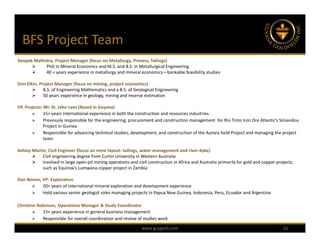

St. John Lees, VP Projects (based in Guyana)

Environmental: Golder Associates

Infrastructure: Knight Piésold

Geotechnical: SRK Consulting

Metallurgy: SGS Lakefield

Process: Ausenco

Project Management: AMEC

Mining: SRK Consulting

Economics: SRK Consulting

Tailings: Knight Piésold

Hydrology: Golder Associates

Social/Community: Golder Associates

Permitting: Golder Associates

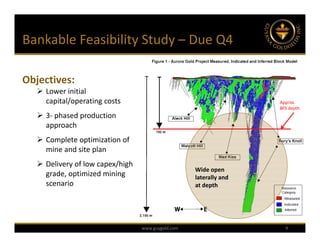

The BFS team has extensive experience in bankable feasibility studies for open pit and underground gold projects globally.

www.guygold.com