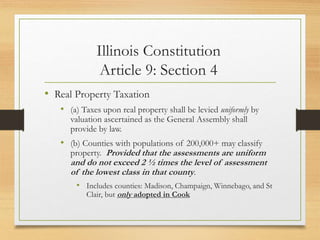

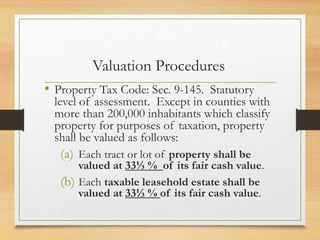

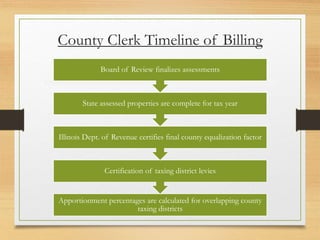

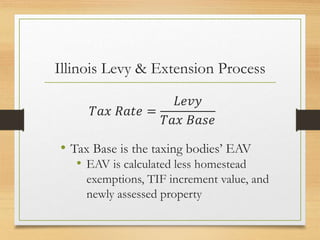

This document provides an overview of property tax exemptions and homestead exemptions in Illinois. It discusses the state constitution and statutes governing property tax assessments, levies, and exemptions. It outlines the general homestead exemption and senior citizen homestead exemption, including historical exemption amounts. Hypothetical examples show how homestead exemptions reduce individual tax bills and tax rates by decreasing the total equalized assessed value that property taxes are levied against.