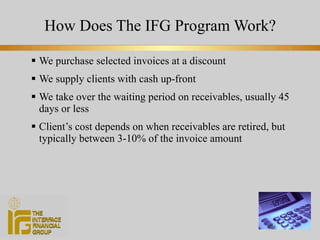

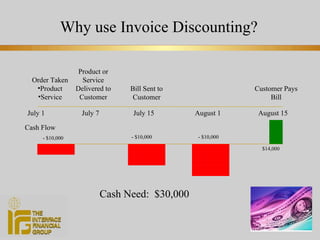

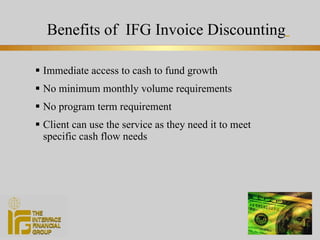

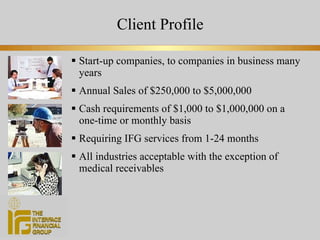

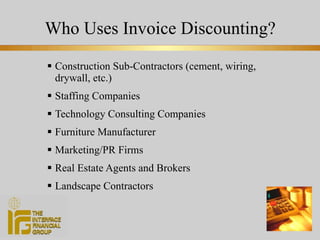

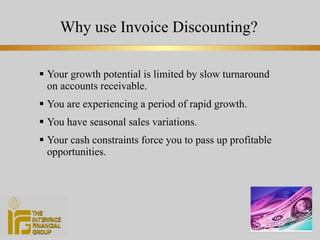

The Interface Financial Group provides short-term working capital by purchasing accounts receivable from businesses, enabling immediate cash access without being a collection agency or lender. Their program involves buying selected invoices at a discount, offering clients upfront cash while taking over the wait time for payment. This service is beneficial for various businesses, especially during periods of growth or cash flow constraints, accommodating companies across multiple industries with varying sales volumes.