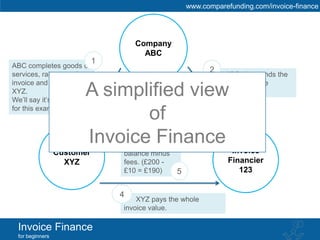

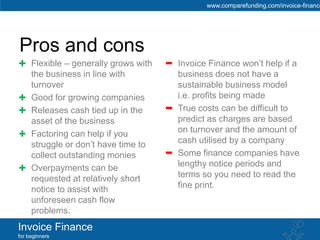

Invoice finance provides businesses with early access to cash from their unpaid invoices. There are two main types: factoring involves the invoice financier collecting payment from customers, while invoice discounting requires the business to pursue customers for payment. While invoice finance can provide cash flow benefits, businesses should understand all associated costs and terms to avoid surprises. Compare Funding can help businesses find the most suitable invoice financing option.