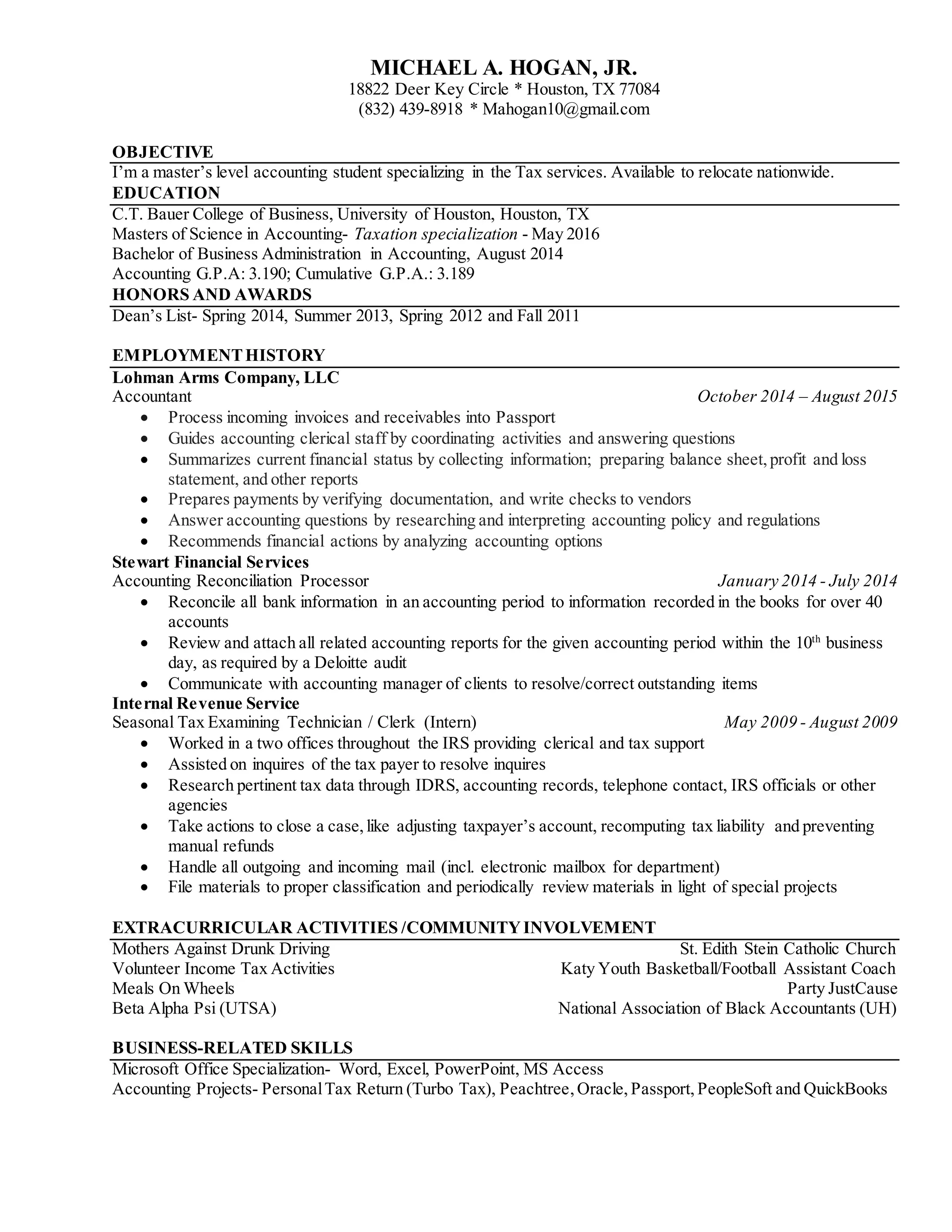

Michael A. Hogan Jr. is seeking a career in tax accounting. He has a Master's degree in Accounting with a tax specialization from the University of Houston. His experience includes processing invoices and financial reports as an accountant, reconciling bank accounts as a processing assistant, and assisting taxpayers with inquiries as an IRS seasonal technician. He has extensive accounting software skills and volunteer experience in his community.