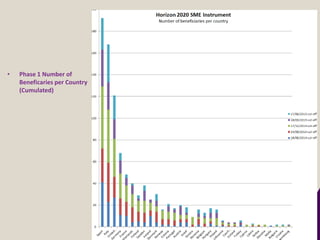

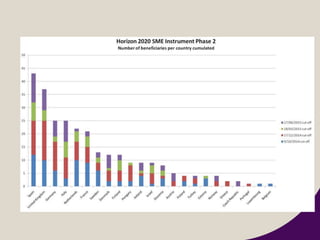

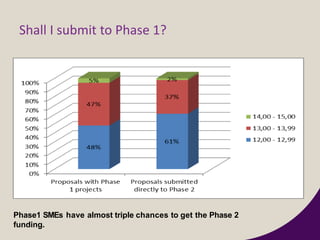

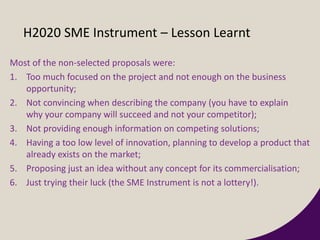

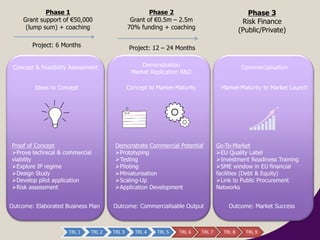

The document outlines how SMEs (small and medium-sized enterprises) can engage with Horizon 2020 funding, providing opportunities for innovation-driven projects through various schemes. It explains the definition of SMEs, funding details, eligibility criteria, and highlights the importance of creating investor-ready business plans for successful applications. Additionally, it discusses the performance of UK SMEs in securing funding and the evaluation process involved in proposal selection.

![Key message

• Focus on the business plan

• The evaluation panels are external experts in investment and

venture capital. As a result the evaluation process, is very

much simulating an investor decision.

• Money coming through the instrument can be seen as an

investment, the Commission does not expect a direct return.

The return on investment [is] more jobs, growth, turnover,

more tax

• Given this, proposals should be structured as a business plan

that is investor-ready.](https://image.slidesharecdn.com/smeinstrumentsouthampton200116-160121090920/85/Horizon-2020-Seminar-12-320.jpg)