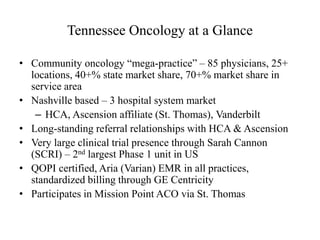

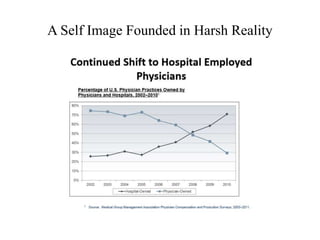

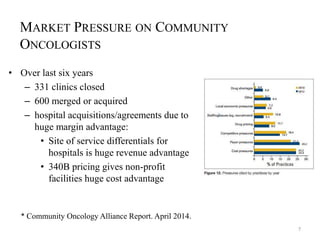

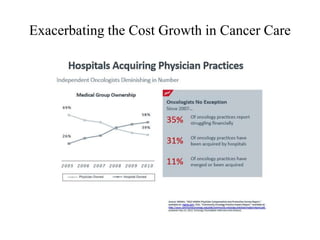

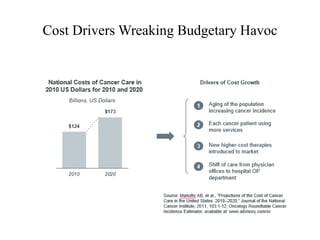

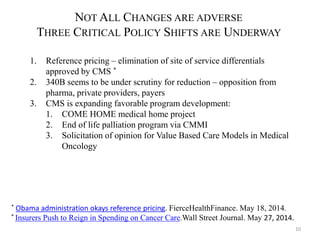

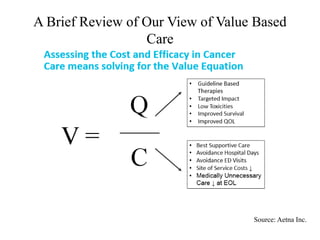

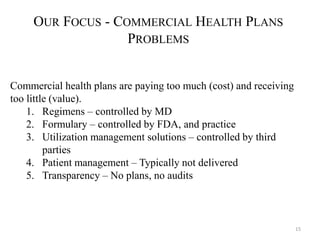

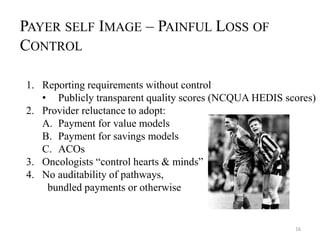

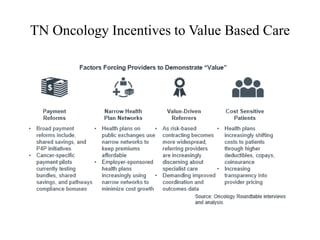

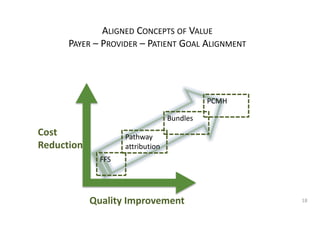

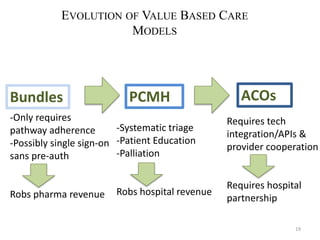

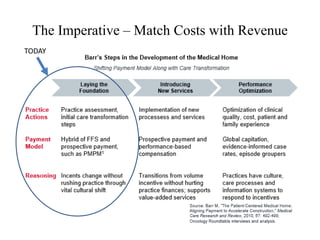

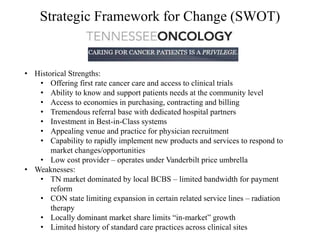

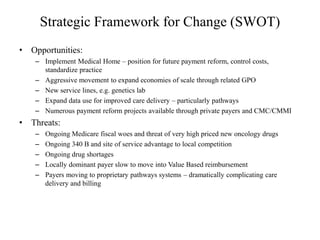

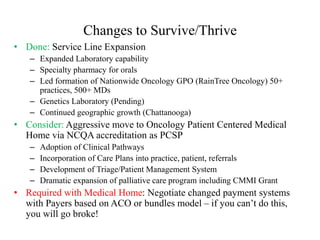

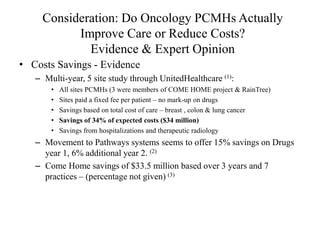

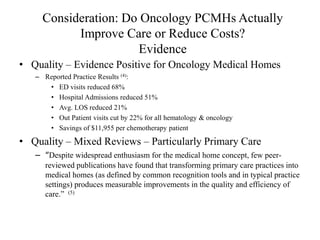

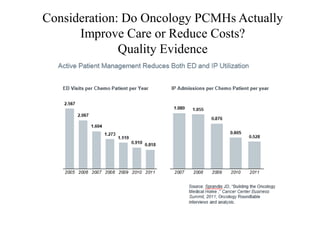

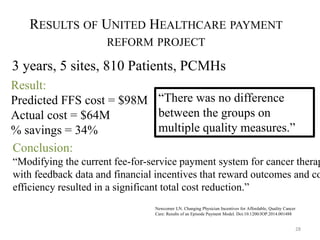

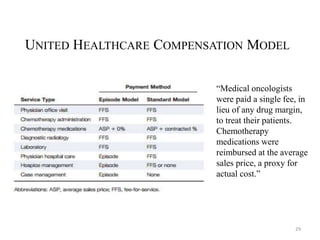

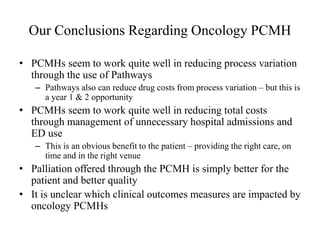

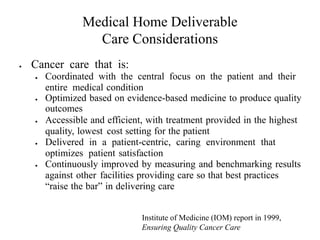

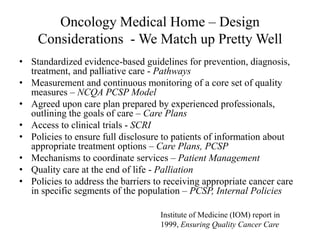

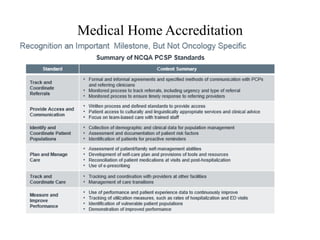

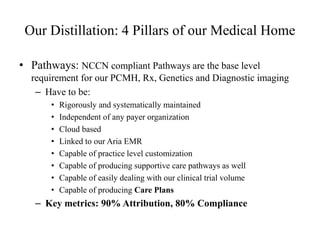

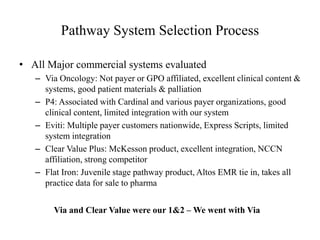

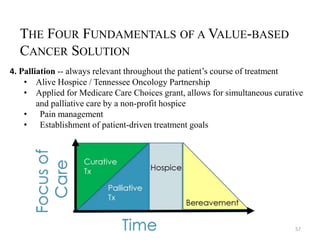

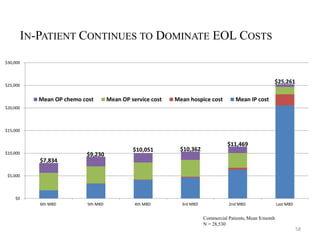

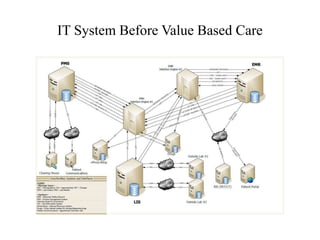

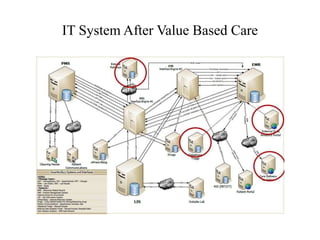

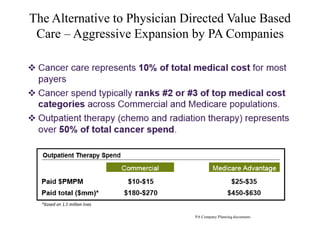

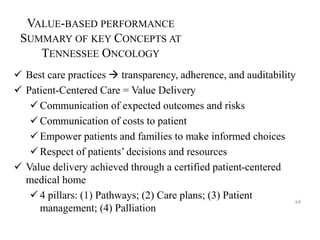

Tennessee Oncology, a large community oncology practice, faces significant market pressures and is transitioning to a value-based care model to improve outcomes and reduce costs. Key strategies include expanding patient-centered medical homes, integrating clinical pathways, and negotiating new payment systems to align costs with revenue. The initiative aims to enhance patient care, control unnecessary treatments, and adapt to evolving healthcare policies while facing challenges from dominant local payers and competition.