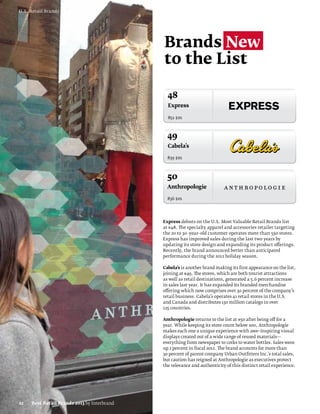

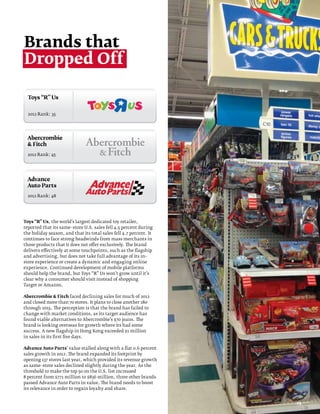

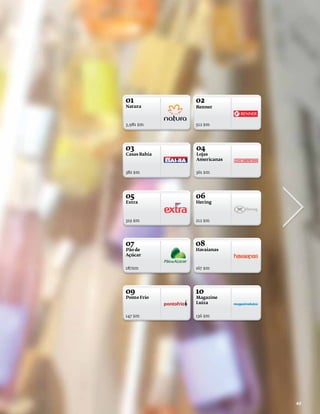

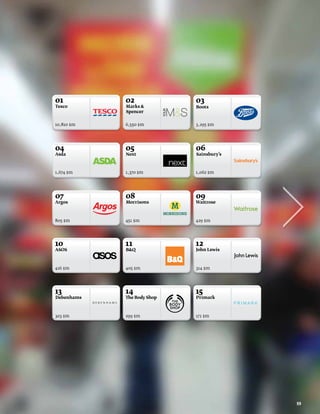

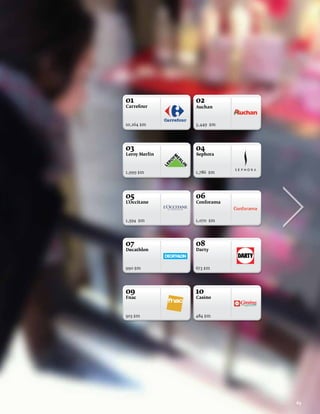

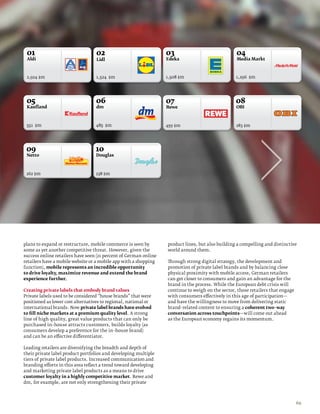

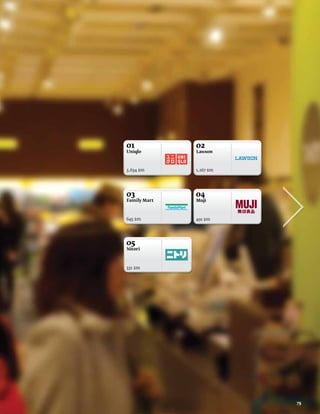

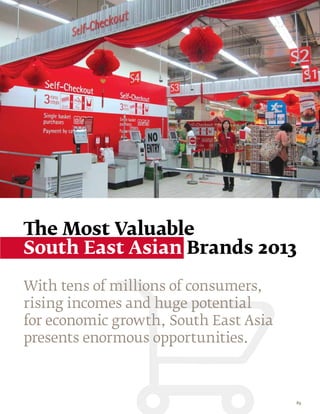

Founded in 1974, Interbrand is a leading global branding consultancy that helps clients manage brand value through strategy, analytics, and design. The document highlights Interbrand's reports on valuable global and sustainable brands, its commitment to creating impactful brand experiences, and the evolving nature of retail, emphasizing the strategic importance of both physical and digital presence in today's market. It also discusses the significant growth potential in emerging markets like Brazil and India, driven by increasing disposable incomes and urbanization, while outlining the need for retail brands to innovate and adapt in a rapidly changing consumer landscape.