1) The document discusses in-bond manufacturing provisions under the Customs Act which allow manufacturers to import goods into a bonded warehouse without paying customs duties and undertake manufacturing processes.

2) Key benefits include postponing payment of customs duties, greater cash flow, no duties if goods are exported, and ability to import inputs and capital goods without duties upfront.

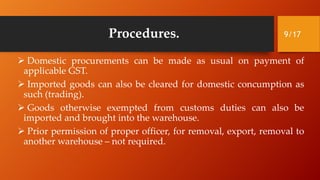

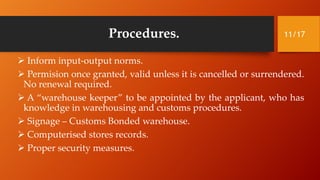

3) The process involves obtaining permission, maintaining records, executing a bond, paying duties via an ex-bond bill of entry if goods are cleared domestically or preparing a shipping bill if exported.