The document discusses several challenges in comparing financial statements across different countries, including:

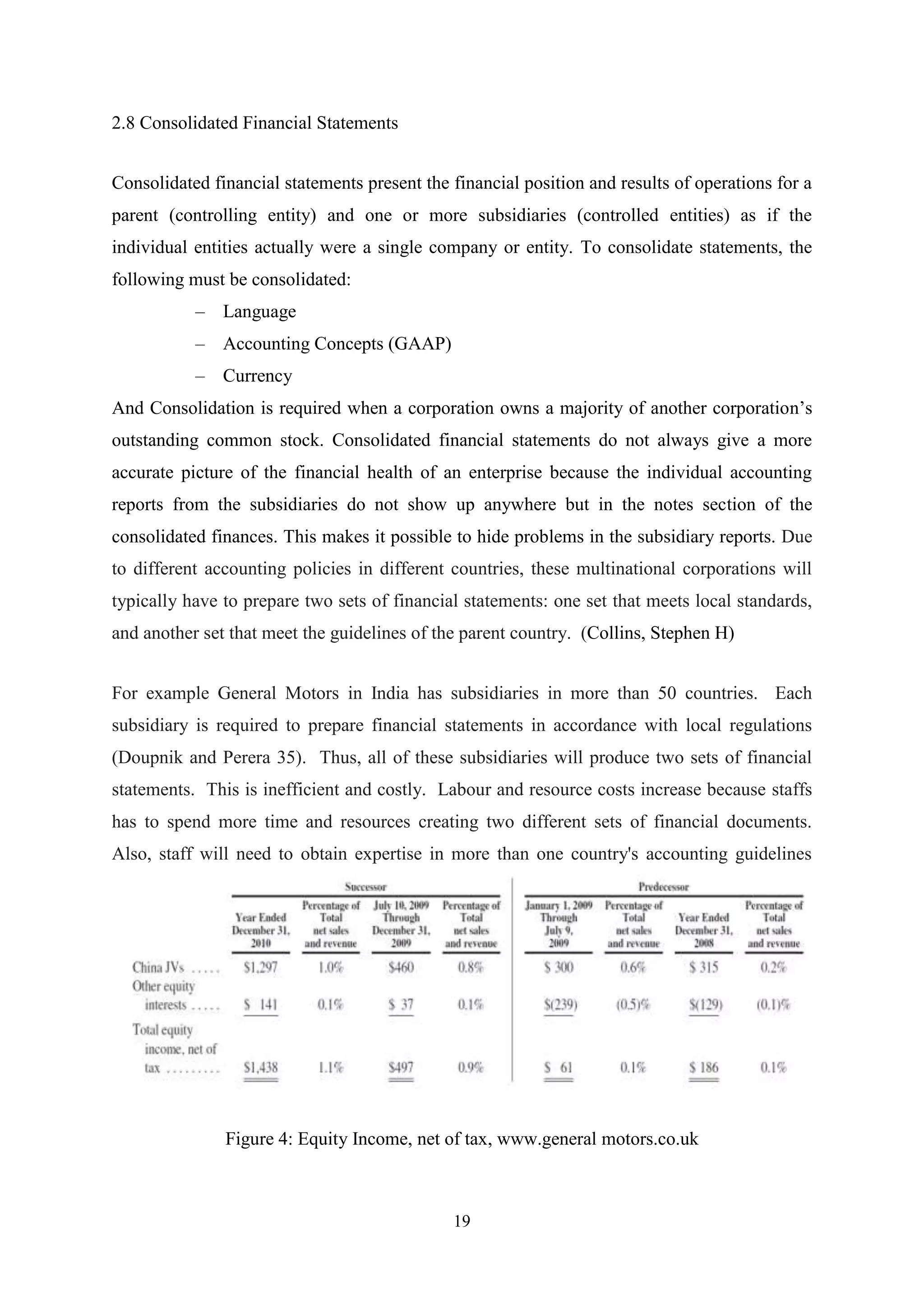

1) Financial data and information from foreign companies can be difficult to access due to limitations in commercial databases and differences in reporting timelines across countries.

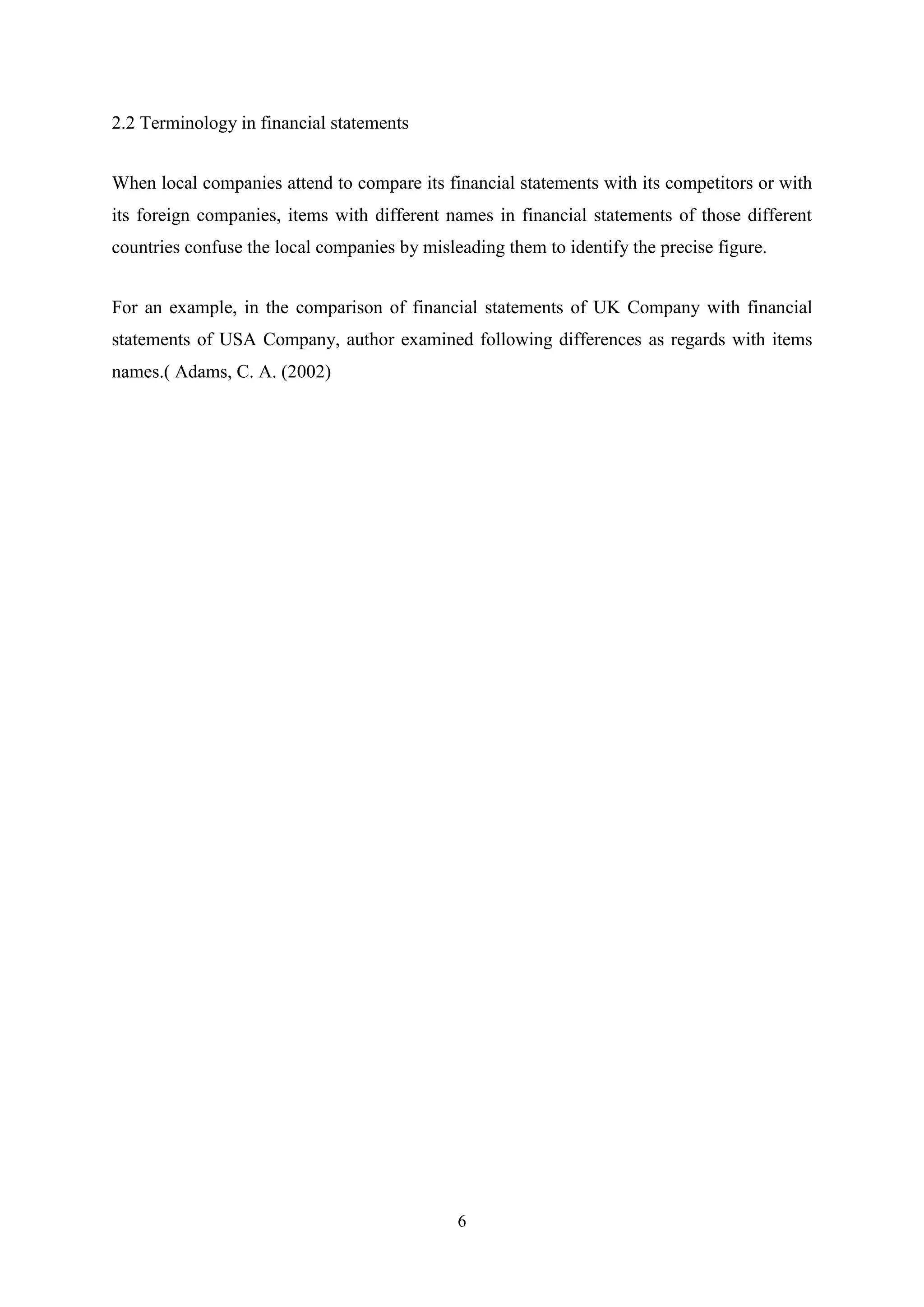

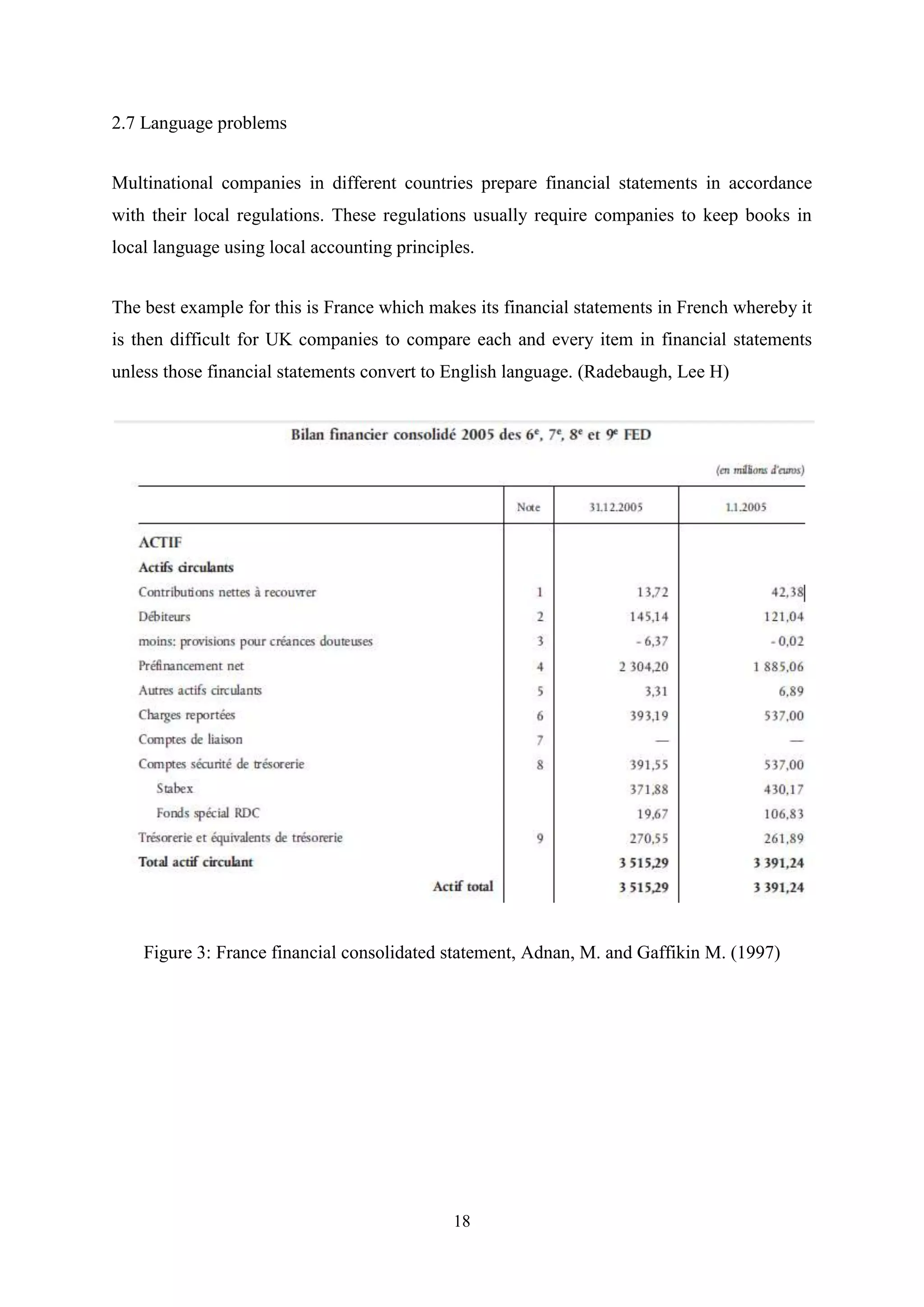

2) Terminology used in line items of financial statements varies between countries, which can mislead companies trying to compare statements.

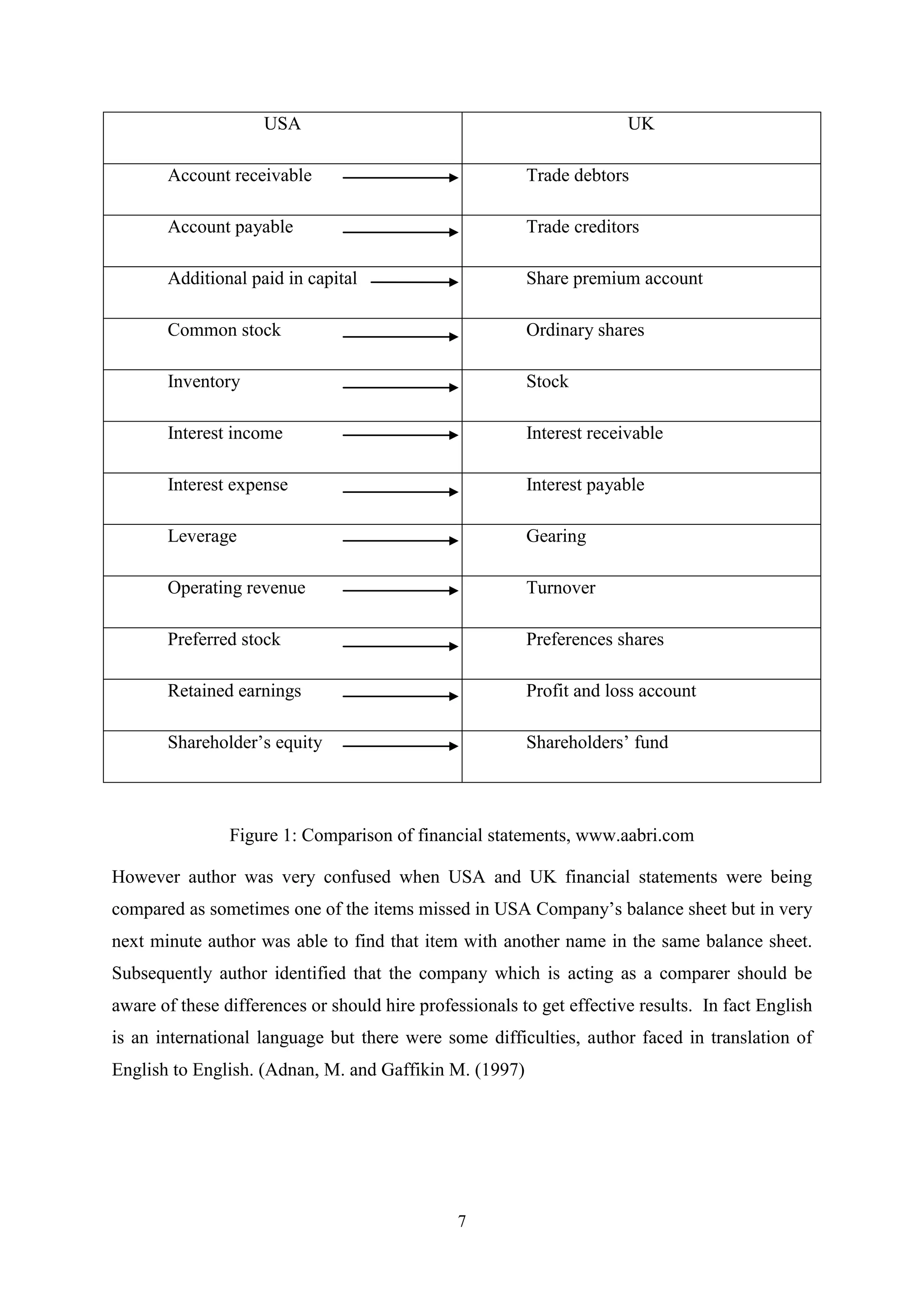

3) The format of financial statements, including the ordering and inclusion of line items, is not consistent between countries.

4) Broader accounting issues like legal systems, taxation, inflation, and currency translation present further challenges for international financial statement comparisons. Overcoming these differences is important for analyzing multinational company performance.