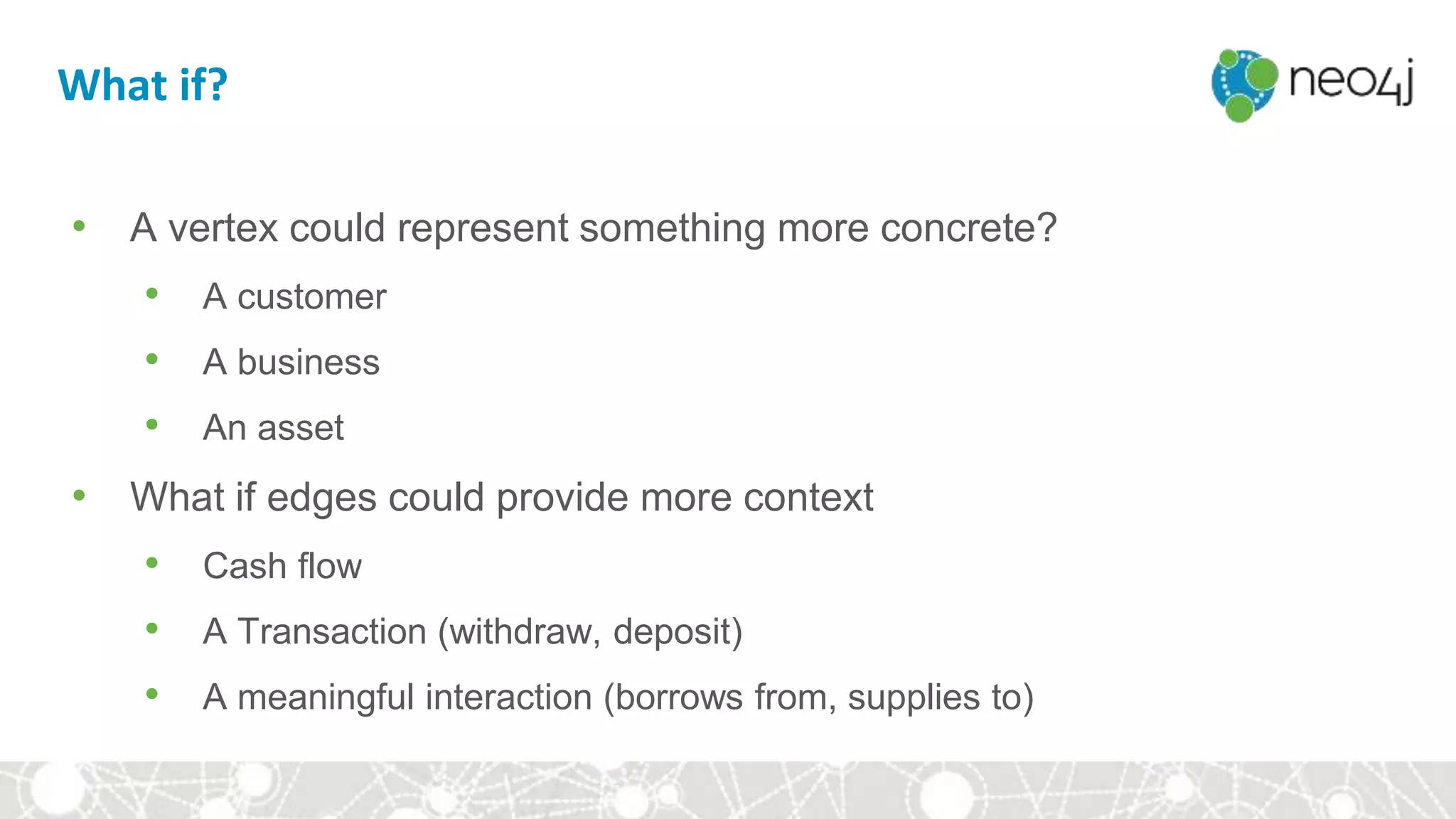

This document discusses how graphs and graph databases can be used for financial services applications. It provides three potential use cases:

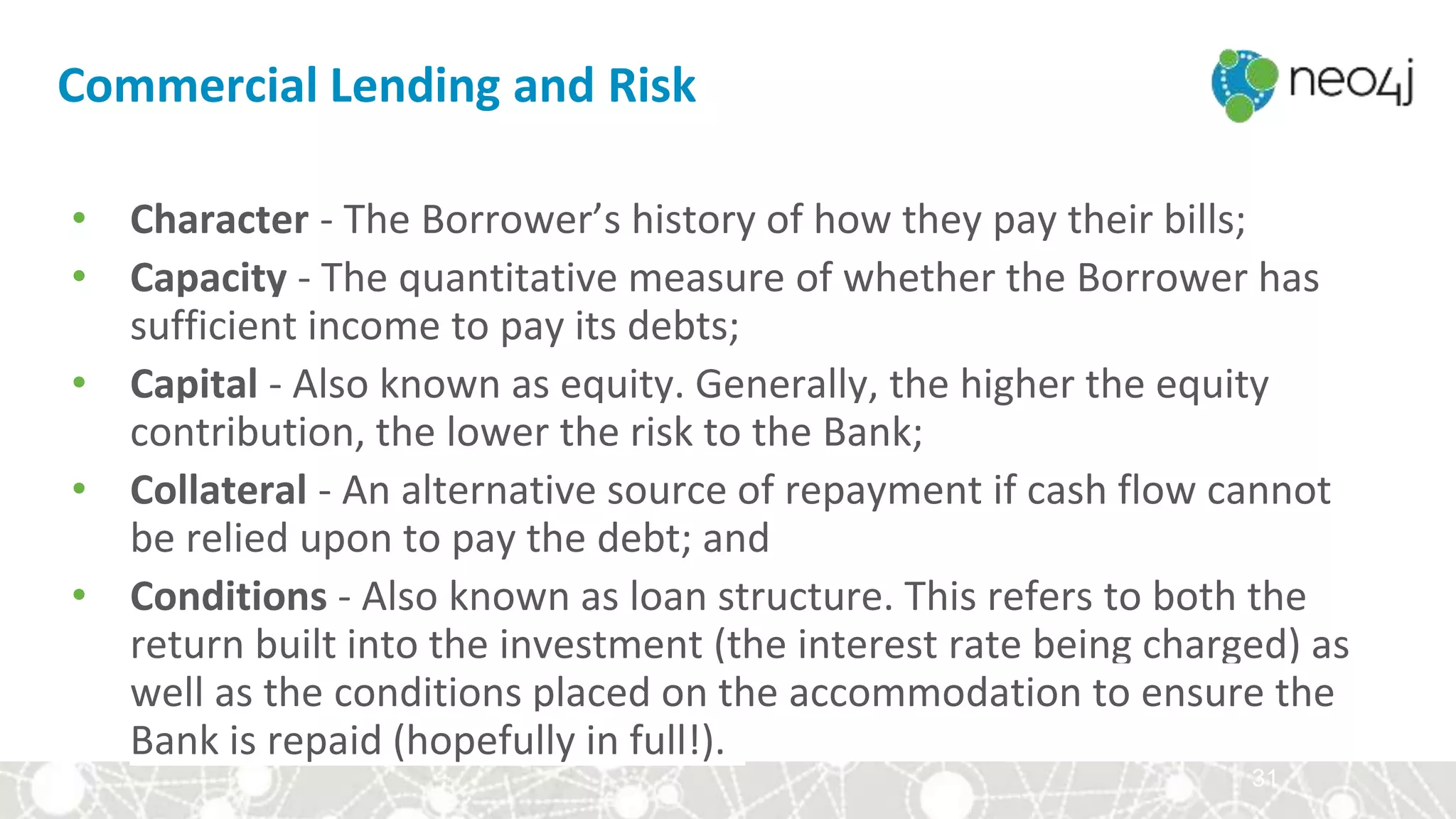

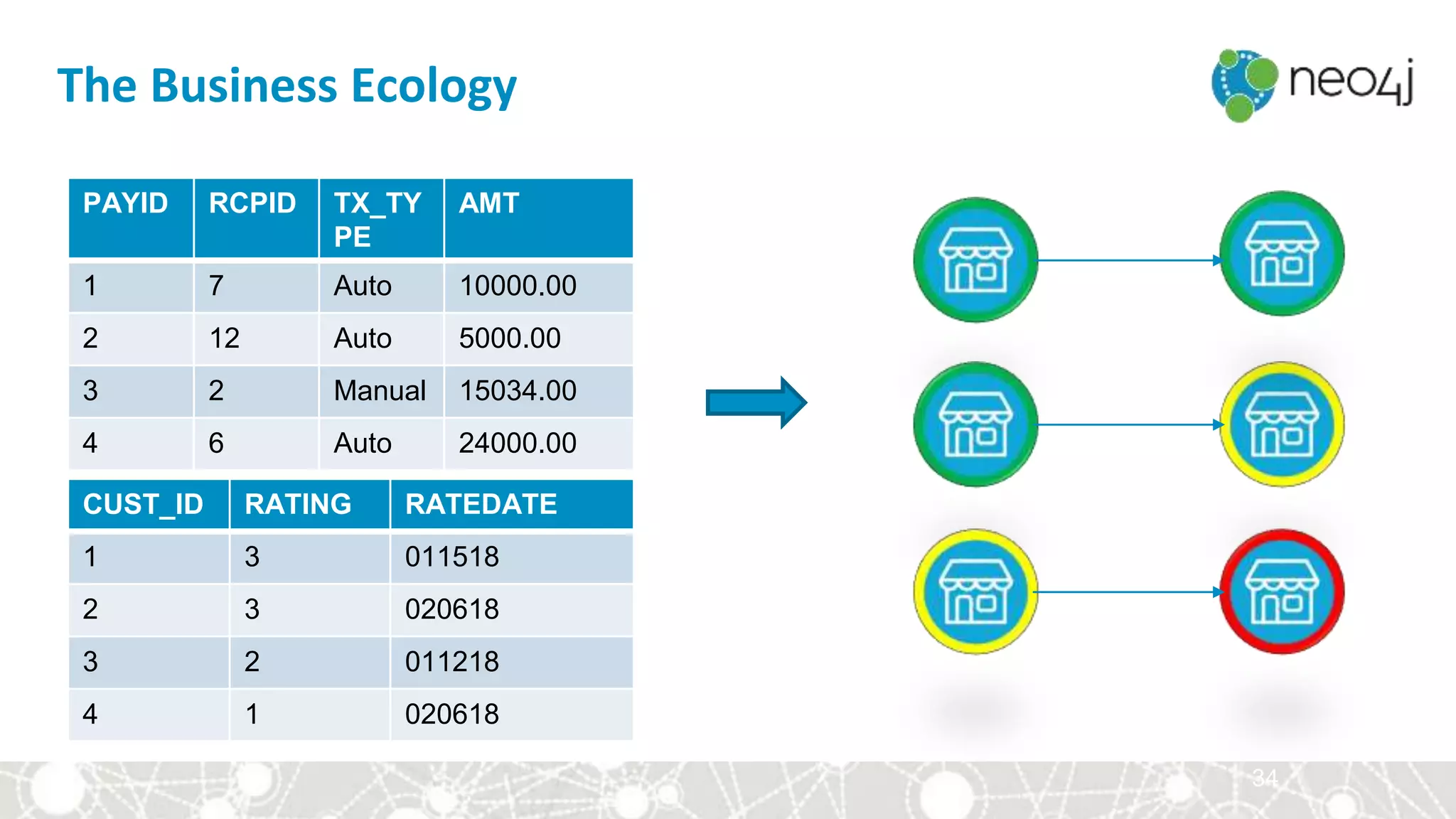

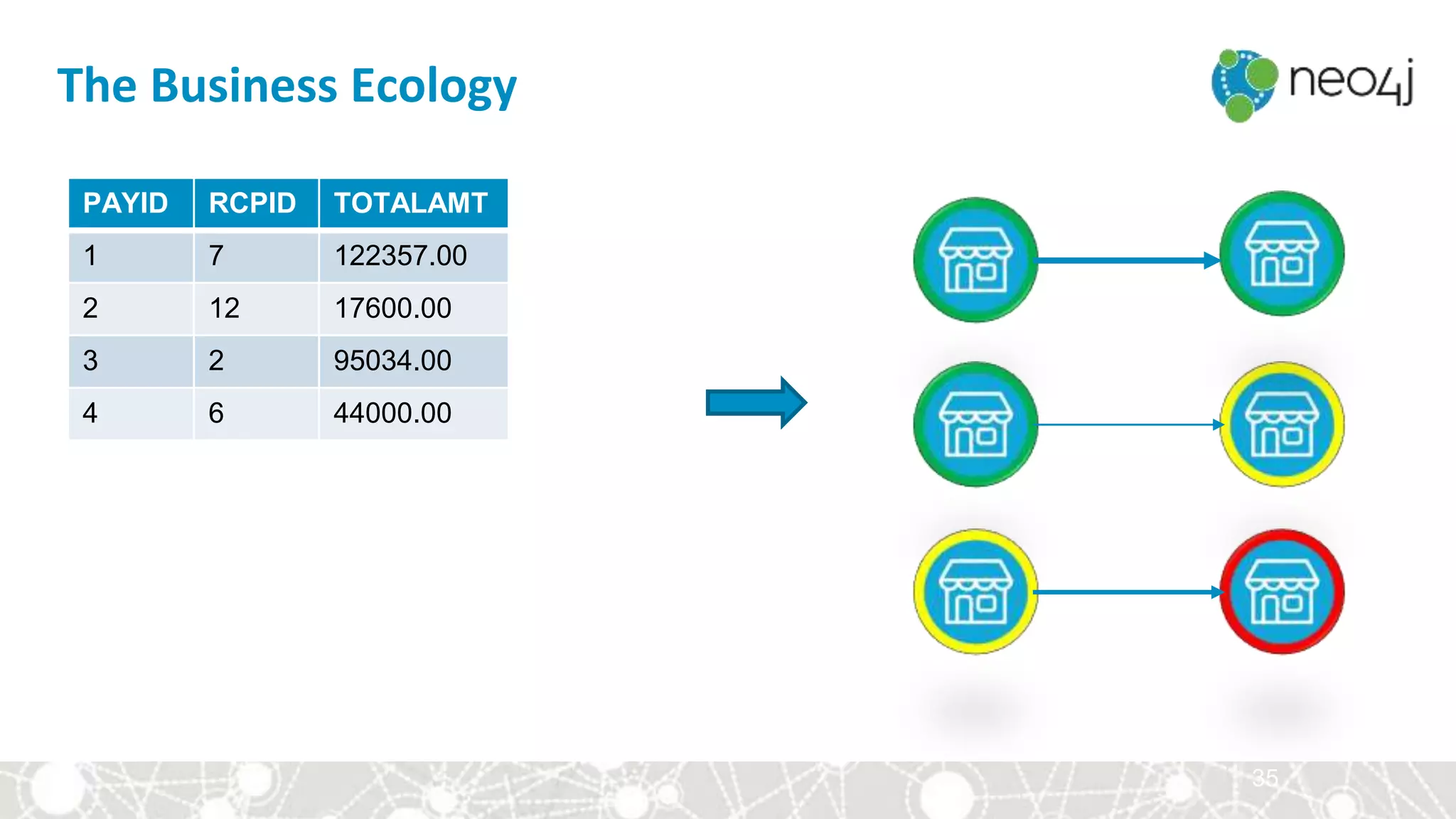

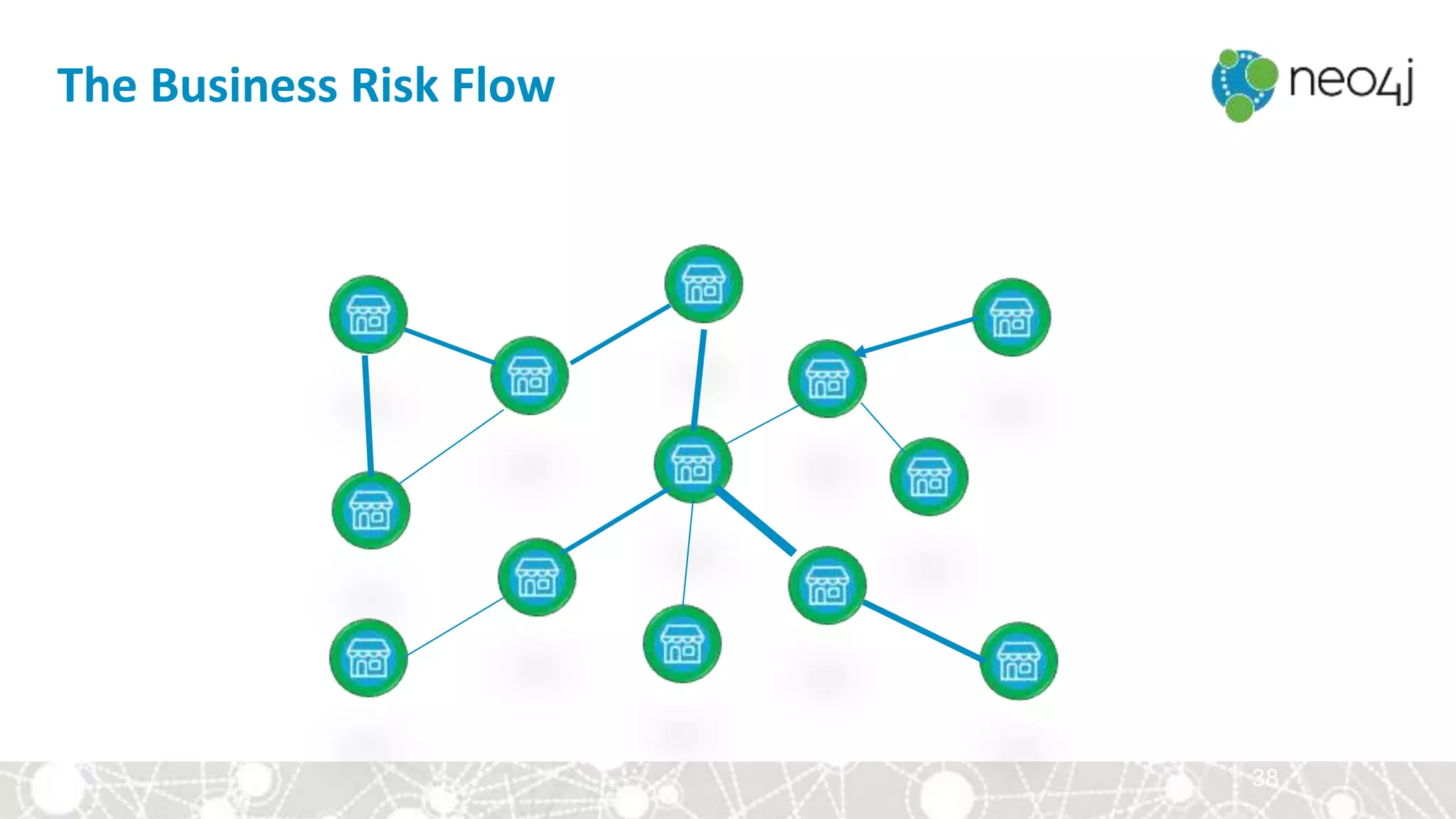

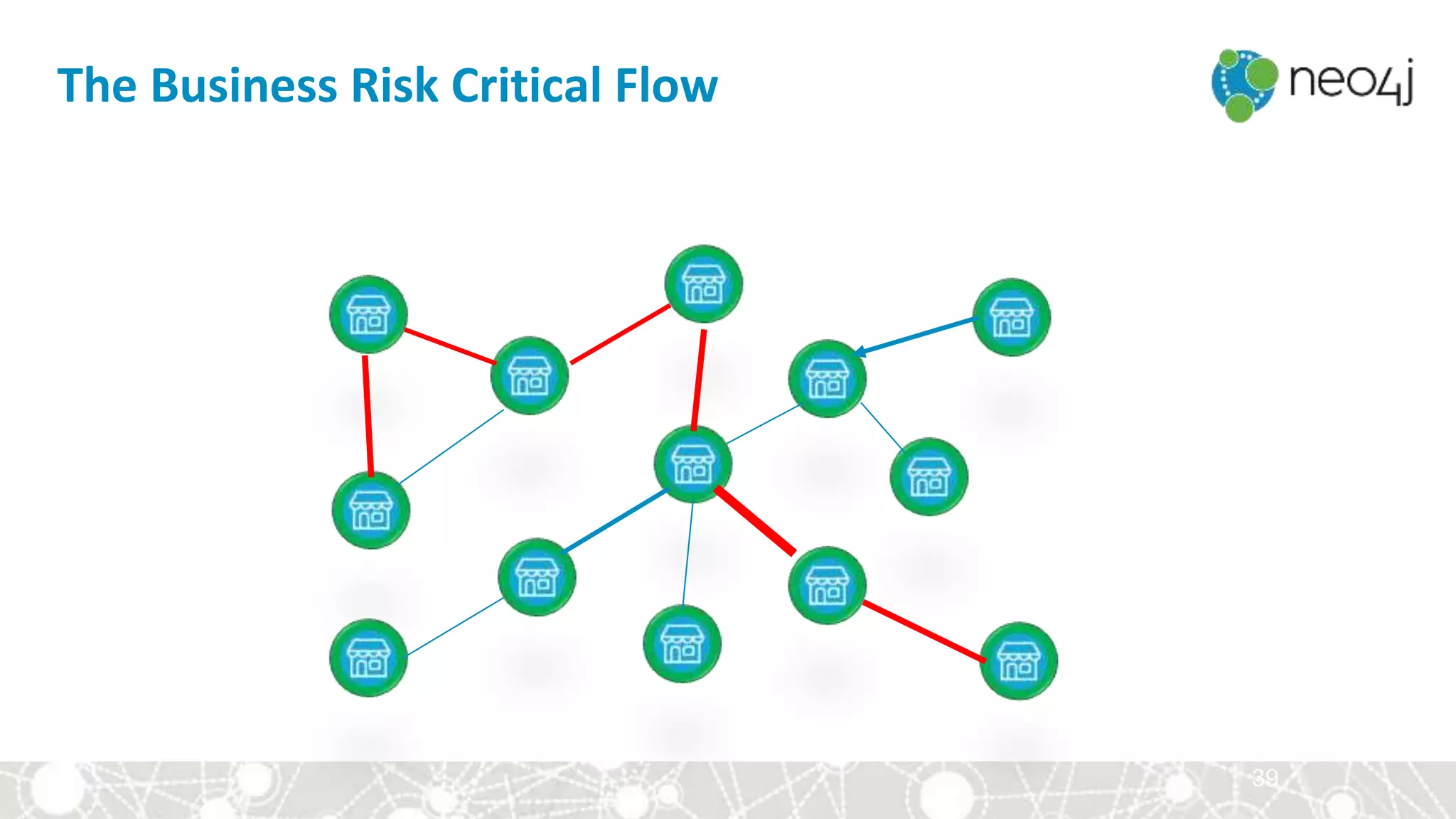

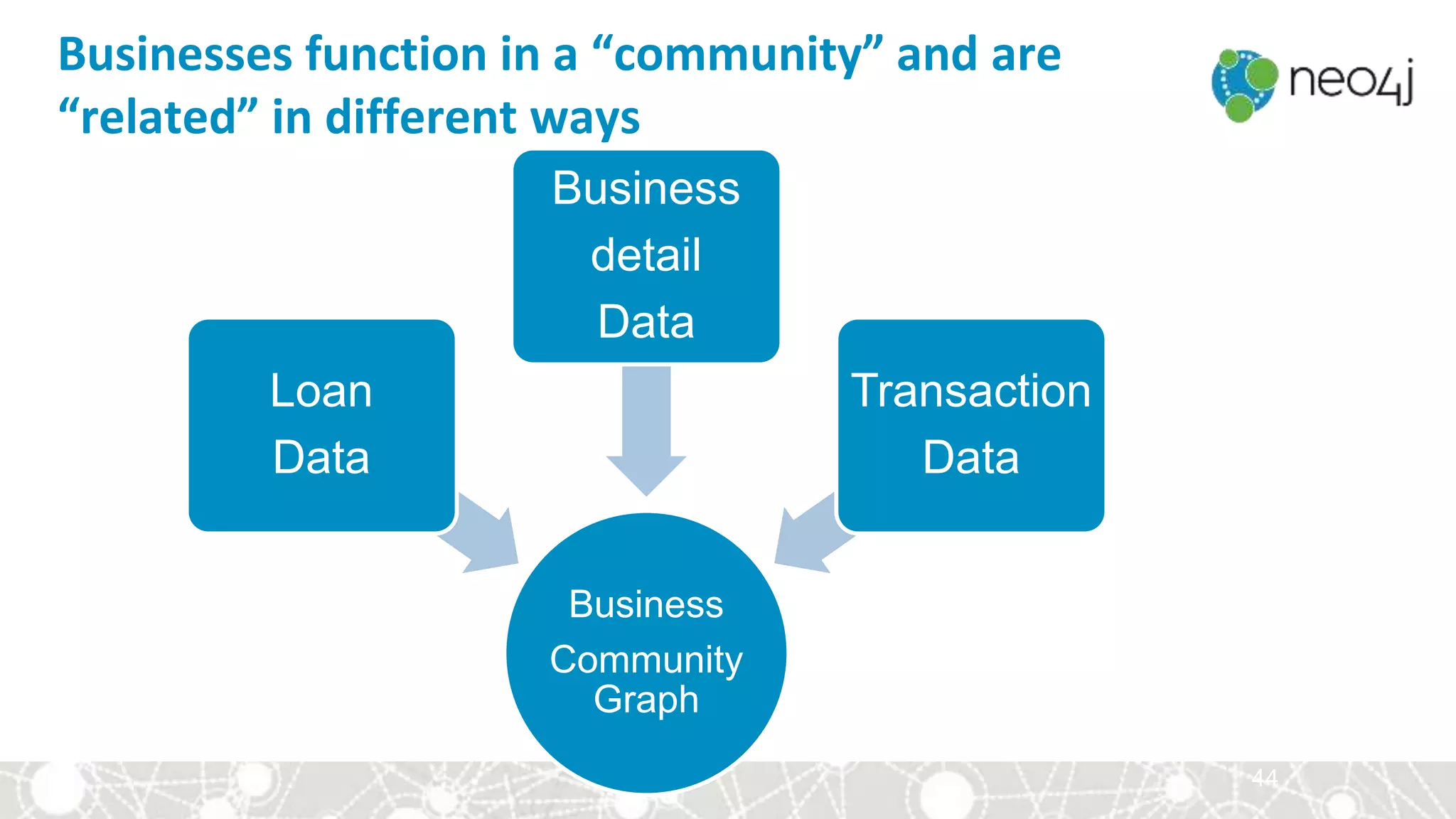

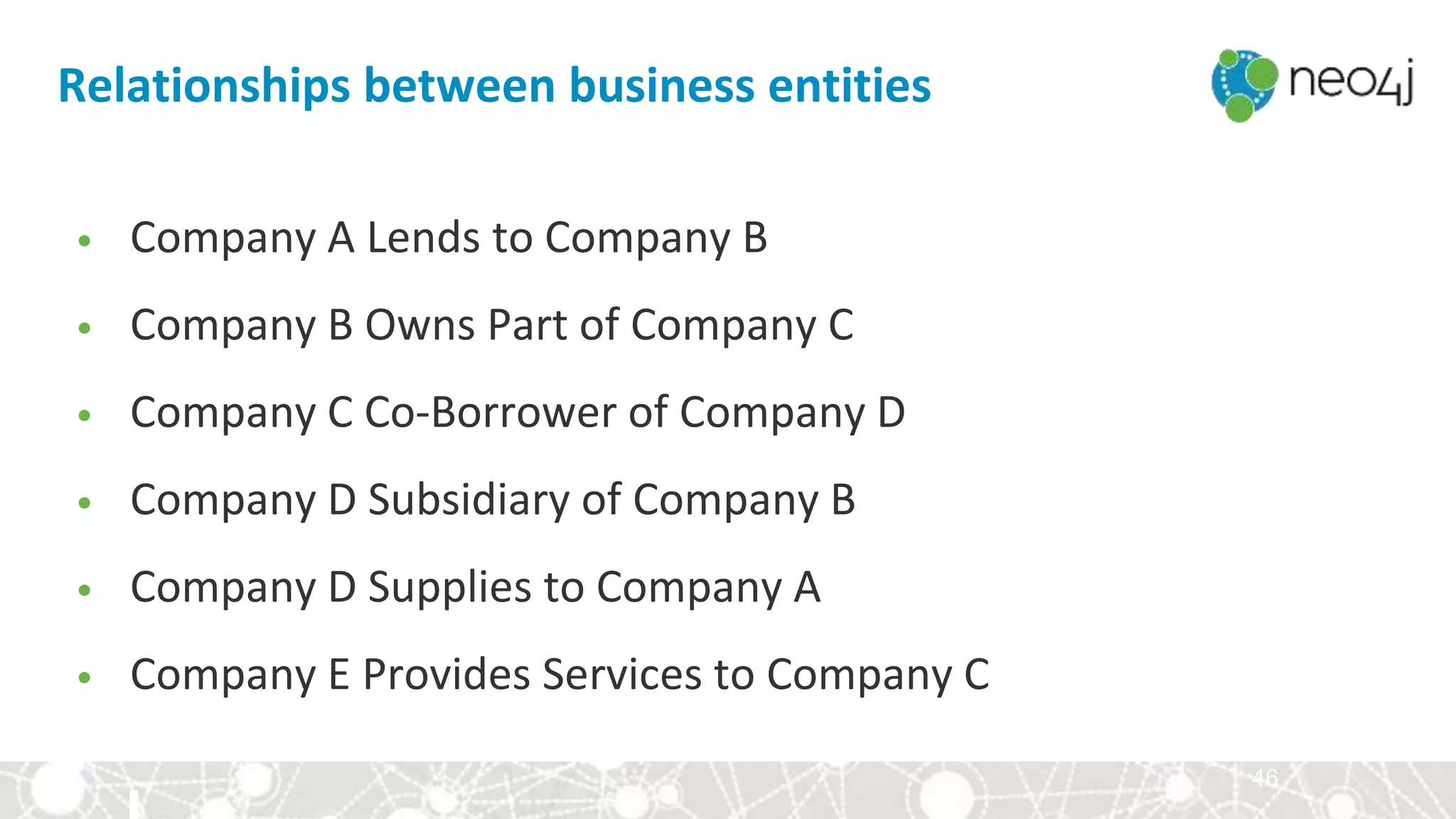

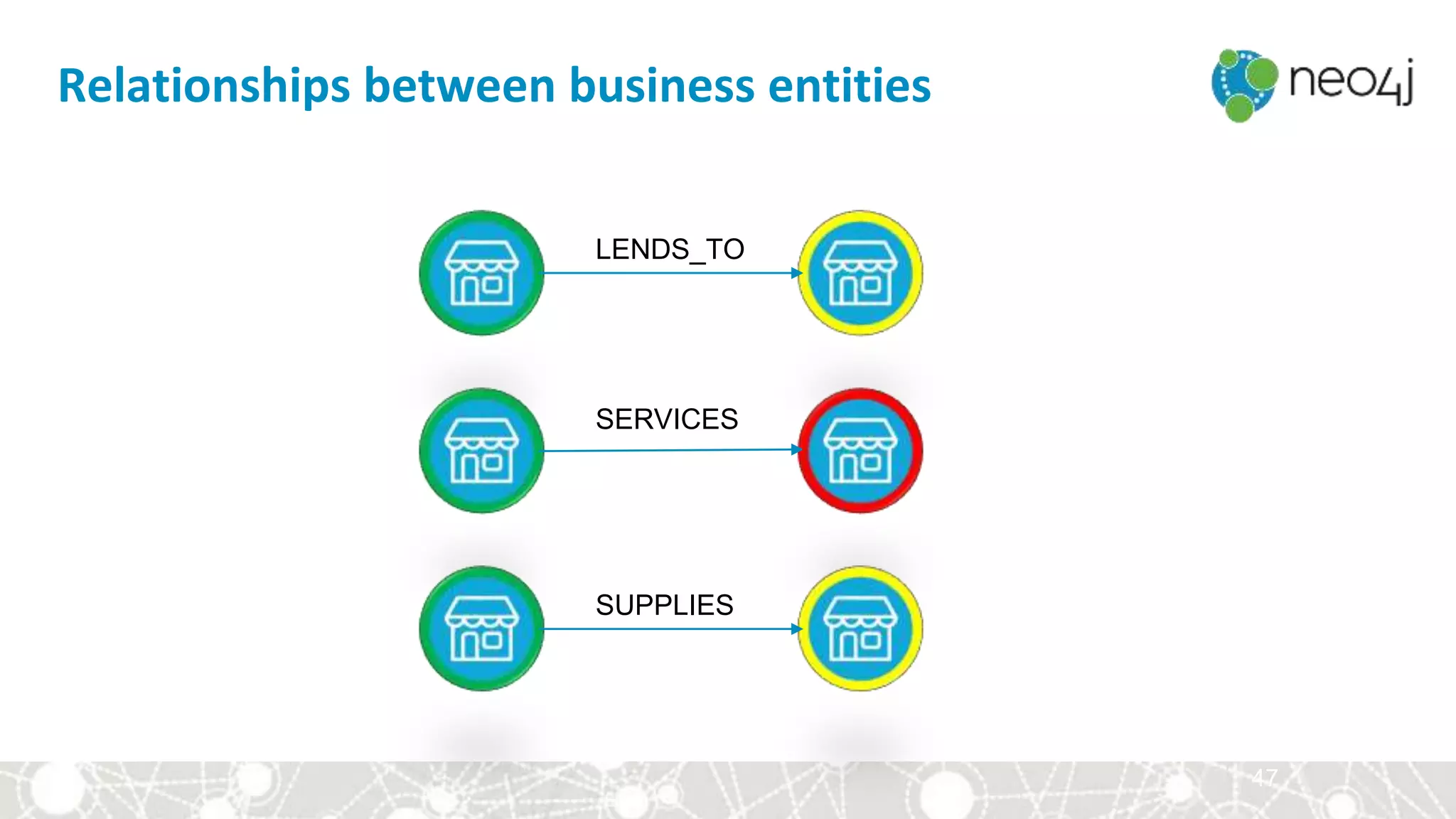

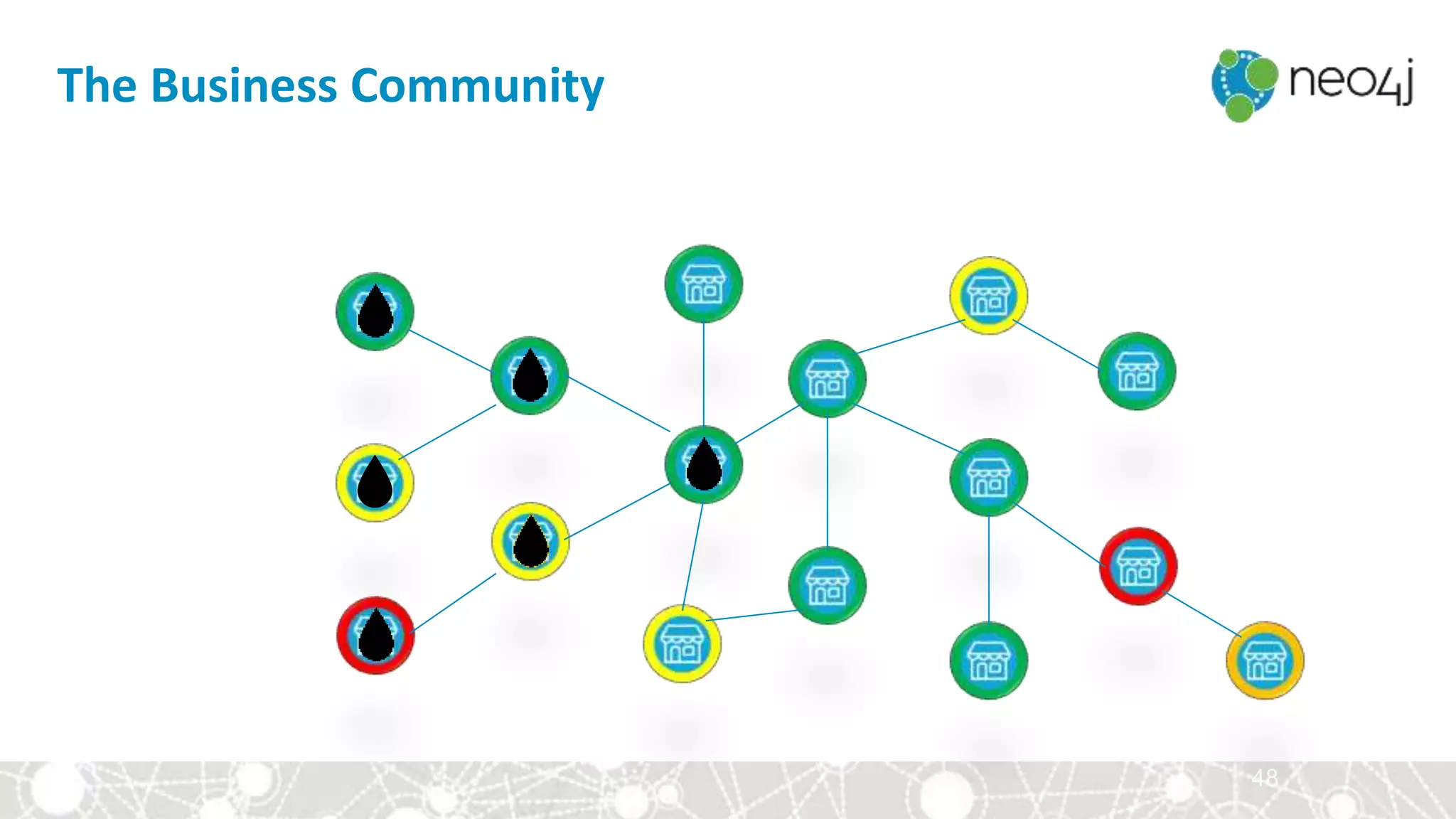

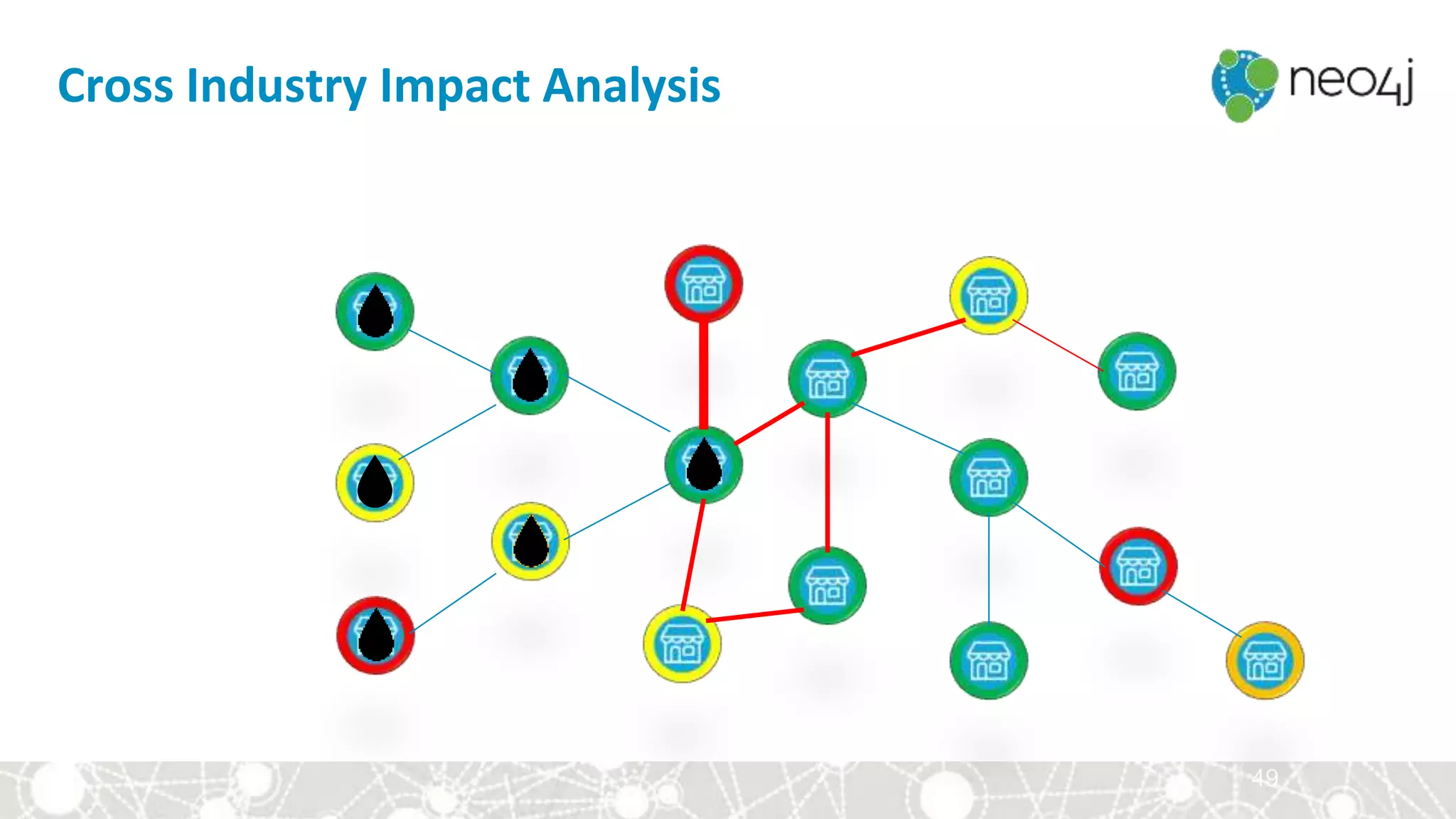

1. Measuring risk in corporate lending by understanding the relationships between businesses and how they are connected through partnerships, supply chains, etc.

2. Understanding exposure to commodities or industries by analyzing how businesses and customers are related to different commodities and how changes in commodities may impact them.

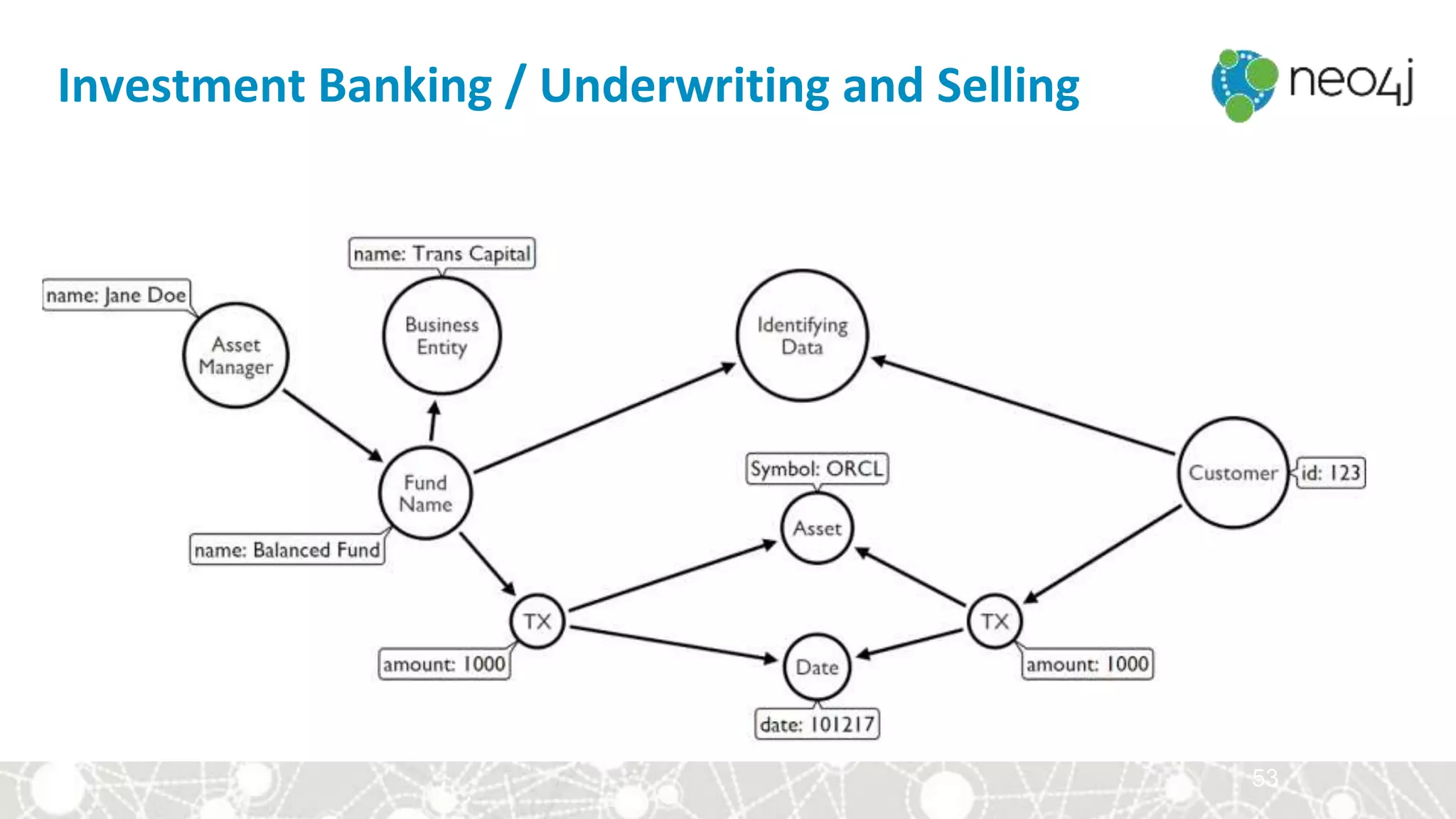

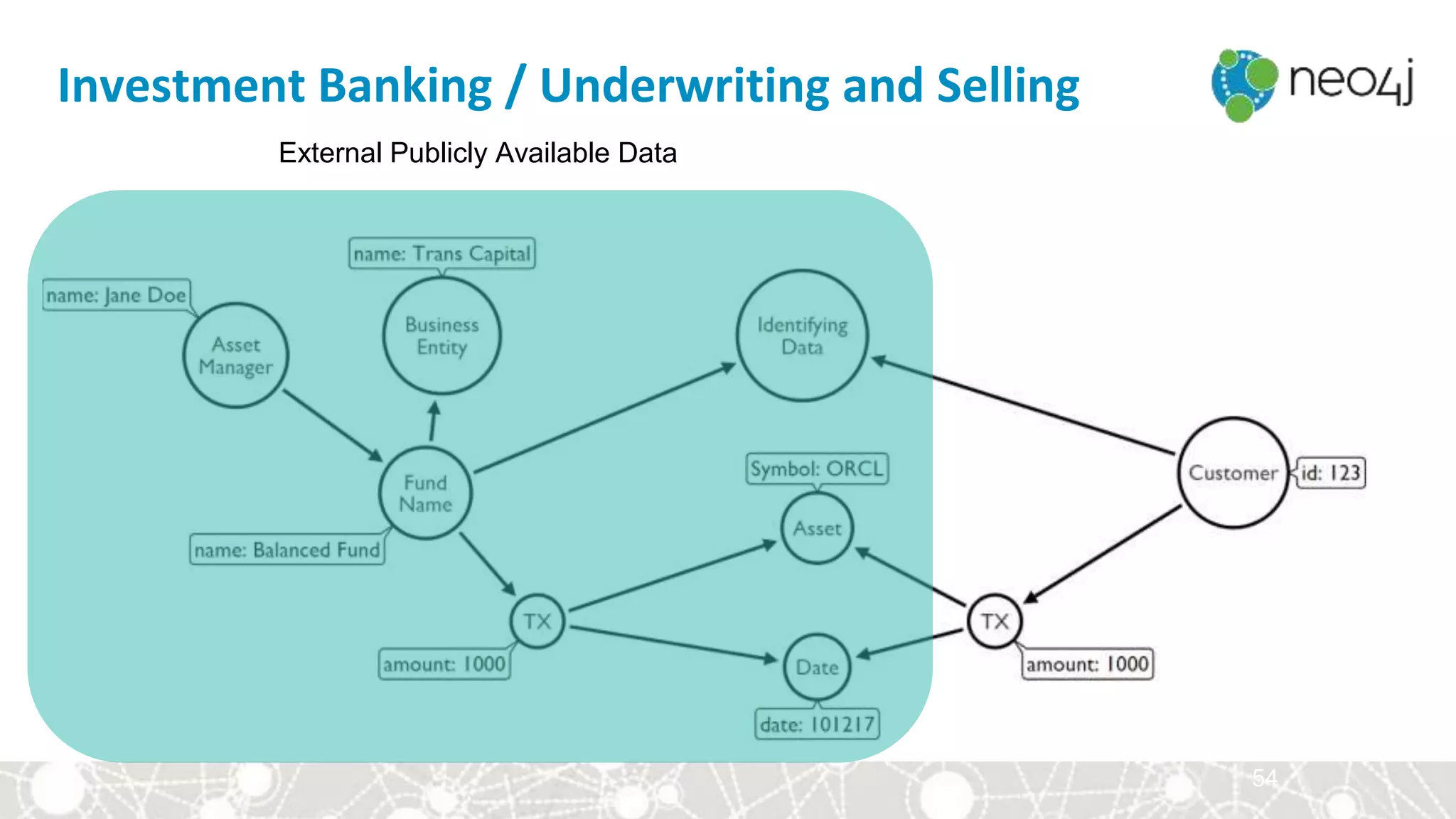

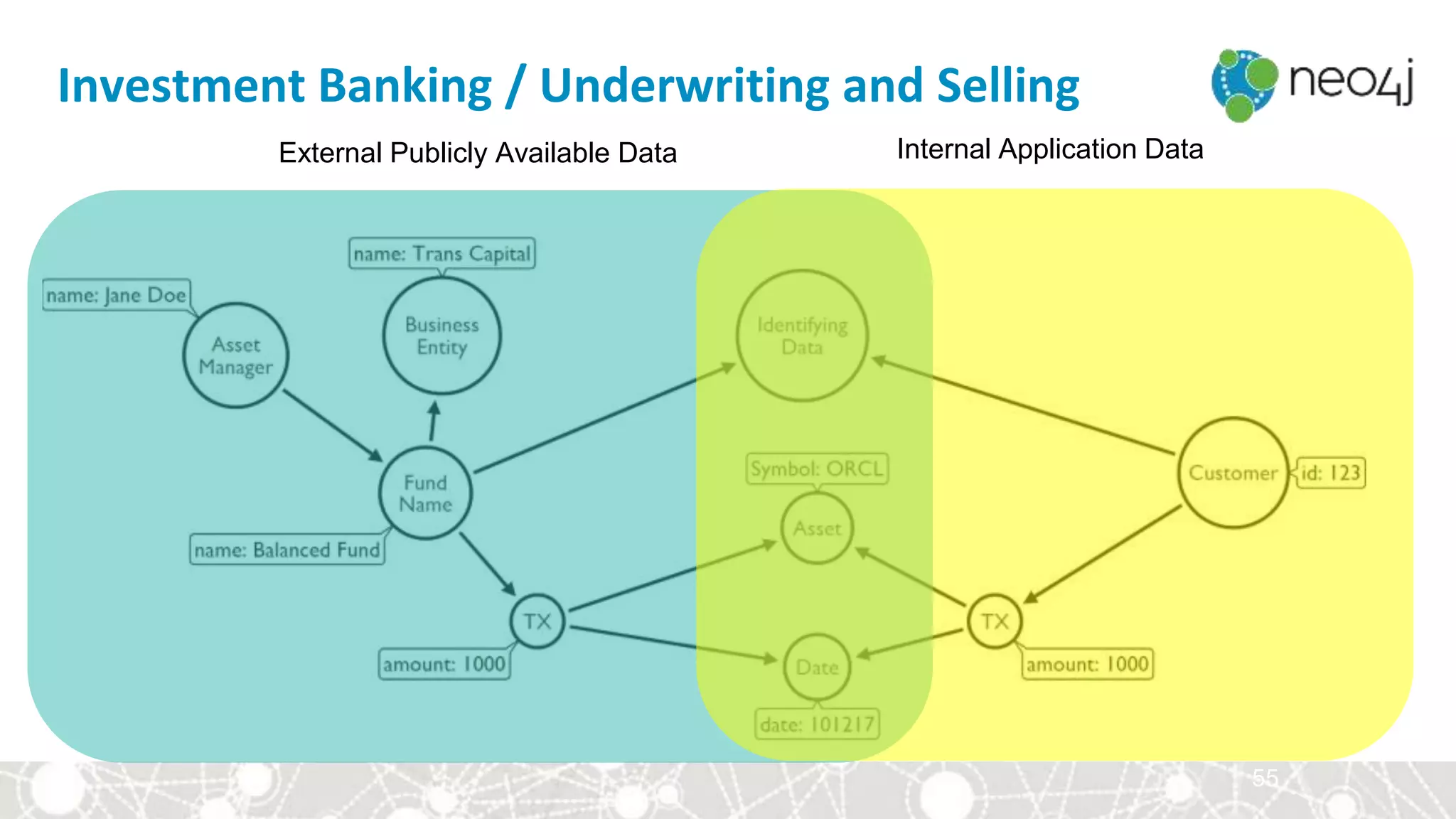

3. Predicting customer behavior for investment banking by using graph analysis to better understand customer relationships and trading patterns to anticipate future wants and needs.