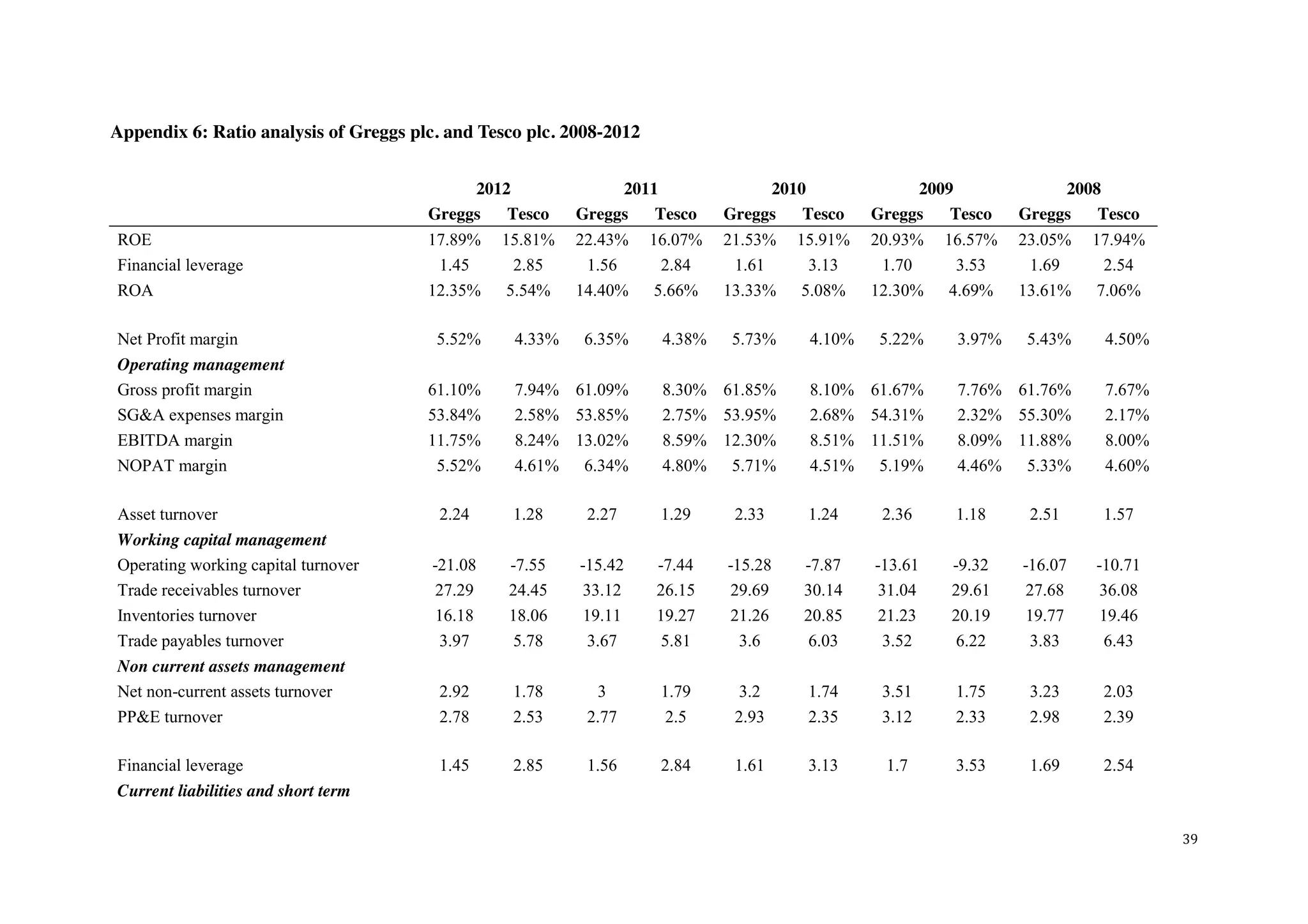

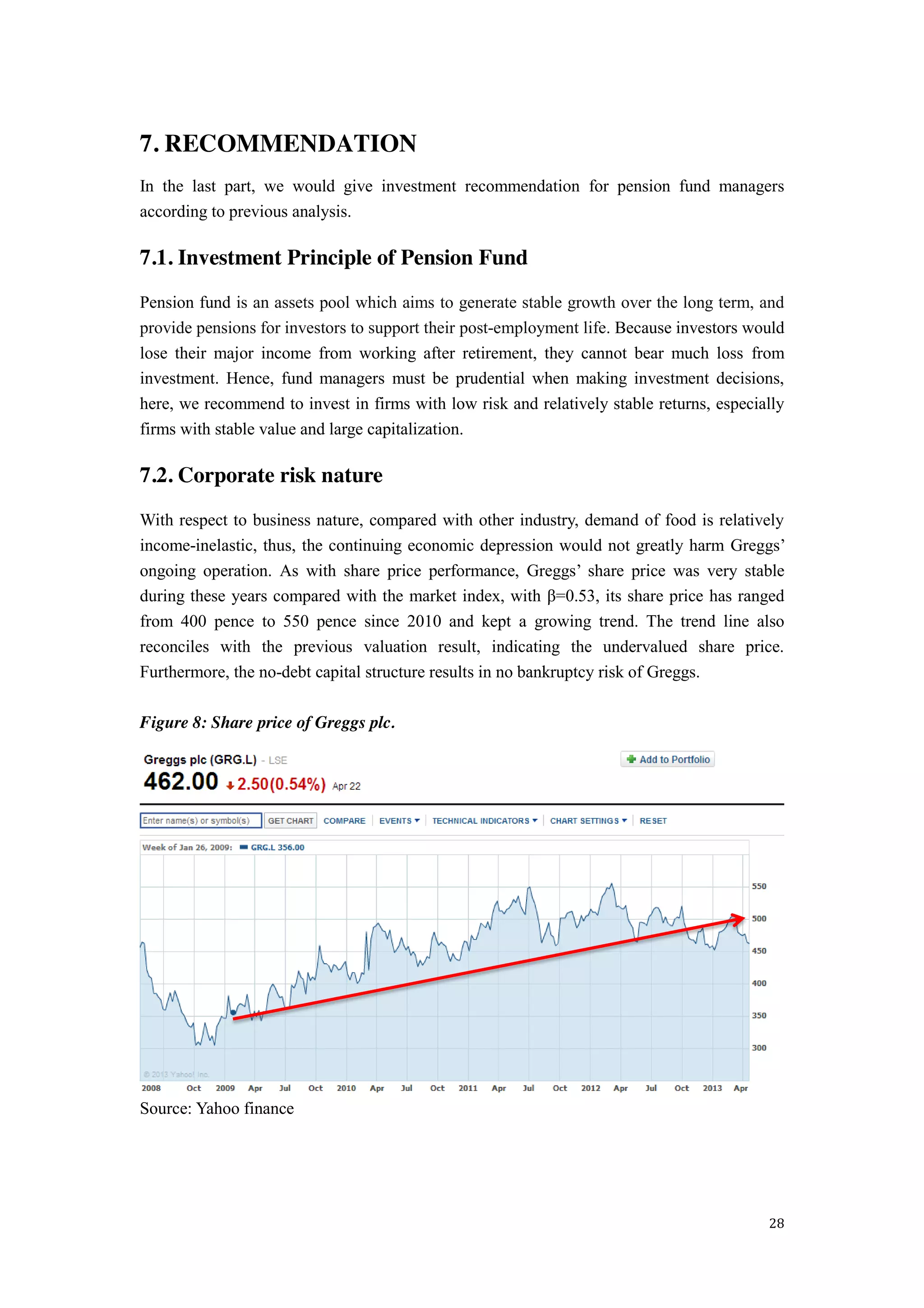

This document provides an analysis of Greggs plc, a UK bakery chain company. It begins with an overview of the company and its history. It then analyzes the food and drug retailer industry using Porter's Five Forces model. There is strong competition among existing bakery firms. The threat of new entrants and substitute products is moderate to high. Buyers have high bargaining power due to price sensitivity. Supplier bargaining power is relatively low. It also provides strategic, financial, and prospective analyses of Greggs through ratio comparisons and forecasting. Overall, the document presents a comprehensive analysis of Greggs' position in the industry.

![30

REFERENCE

British Baker (2013) BB 75 2013 report [Online] Available at

<http://www.bakeryinfo.co.uk/news/categoryfront.php/id/286/BB75_2013.html> [8th

April 2013]

Chris, T. (2011) Greggs picks its moment to take on Starbucks. [Online] Available at

<http://www.ft.com/cms/s/0/64ae9dba-f26f-11e0-931e-00144feab49a.html#axzz2RAue9

18o> [7th

April 2013]

CountryEconomy (2013) UK Bonds - 10 Years [Online] Retrieved at <

http://countryeconomy.com/bonds/uk?dr=2013-01> [12th

April 2013]

Covell, J. (2005) “Greggs PLC” International Directory of Company Histories 2005 [Online]

Available from < http://www.encyclopedia.com/doc/1G2-3429200053.html > [7th

April

2013]

Datamonitor (2010), Food Retail in the United Kingdom, [online] Available at:

<http://www.docin.com/p-338524950.html> [1st

April 2013]

Financial Times (2013) Greggs PLC, GRG:LSE performance, [Online] Available at

<http://markets.ft.com/research/Markets/Tearsheets/Summary?s=GRG:LSE> [1st

April

2013]

Greggs plc (2008) Annual Reports and Accounts 2008 [Online] Available at <

http://corporate.greggs.co.uk/assets/Uploads/2008-Annual-Report.pdf> [25th

March,

2013]

Greggs plc (2009) Annual Reports and Accounts 2009 [0nline] Available at <

http://corporate.greggs.co.uk/assets/Financial-Results/GREGGS%20ANNUAL%20REP

ORT_2010.pdf> [25th

March, 2013]

Greggs plc (2011) Annual Reports and Accounts 2010 [Online] Available at <

http://corporate.greggs.co.uk/assets/Uploads/630554A4ANNUAL-REPORT2011-3.pdf>

[25th

March, 2013]

Greggs plc (2012) Annual Reports and Accounts 2011 [Online] Available at

<http://corporate.greggs.co.uk/assets/Uploads/GREGGS-PLC-REPORT-AND-ACCOU

NTS.pdf> [25th

March, 2013]

Greggs plc (2013a) Annual Reports and Accounts 2012 [Online] Available at

<http://corporate.greggs.co.uk/assets/Uploads/GREGGS-18035-AR2012-Web.pdf> [25th](https://image.slidesharecdn.com/f02e9801-bbf4-453c-8b1b-bbc686852439-150709131601-lva1-app6891/75/Greggs-Financial-Analysis-30-2048.jpg)

![31

March, 2013]

Greggs plc (2013b) Company Overview [Online] Available at

<http://corporate.greggs.co.uk/company-overview> [28th

March, 2013]

Palepu, K. G., Healy, P.M. & Peek, E. (2010) Business Analysis and Valuation IFRS edition:

Second edition. Hampshire: South-Western, Cengage Learning Inc.

Porter M.E. (1979), The Five Competitive Forces that Shape Strategy, [online] Available at:

<http://prolog.univie.ac.at/teaching/LVAs/KFK-LM/WS07/Porter.pdf> [25th

March

2013]

TESCO plc (2009) Annual Report and Financial Statements 2008 [Online] Available at <

http://www.tescoplc.com/files/pdf/reports/annual_report_2009.pdf > [25th

March, 2013]

TESCO plc (2010) Annual Report and Financial Statements 2009 [Online] Available at <

http://www.tescoplc.com/files/pdf/reports/annual_report_2009.pdf > [25th

March, 2013]

TESCO plc (2011) Annual Report and Financial Statements 2010 [Online] Available at <

http://www.tescoplc.com/files/pdf/reports/annual_report_2010.pdf> [25th

March, 2013]

TESCO plc (2012) Annual Report and Financial Statements 2011 [Online] Available at <

http://www.tescoplc.com/files/pdf/reports/tesco_annual_report_2011.pdf> [25th

March,

2013]

TESCO plc (2013) Annual Report and Financial Statements 2012 [Online] Available at <

http://www.tescoplc.com/files/pdf/reports/tesco_annual_report_2012.pdf> [25th

March,

2013]

Trading Economics 2013, United Kingdom Households Disposable Income, [online]

Retrieved at:

<http://www.tradingeconomics.com/united-kingdom/disposable-personal-income> [3rd

April, 2013]

Trading Economics 2013, United Kingdom Consumer Spending, [online] Retrieved at:

<http://www.tradingeconomics.com/united-kingdom/consumer-spending> [3rd

April,

2013]

Verdict (2013) How the UK Will Shop: 2013, [online] Available at:

<http://www.sas.com/offices/europe/uk/downloads/retail/retail-predictions2013.pdf> [2nd

April 2013]](https://image.slidesharecdn.com/f02e9801-bbf4-453c-8b1b-bbc686852439-150709131601-lva1-app6891/75/Greggs-Financial-Analysis-31-2048.jpg)