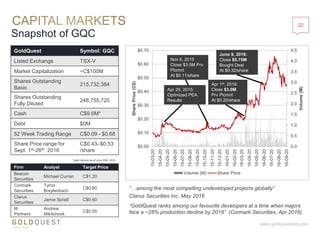

The document discusses Goldquest Corporation's Romero gold-copper project in the Dominican Republic. Key points include:

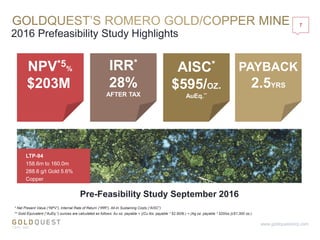

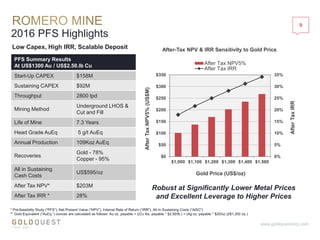

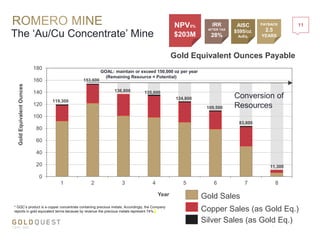

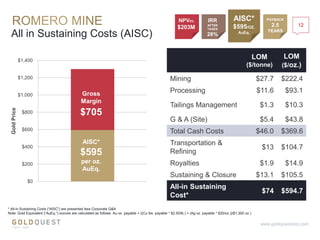

- A pre-feasibility study shows the project has an after-tax NPV of $203 million and IRR of 28% at $1,300/oz gold.

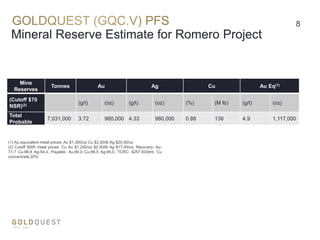

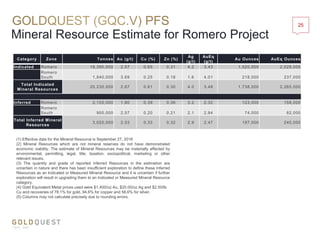

- Proven and probable reserves total over 7 million tonnes grading 3.72 g/t gold and 0.88% copper for 980,000 ounces of gold.

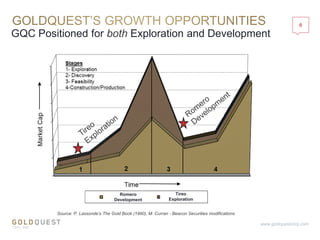

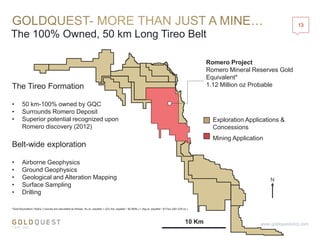

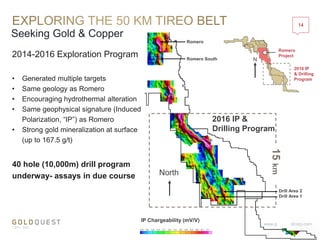

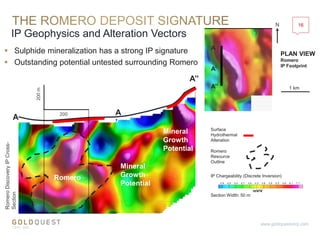

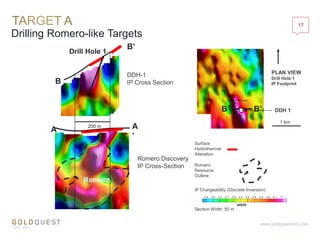

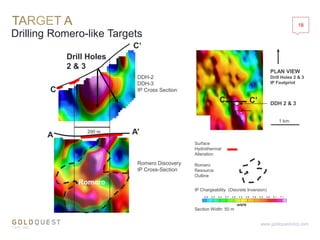

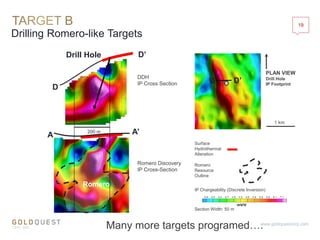

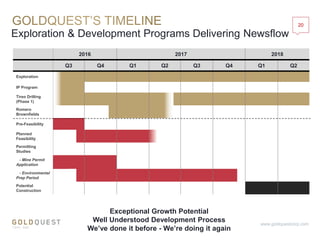

- Exploration is targeting additional deposits along the 50 km Tireo Formation, with a 10,000 meter drill program underway.