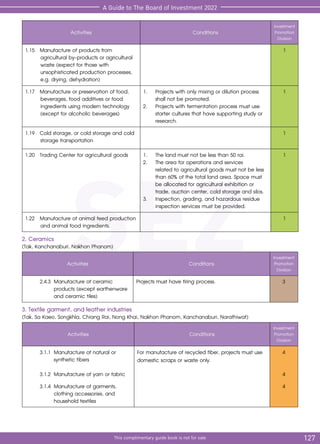

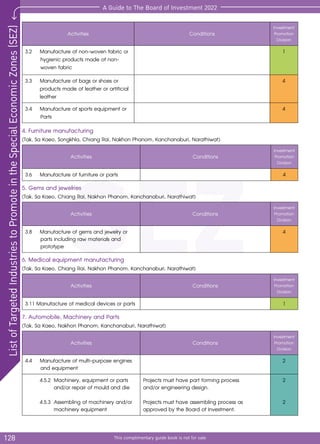

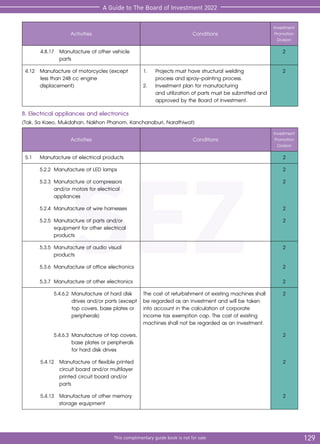

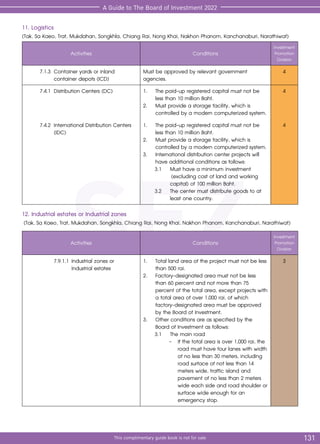

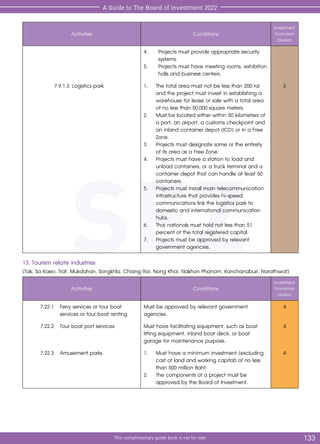

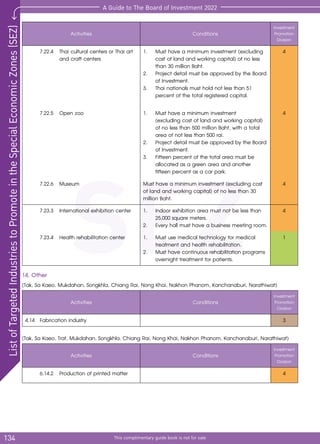

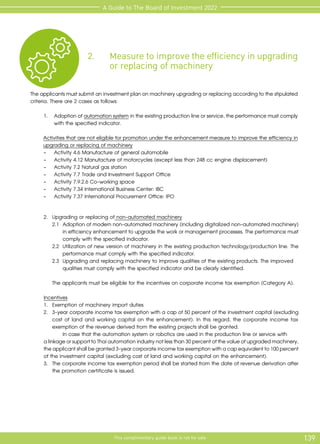

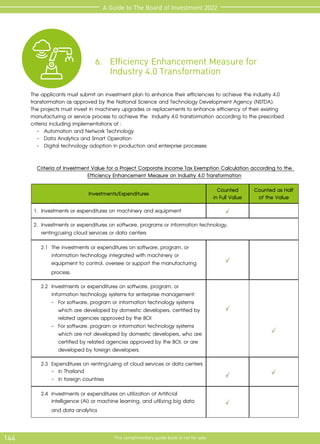

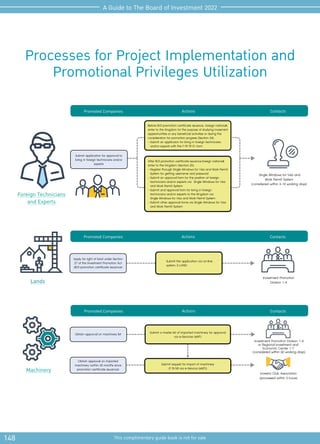

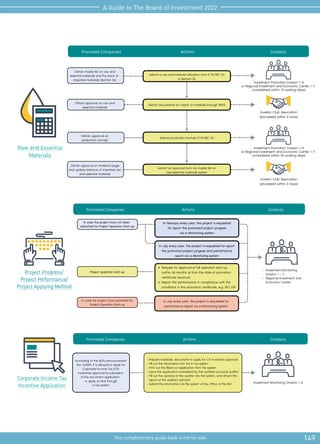

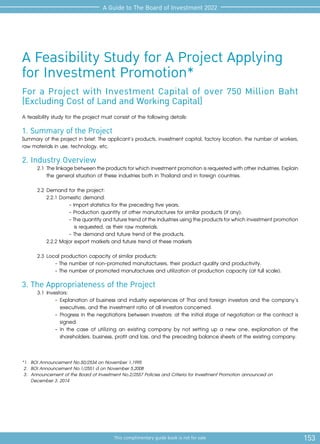

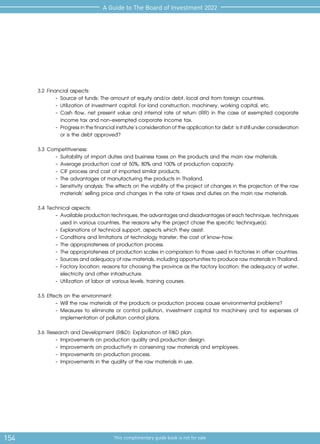

The document is a comprehensive guide prepared by the Office of the Board of Investment in Thailand, detailing investment promotion strategies, policies, incentives, and application procedures as of 2022. It outlines the criteria for qualifying projects, types of available incentives, and the organizational structure of the board, emphasizing support for various industries and regions. The guide aims to enhance Thailand's competitiveness and attract both local and foreign investments.