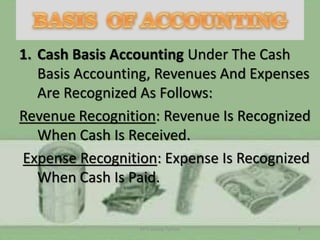

The document explains two accounting methods: cash basis and accrual basis. Under cash basis accounting, revenues and expenses are recognized when cash is received or paid, respectively. In contrast, accrual basis accounting recognizes revenues when earned and expenses in the period related to the recognized revenue.