This document provides an overview of Hibbett Sporting Goods Inc. Key points include:

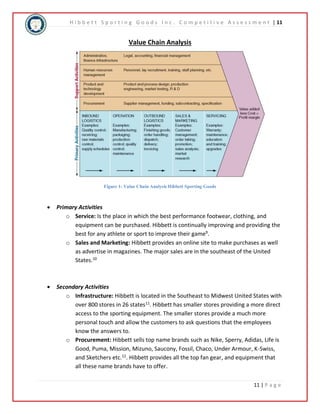

1) Hibbett targets smaller retail markets in the Southeast and Midwest US, which allows for lower costs and expansion opportunities.

2) Hibbett offers specialized products catering to local community interests, allowing it to compete with larger stores.

3) Hibbett management has significant retail experience.

However, weaknesses include reliance on regional economies and sports team performance. Expansion of competitors like Dick's into smaller markets also poses a threat. The document analyzes Hibbett's strengths, weaknesses, and value chain.

![H i b b e t t S p o r t i n g G o o d s I n c . C o m p e t i t i v e A s s e s s m e n t | 96

117http://news.investors.com/business-the-new-america/080112-620575-rising-industry-trends-for-hibb-ua-nke-dks.

96 | P a g e

htm?p=full

118 http://www.epsit.com/ecommerce.php

119 http://www.guardian.co.uk/media-network/media-network-blog/2012/oct/30/technology-retail-interview-series

120http://phx.corporate-ir.net/phoenix.zhtml?c=78137&p=irol-irhome

121 http://www.hibbett.com/uploads/default/files/vendor_compliance_manual-hibbett_plan_version_may12.pdf

122 http://www.retailtechnology.co.uk/market-analysis/technology-change-throws-spotlight-support

123 http://www.google.com/webhp?hl=en&tab=ii#hl=en&tbo=d&output=search&sclient=psy-ab&

q=recession+affects+retail+industry&oq=recession+affects+retail+industry&gs_l=hp.3..0i30j0i8i30j0i22.757.67

40.0.6998.35.29.1.5.5.4.924.4361.20j5j0j2j1j0j1.29.0.les%3B..0.0...1c.1.l7M0GjkFZ0w&pbx=1&bav=on.2,or.r_gc.r_

pw.r_qf.&fp=bb4ade3441768232&bpcl=38093640&biw=1280&bih=930

124 http://blog.onlinemediadirect.co.uk/facebook-is-the-favoured-platform-for-online-ads/518/

125 http://voices.washingtonpost.com/posttech/2010/11/facebook_ranks_first_in_displa.html?wprss=posttech

126http://community.nasdaq.com/News/2012-10/hibbett-expected-to-outperform-analyst-blog.

aspx?storyid=181223

127 http://www.businessinsider.com/fastest-growing-retailers-in-america-2012-7?op=1

128 http://phx.corporate-ir.net/phoenix.zhtml?c=132215&p=irol-irhome

129 http://usatoday30.usatoday.com/money/story/2012-06-01/consumer-spending-april-report/55326804/1

130 http://simon.com/mall/longview-mall/stores/hibbett-sporting-goods

131 Dick’s Sporting Goods. (2011). 2011 Annual Report to the Stockholders. Pg .14

132 Dick’s Sporting Goods. (2011). 2011 Annual Report to the Stockholders. Pg .14

133 Dick’s Sporting Goods. (2011). 2011 Annual Report to the Stockholders. Pg .4

134 Pring , C. (2012, 10 05). 99 more social media statistics for 2012 [Web log message]. Retrieved from

http://thesocialskinny.com/99-new-social-media-stats-for-2012/

135 Pring , C. (2012, 10 05). 99 more social media statistics for 2012 [Web log message]. Retrieved from

http://thesocialskinny.com/99-new-social-media-stats-for-2012/

136 Thesocialconcept.jobamatic.com/a/jobs/find-jobs/q-Hibbett-Sports

137 Pring , C. (2012, 10 05). 99 more social media statistics for 2012 [Web log message]. Retrieved from

http://thesocialskinny.com/99-new-social-media-stats-for-2012//

138 (n.d.). Retrieved from http://techcrunch.com/2012/05/07/nielsen-smartphones-used-by-50-4-of-u-s-consumers-

android-48-5-of-them/

139 Hibett Sporting Goods. (2012). 2012 Annual Report to the Stockholders. Pg .7

140 Hibbett Sporting Goods Mission statement. www.hibbett.com

141 Hibbett Sporting Goods Mission statement. www.hibbett.com

142 Hibbett Sporting Goods Mission statement. www.hibbett.com](https://image.slidesharecdn.com/hibbettsportinggoods-140915154828-phpapp01/85/Hibbett-Sporting-Goods-Competitive-Overview-97-320.jpg)