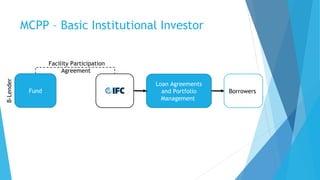

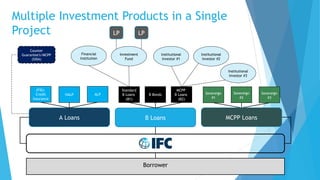

The document provides an overview of the Managed Co-Lending Portfolio Program (MCPP), an IFC product that allows institutional investors to passively participate in IFC's loan portfolio. Key points include: MCPP allows pre-approval of investors who provide capital deployed by IFC according to its strategy; the SAFE partnership committed $3B over 6 years, with $1.5B disbursed; the HKMA recently committed $1B; and partnerships with Allianz, Prudential, AXA, and insurers will help raise $5B for infrastructure projects. MCPP offers investors exposure to IFC's diverse emerging market portfolio while IFC maintains control over investment decisions.