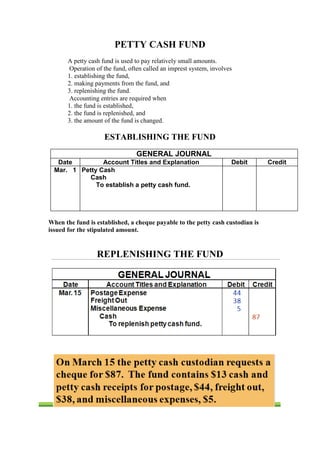

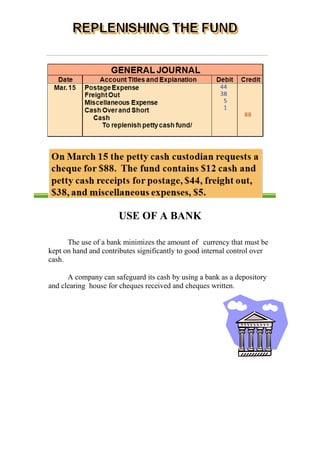

Internal control over cash is important to safeguard assets and ensure accurate accounting records. Key aspects of internal control for cash receipts include segregating duties among employees who handle cash, using prenumbered documents to record transactions, limiting access to cash, and reconciling daily records. Similarly for cash disbursements, important controls are segregating duties, restricting cheque access and signing, and ensuring supporting documentation. Maintaining a petty cash fund and using banks also aids in effective internal control over cash.