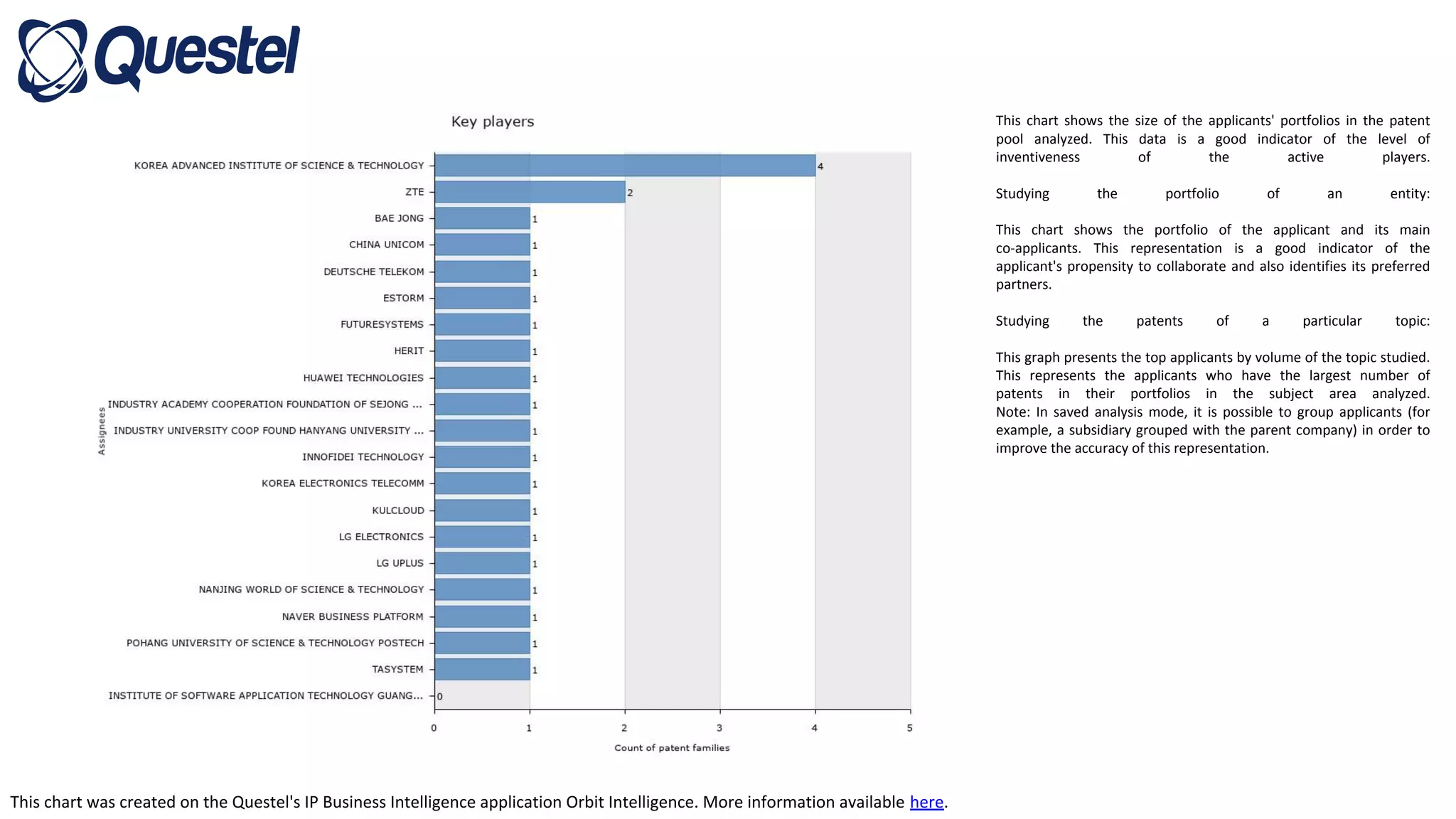

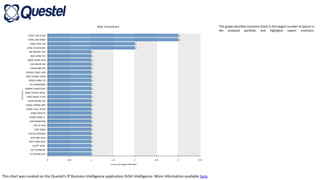

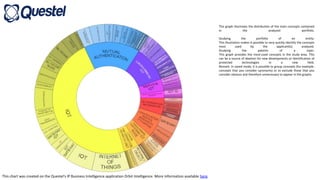

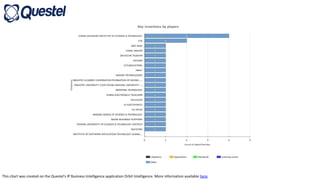

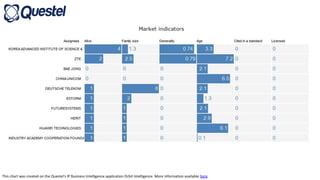

This document provides descriptions of various charts and graphs that can be generated from patent data to analyze applicants, portfolios, topics, and their relationships. The charts include information on applicant portfolio size, collaboration networks, filing trends over time, technology classifications, popular concepts, and citations between applicants. The analyses can help identify pioneering applicants, growth strategies, areas of focus, and competitive landscapes.