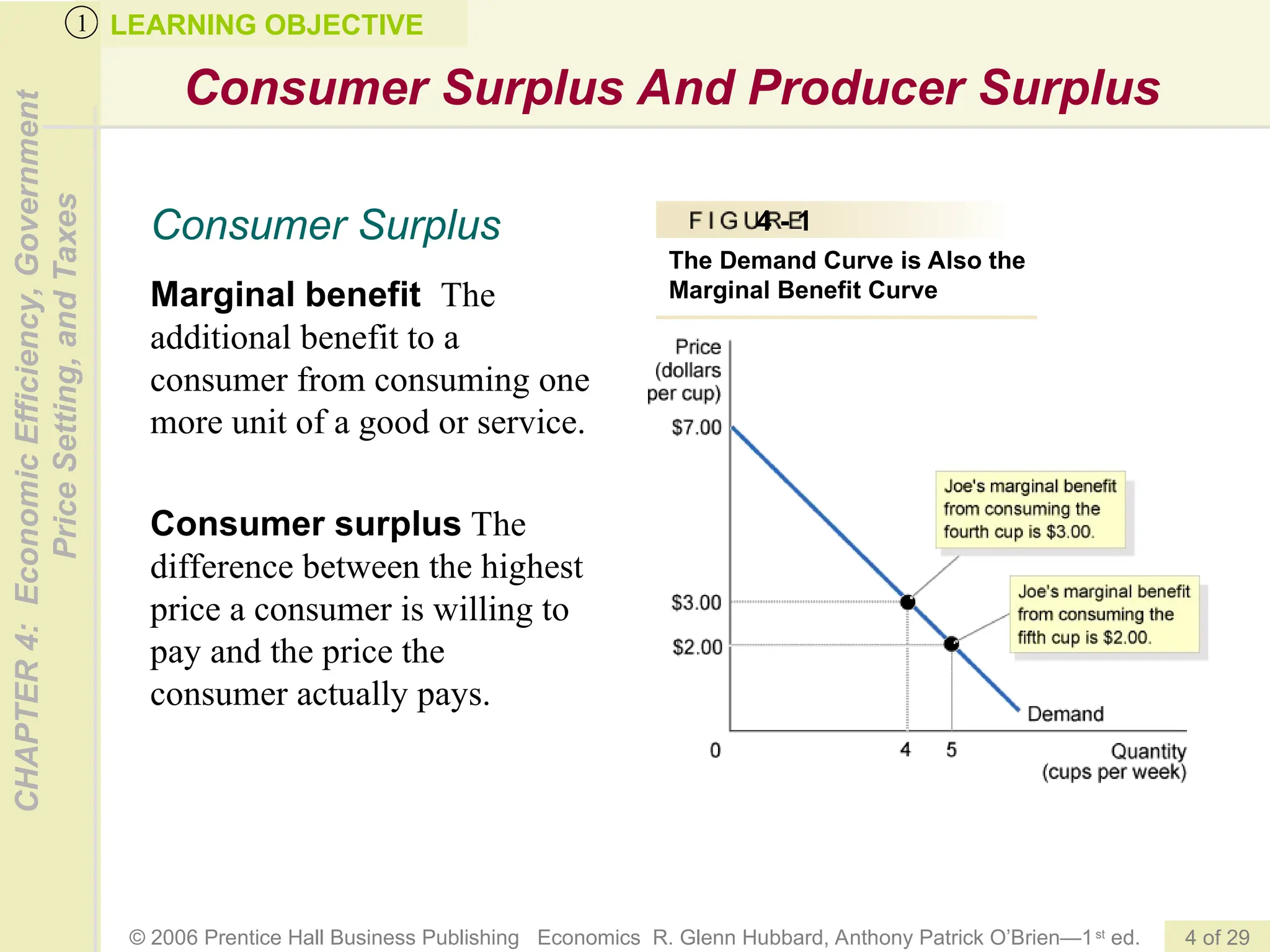

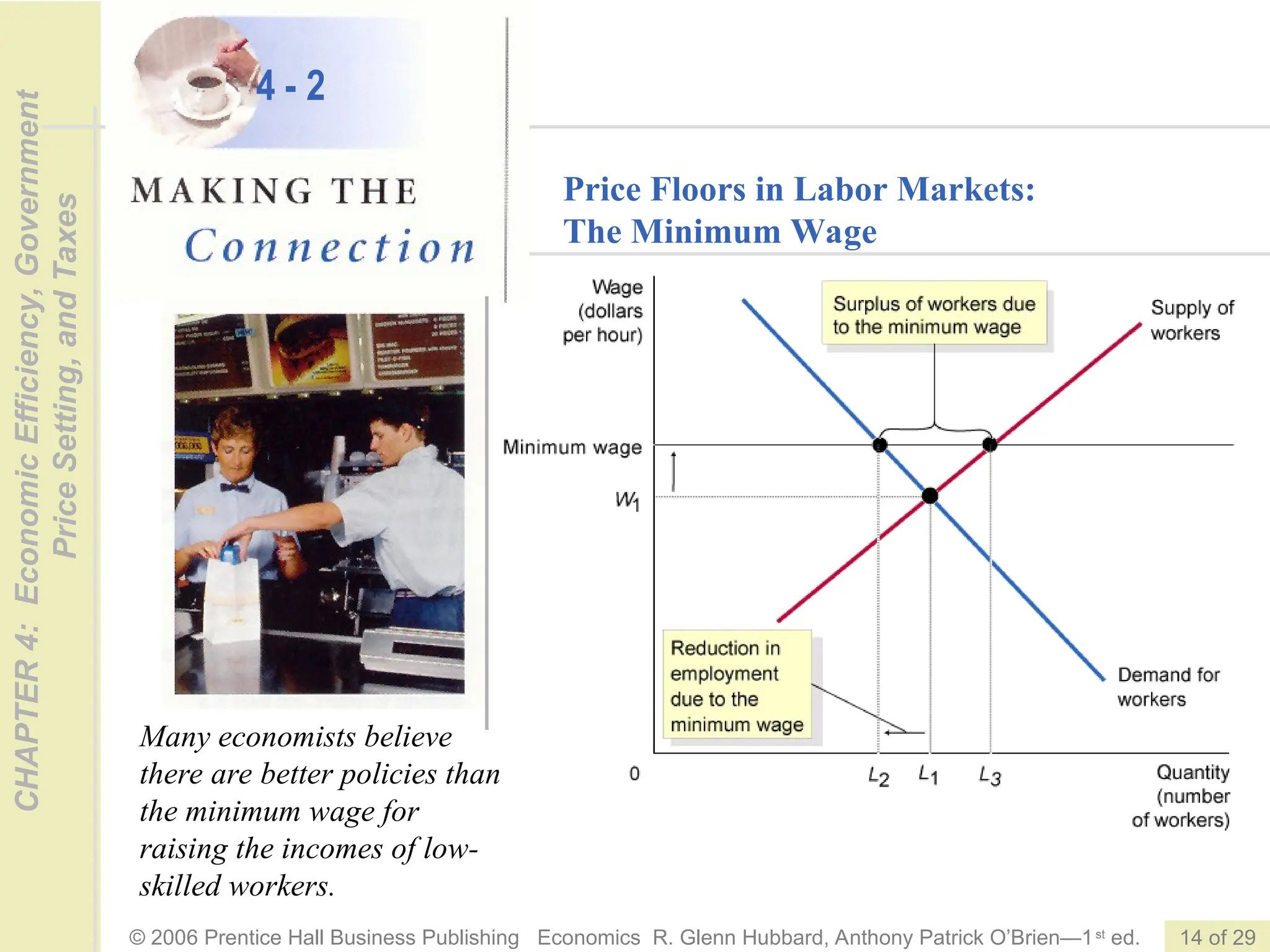

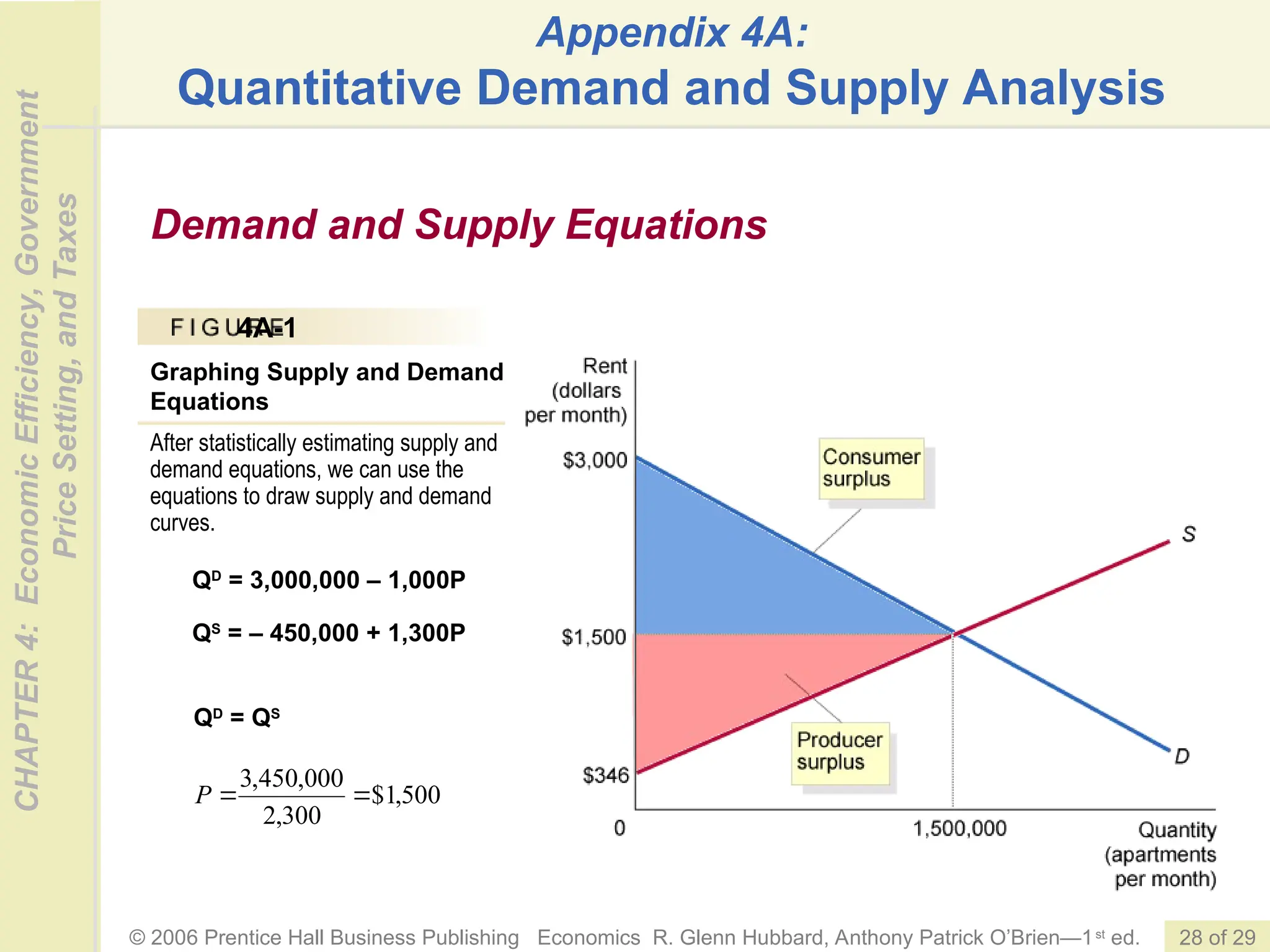

Chapter 4 discusses economic efficiency, government price setting, and the effects of taxes, introducing concepts such as consumer surplus, producer surplus, and the impact of price ceilings and floors. It highlights the inefficiencies that arise when markets are not in competitive equilibrium and examines the consequences of government interventions on economic welfare. Additionally, the chapter explores tax incidence and its implications on market participants.