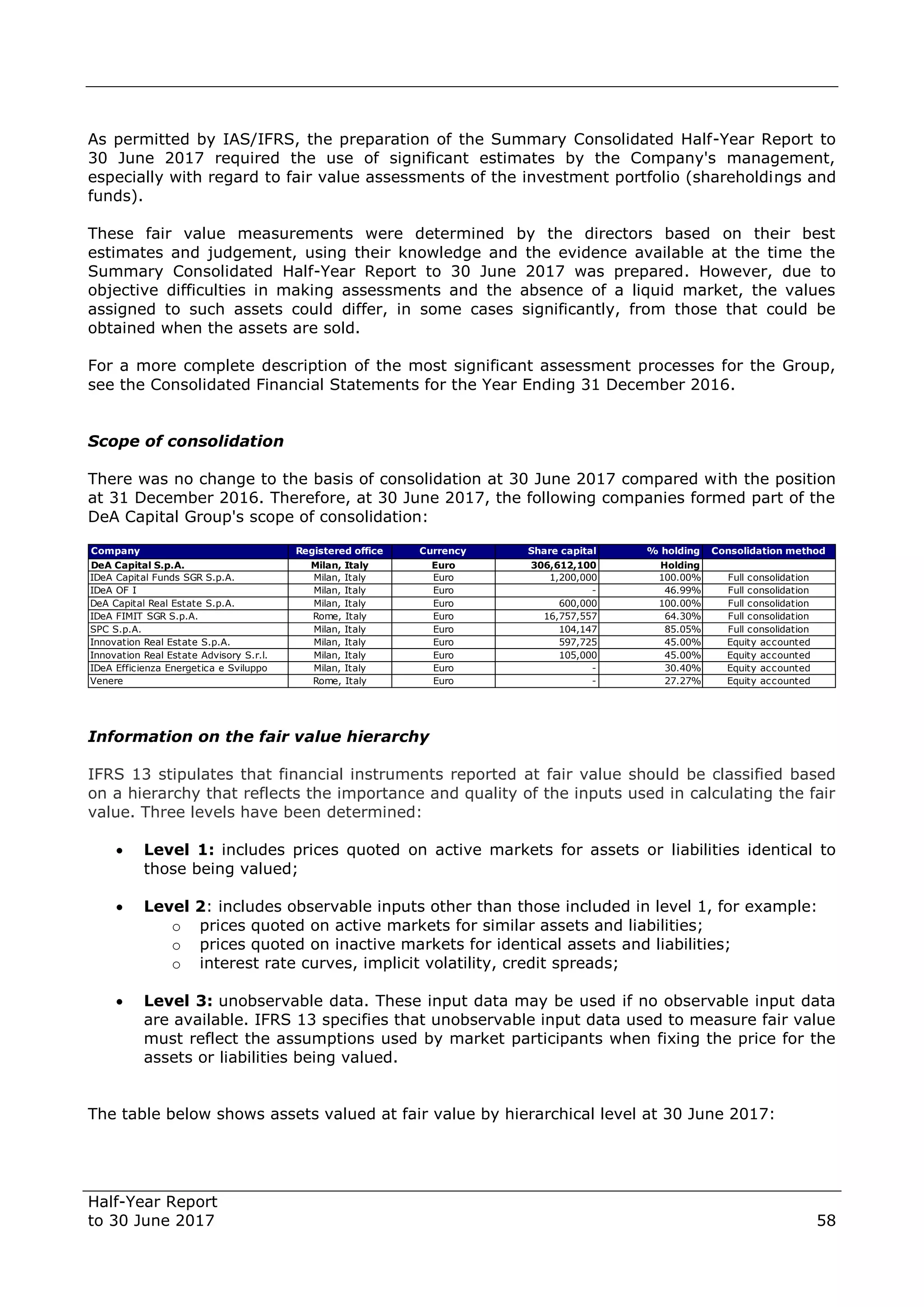

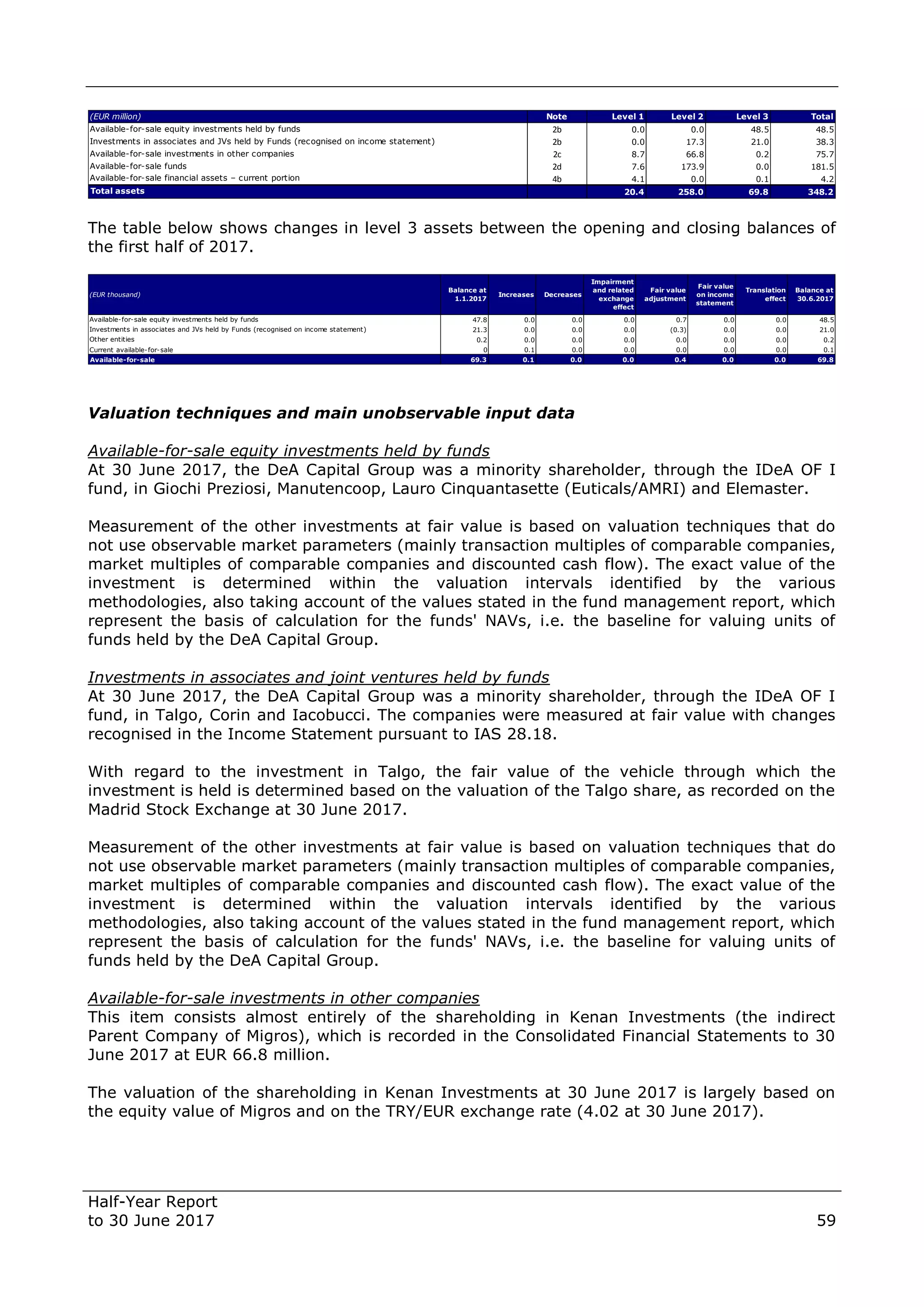

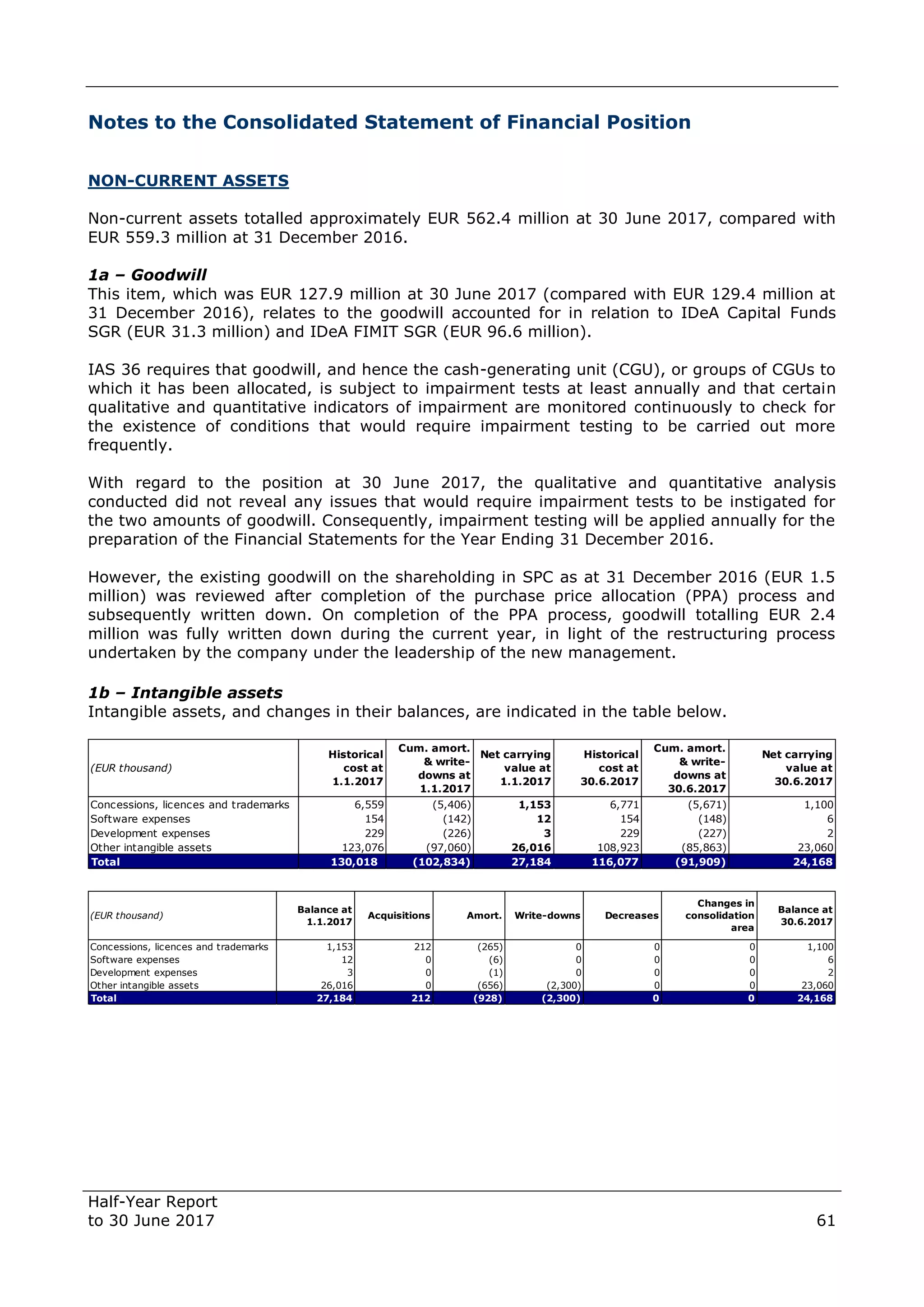

The document is a half-year report for DeA Capital S.p.A. for the period ending June 30, 2017. It provides key financial information including:

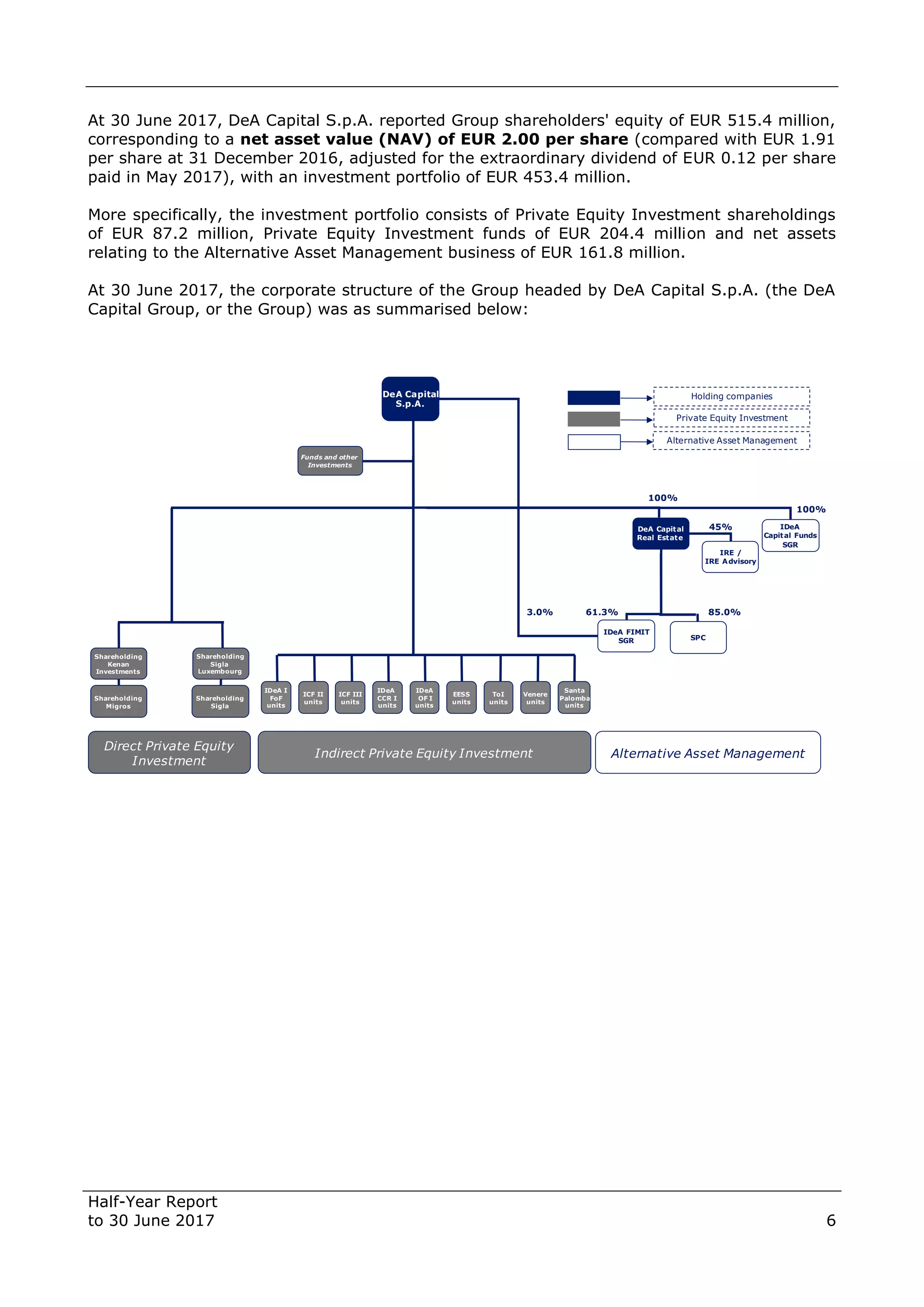

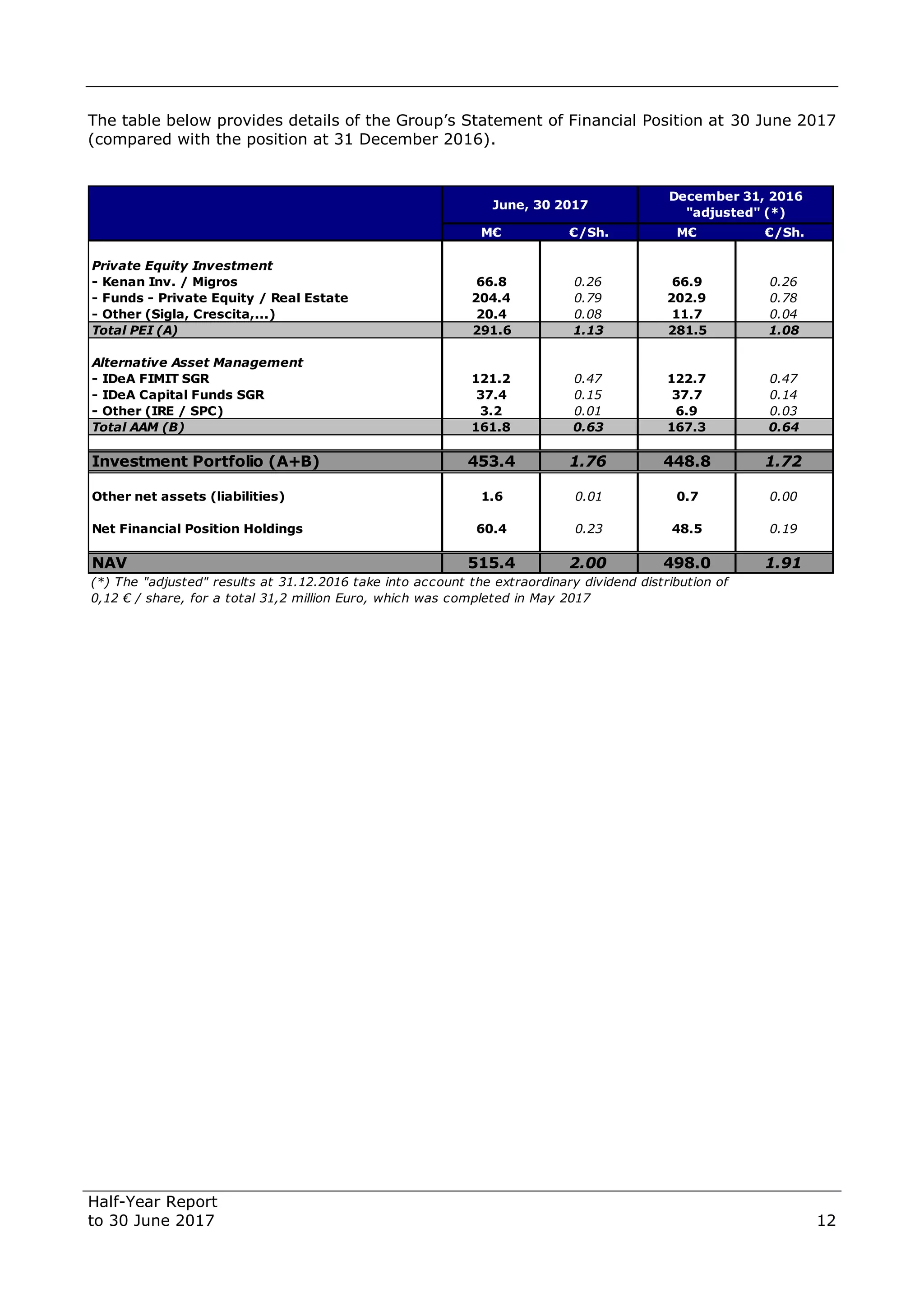

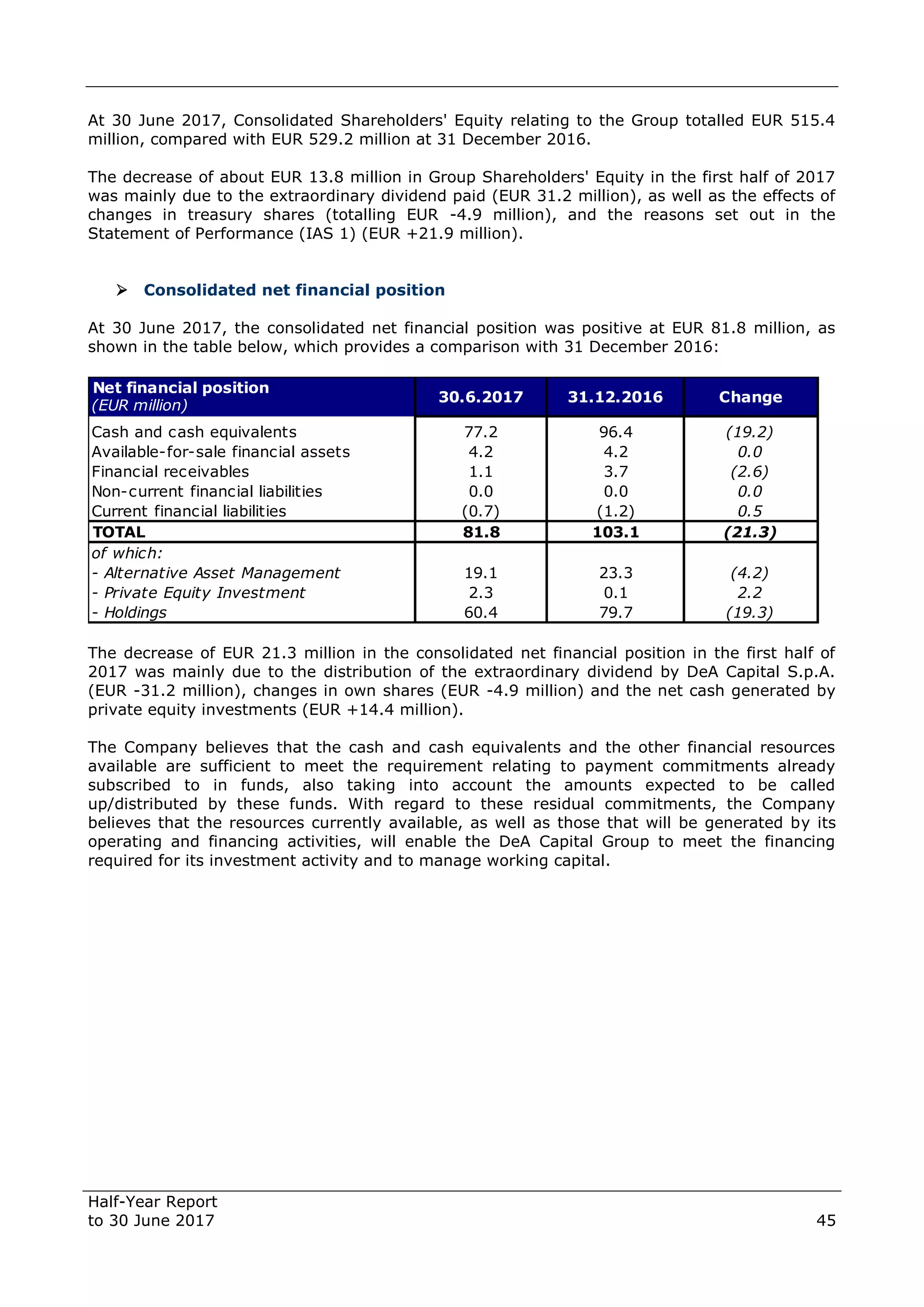

- The Group's net asset value increased to EUR 515.4 million, corresponding to a net asset value per share of EUR 2.00.

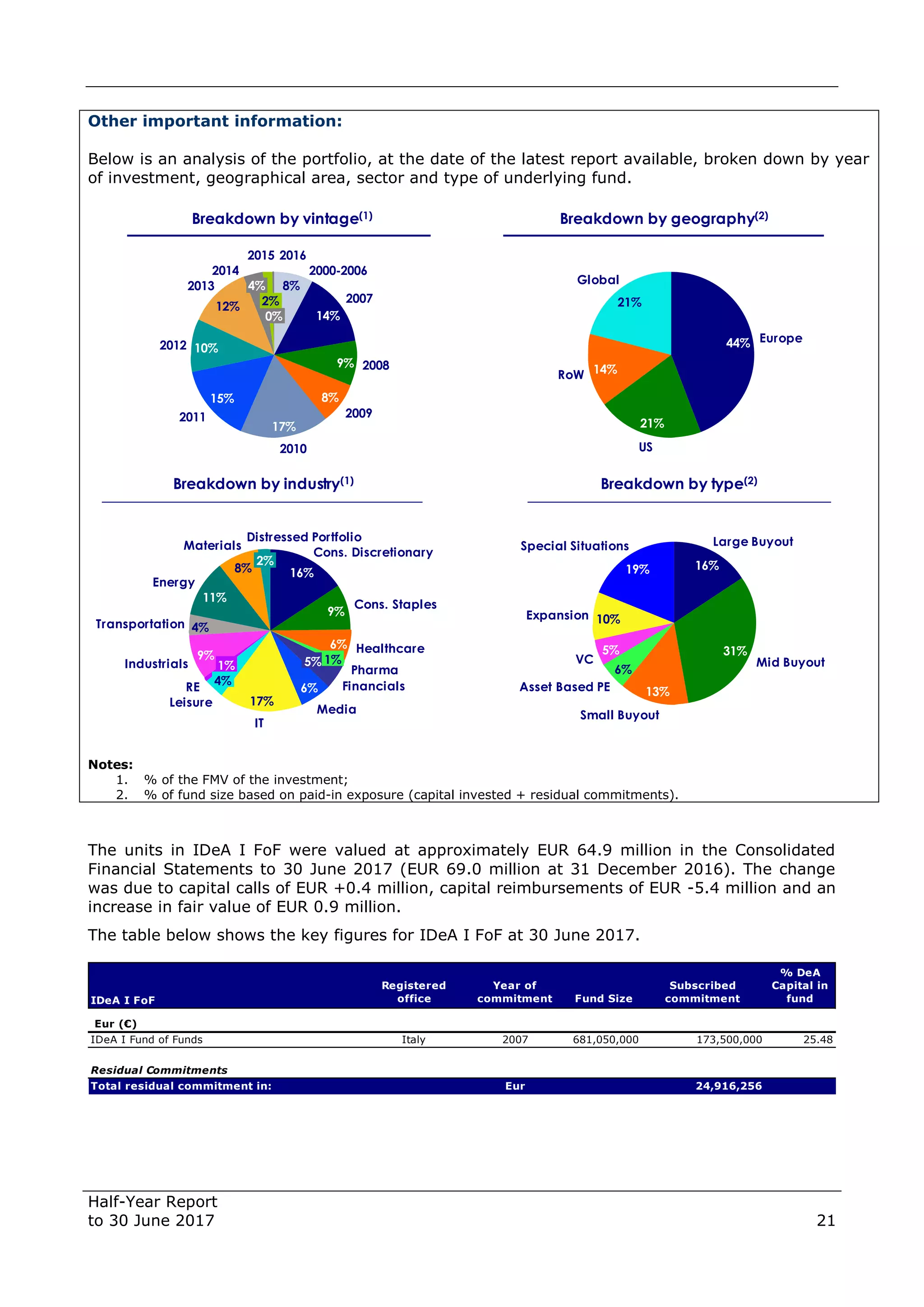

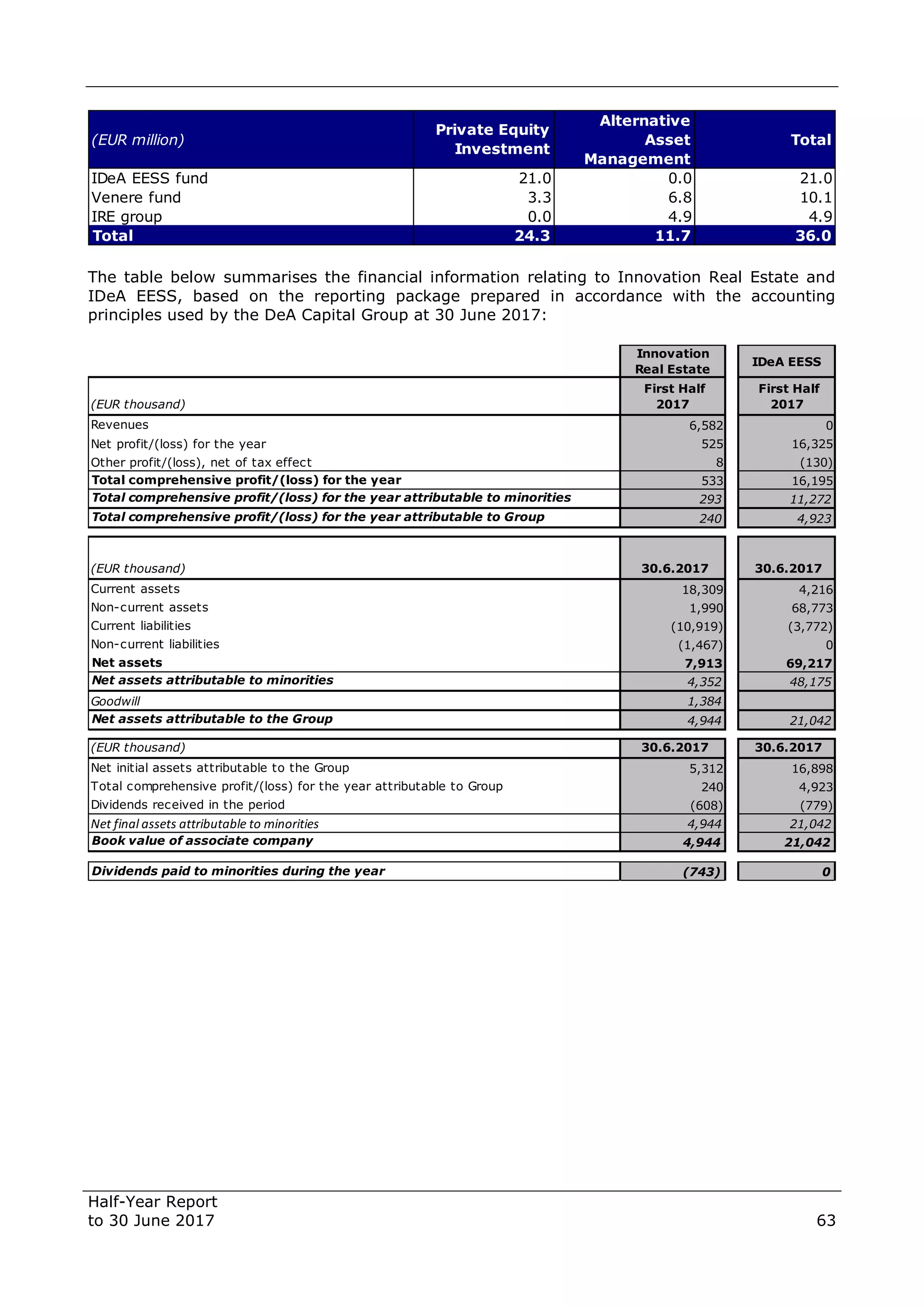

- The investment portfolio totalled EUR 453.4 million, including private equity investments of EUR 291.6 million and alternative asset management assets of EUR 161.8 million.

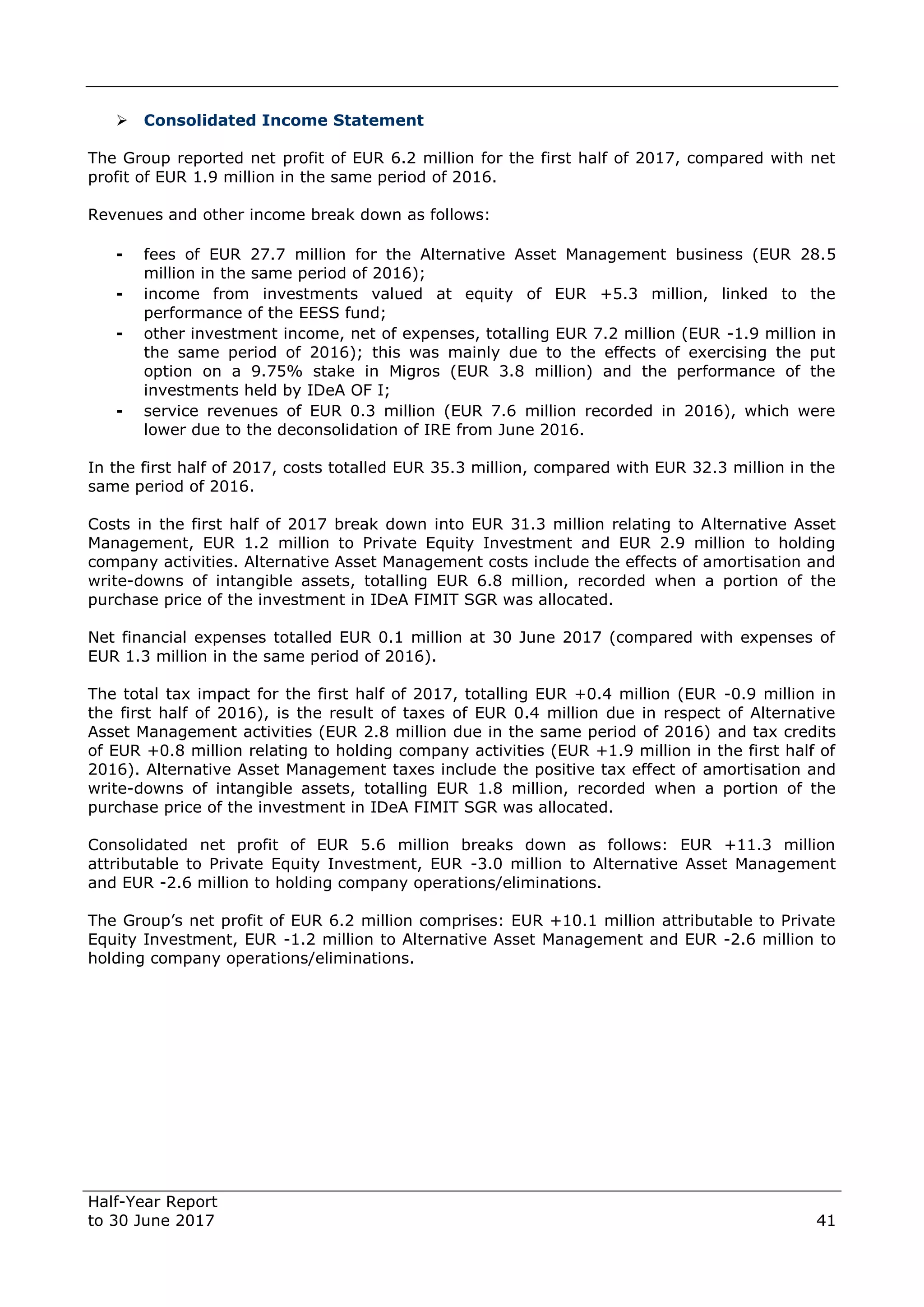

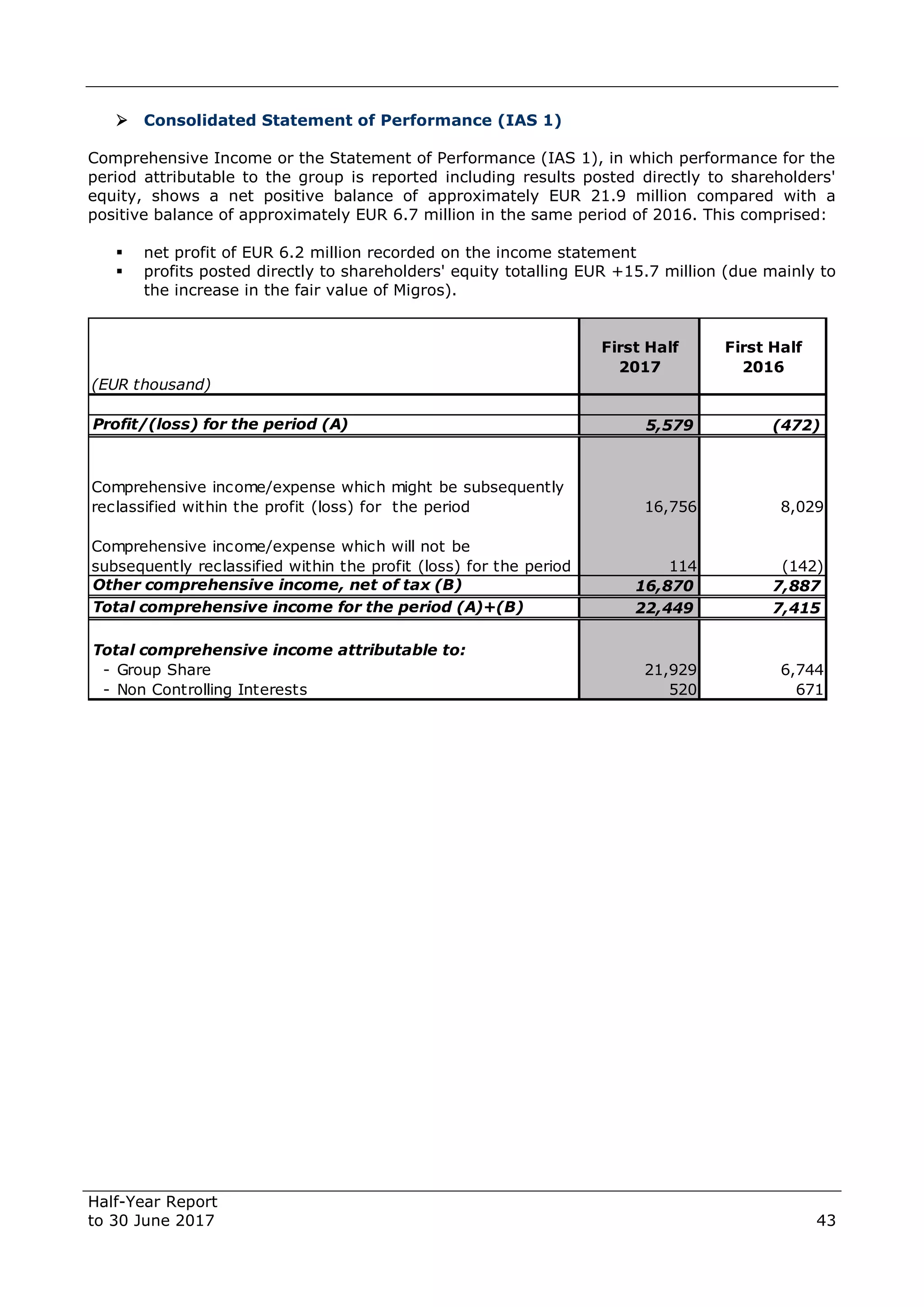

- The Group reported a net profit of EUR 6.2 million and comprehensive income of EUR 21.9 million for the first half of 2017.