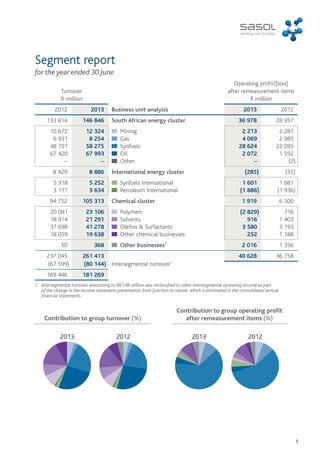

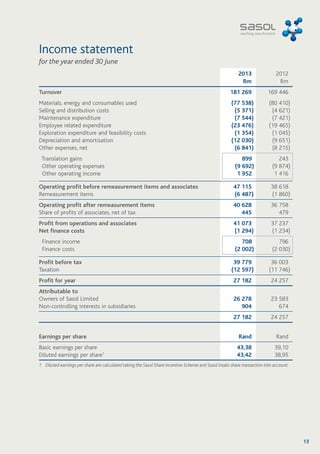

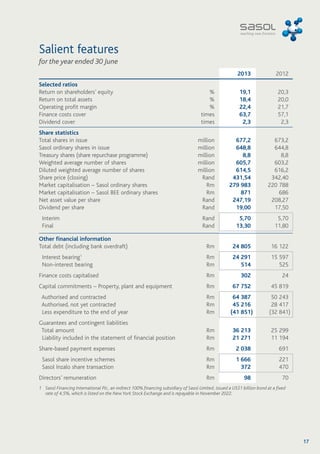

Sasol Limited reported stronger financial results for the year ended June 30, 2013 compared to the previous year. Key highlights included a 26% increase in operating profit, excluding once-off items, a 25% rise in headline earnings per share, and a 24% increase in cash generated from operating activities. Production volumes at Sasol Synfuels were up 4% and the company's safety recordable case rate reached a new low. However, the results were negatively impacted by several impairment charges and other once-off items totaling R8.5 billion. Looking ahead, Sasol aims to improve operational efficiency and reduce costs through a business performance enhancement program.