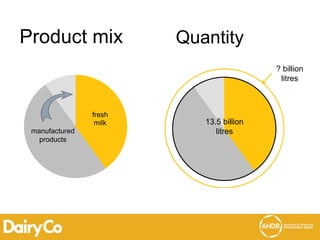

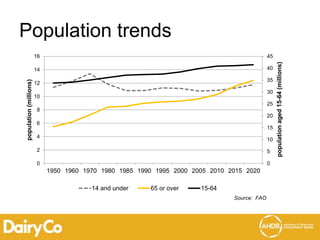

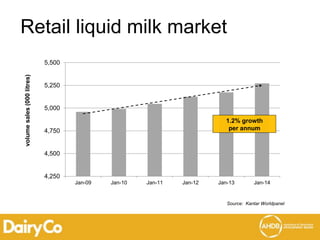

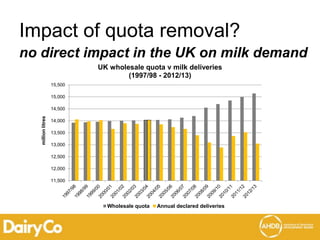

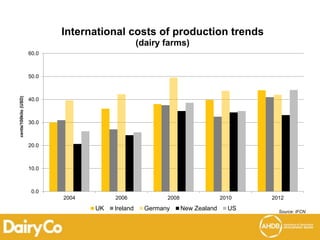

The document analyzes the potential changes in the UK's milk demand following the quota removal, highlighting key factors such as population trends and market dynamics for both fresh milk and manufactured products. It emphasizes that the UK may face increased competition from imports and exports, but the removal of quotas may not directly impact overall milk demand. Future growth will rely on enhancing competitiveness and investment in processing capabilities.