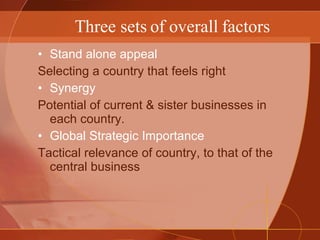

The document outlines a six-step process for selecting countries for global expansion:

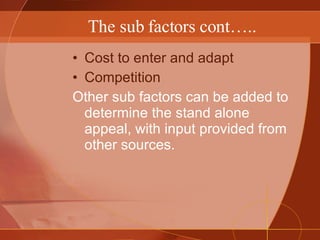

1. Build a list of sub-factors from three overall factors: stand-alone appeal, synergy potential, and global strategic importance.

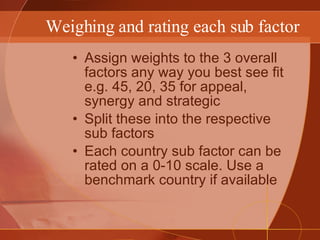

2. Allocate weights to each sub-factor and pinpoint countries to analyze.

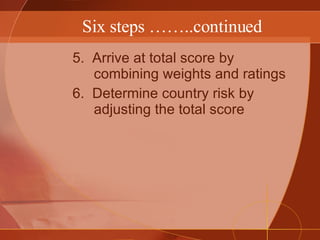

3. Rate each country on each sub-factor and arrive at a total score by combining weights and ratings.

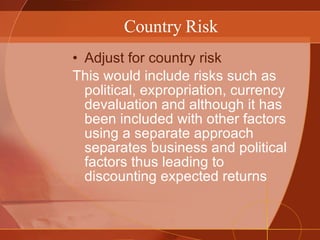

4. Determine country risk by adjusting the total score.