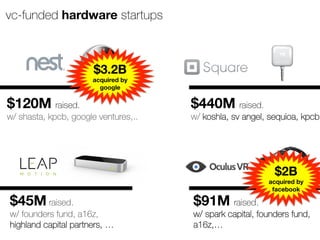

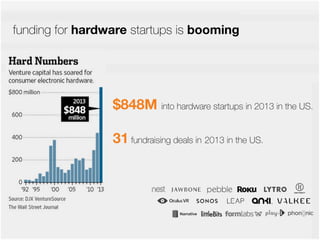

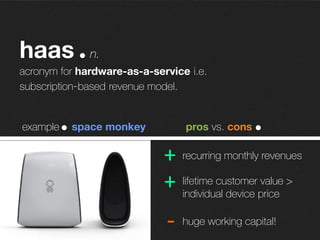

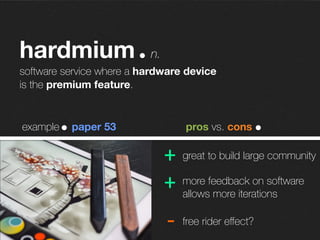

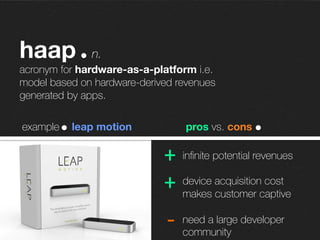

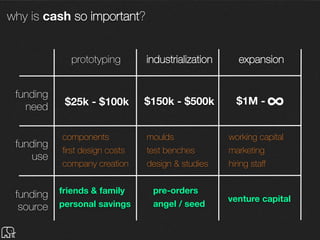

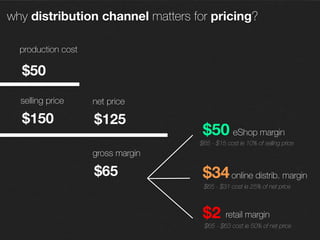

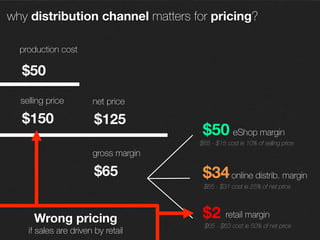

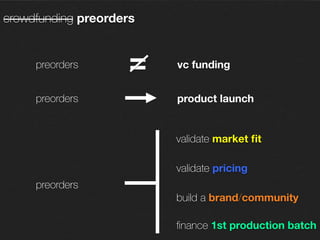

The document discusses the evolution and potential of hardware startups, highlighting significant venture exits and increasing VC investments from 2010 to 2014. It outlines various business models such as hardware-as-a-platform and hardware-as-a-service, emphasizing the importance of cash flow, margins, and funding strategies for success. Additionally, it indicates that new funding sources, including crowdfunding and preorders, are becoming crucial for hardware startups looking to validate their market fit and scale effectively.