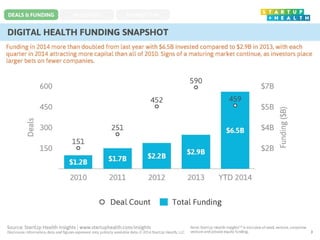

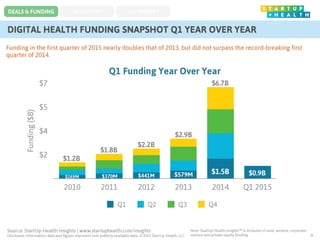

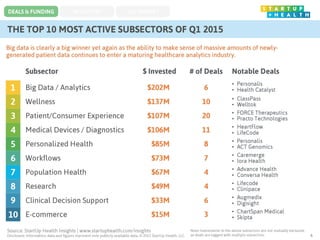

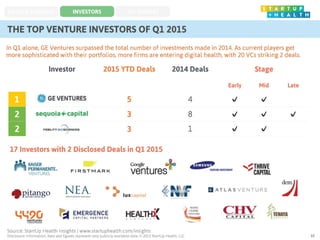

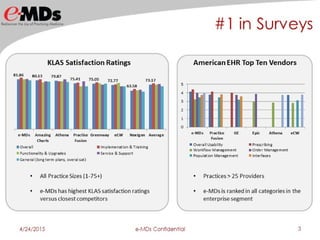

The document outlines the activities and insights of the World Financial Symposiums (WFS), focusing on health technology opportunities and mergers & acquisitions in the sector. It highlights upcoming events, notable transactions, and key individuals in the industry like Nat Burgess and Katya Hancock, detailing their backgrounds and roles. Additionally, it discusses market trends, societal changes affecting healthcare, and strategies for M&A success in a dynamic market landscape.

![Sold to

Target: Caretech AB [Sweden]

Acquirer: Doro AB [Sweden]

Date Announced: December 2014

Transaction Value: $31.76 million

-Senior citizen mobile telehealth and remote medical monitoring, wearables, alert

systems and software

-Will focus on entering the telecare sector and synergies with current senior mobile

device business](https://image.slidesharecdn.com/healthtechv14-150518175650-lva1-app6891/85/Health-Tech-Market-Spotlight-19-320.jpg)

![Sold to

Target: Bina Technologies

Acquirer: Roche AG [Switzerland]

Date Announced: December 2014

Transaction Value: Undisclosed

-Big data genomic analytics software and hardware for cancer and inherited disease research

-Will expand genomic analysis solutions portfolio](https://image.slidesharecdn.com/healthtechv14-150518175650-lva1-app6891/85/Health-Tech-Market-Spotlight-21-320.jpg)