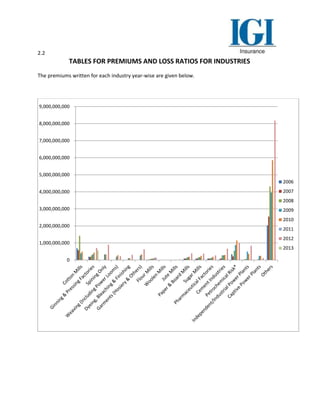

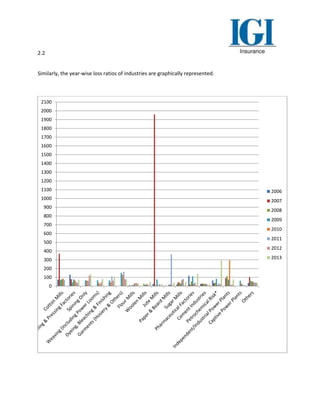

This statistical analysis report examines IGI's position in Pakistan's insurance market and analyzes profitability and risk segmentation in the fire industry. Section 1 analyzes the top insurance companies based on underwriting profits and gross premiums from 2005-2013. IGI shows inconsistent underwriting growth trends compared to other mid-sized companies that generally see premium growth boost underwriting. Section 2 will segment fire industries based on profitability ratios to identify low-risk industries for IGI to target. The report aims to link the sections to improve IGI's underwriting profits and profitability through its fire premium portfolio. Regression analysis is conducted to determine the impact of various factors like premium, claims, and commissions on underwriting profits for different companies.