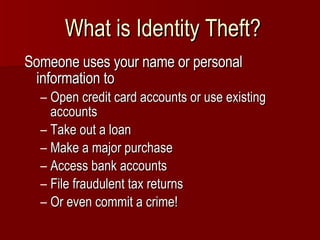

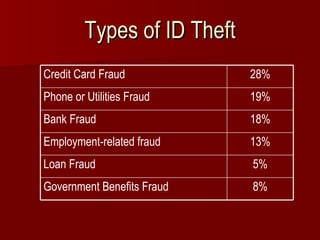

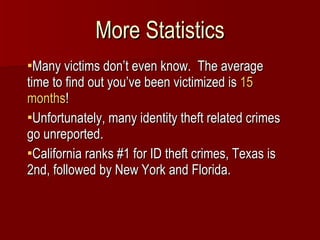

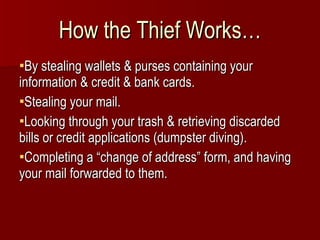

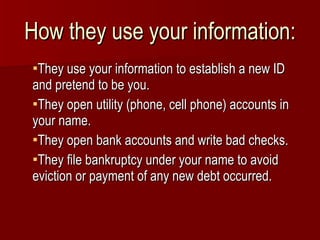

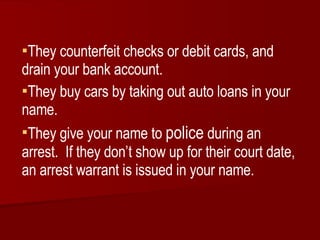

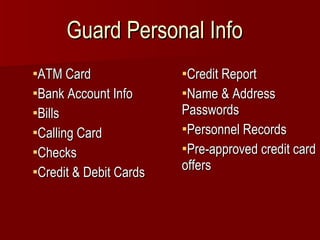

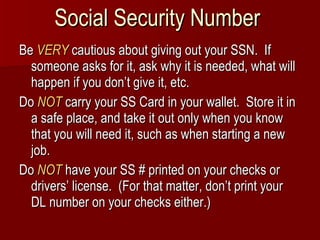

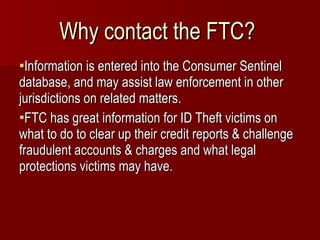

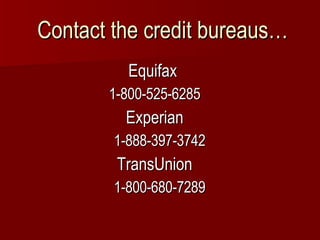

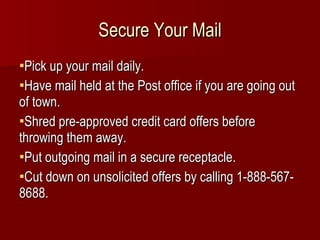

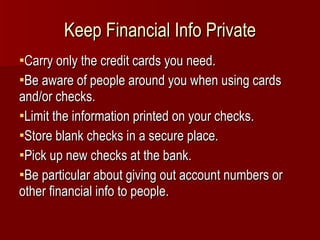

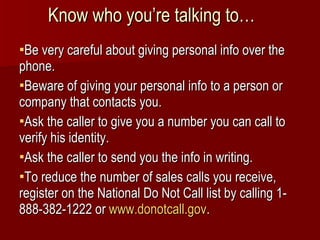

Identity theft involves someone using personal information like a name, Social Security number, or bank account information without permission to commit fraud or theft. Common types of identity theft include credit card fraud, phone or utility fraud, bank fraud, and employment-related fraud. Victims often don't discover the theft for over a year. To reduce risk, people should shred financial documents before throwing them out, be cautious about sharing personal information, and monitor bank statements and credit reports for suspicious activity. If identity theft is suspected, victims should file a police report and contact credit bureaus and the Federal Trade Commission for assistance.

![For more information, contact: Isaac B. Chappell, Jr. Regional Extension Agent 1702 Noble Street, Suite 108 Anniston, AL 36201 Phone: (256) 237-1621 www.aces.edu [email_address]](https://image.slidesharecdn.com/identity-thefttest-1221143623619509-8/85/Identity-Theft-Test-38-320.jpg)