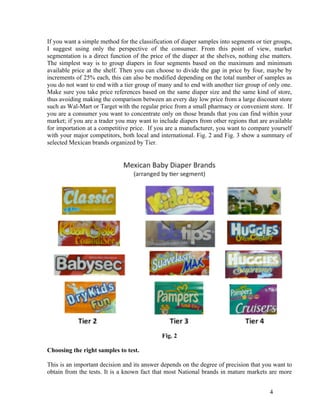

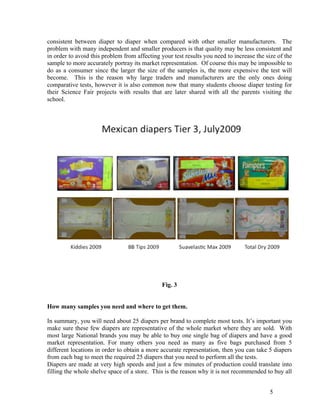

This document provides an overview of how to evaluate different baby diaper brands to determine which offers the best performance. It discusses looking at diapers within the same price tier or segment. Key areas to test include diaper construction quality, the absorbent pad system, fastening system, containment system, and manufacturing costs. Tests of the absorbent pad include free swell capacity, absorbency under load, strike through times, and wicking speed. The goal is to perform objective testing and analysis to identify the highest performing diapers.