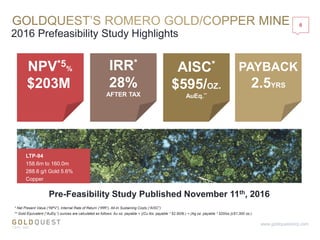

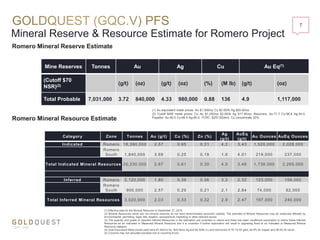

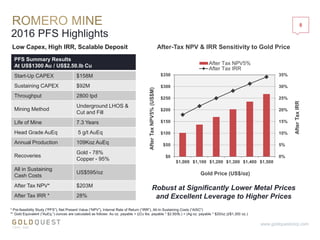

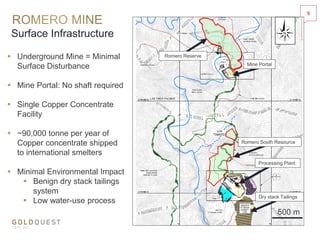

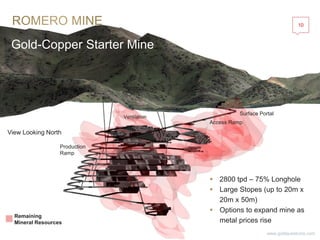

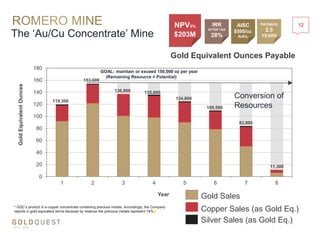

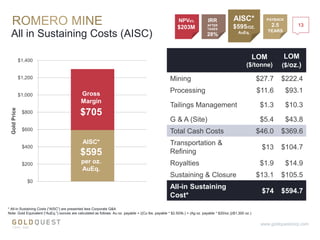

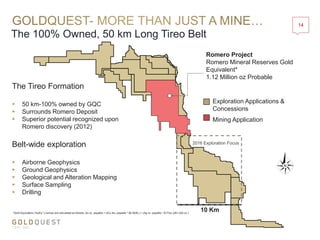

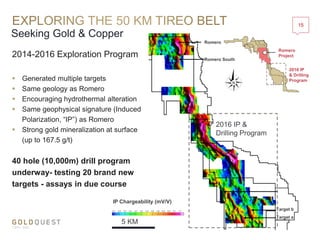

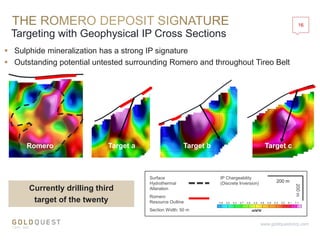

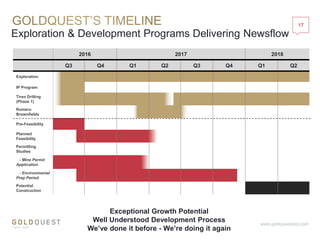

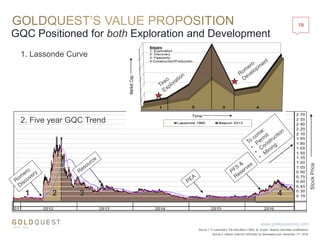

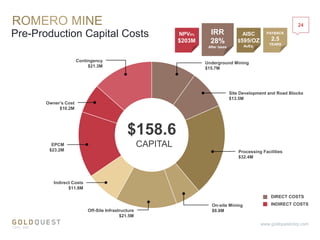

The document discusses Goldquest Corp's Romero gold-copper project in the Dominican Republic. It highlights results from a 2016 pre-feasibility study that showed the project has an after-tax NPV of $203 million and IRR of 28% at $1,300/oz gold price. The study outlined probable mineral reserves of 7 million tonnes grading 3.72 g/t gold and 0.88% copper containing 1.12 million ounces of gold equivalent. The project is planned as an underground mine producing over 100,000 ounces of gold equivalent annually at average all-in sustaining costs of $595/oz over a 7 year mine life. Goldquest also discusses exploration potential from the surrounding 50km