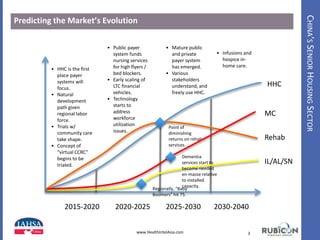

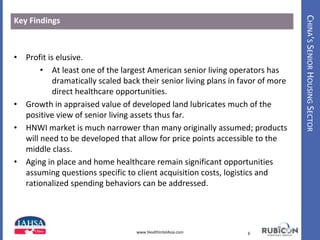

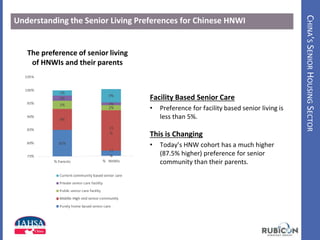

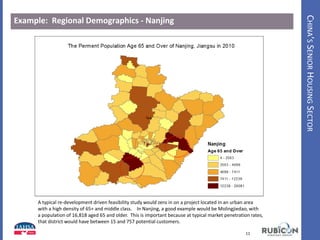

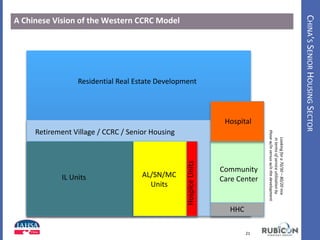

The document discusses trends in China's senior housing market from 2015-2040. It finds that while real estate developers view senior living as a real estate play, care needs are not adequately met. Preference is for facilities within cities rather than suburbs. The market is narrower than expected and products are needed for the middle class. Redevelopment of existing properties is more successful than greenfield projects. Operational capabilities for assisted living/memory care often do not match advertised services.