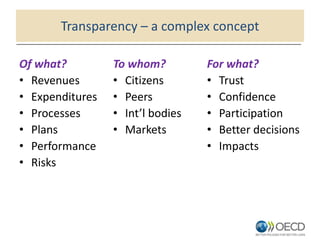

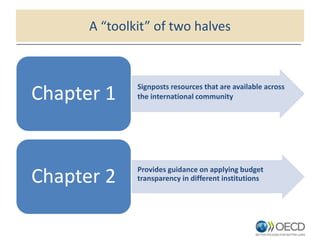

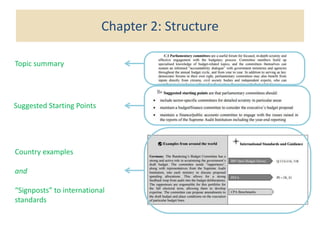

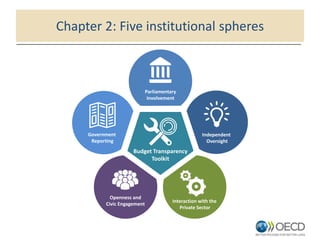

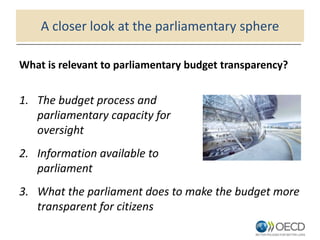

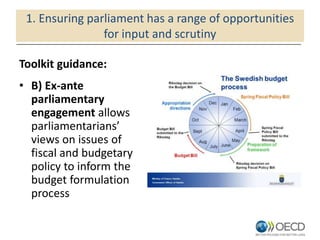

The document discusses the importance of budget transparency in parliaments, highlighting its complexity and relevance to various stakeholders such as citizens and international bodies. It presents a toolkit that includes guidance on institutional approaches, parliamentary oversight, and enhancing engagement in the budget process. Key aspects emphasize the need for parliaments to have opportunities for input and scrutiny and support their capacity to enhance accountability and fiscal responsibility.