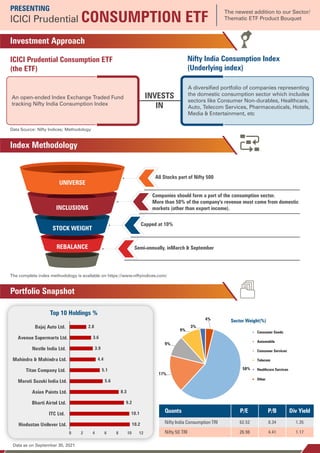

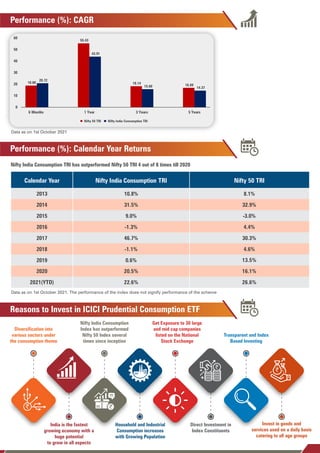

The document summarizes ICICI Prudential's new Consumption ETF. The ETF aims to track the Nifty India Consumption Index, which includes companies representing the domestic consumption sector such as consumer goods, automobiles, services, telecom, healthcare, etc. It provides diversified exposure to 30 large and mid-cap consumption companies listed on the NSE. Historical performance shows the underlying index has outperformed the Nifty 50 index in 4 of the last 8 years. The ETF offers investors a way to gain exposure to India's growing consumption sector in a low-cost manner through a transparent index-based fund.