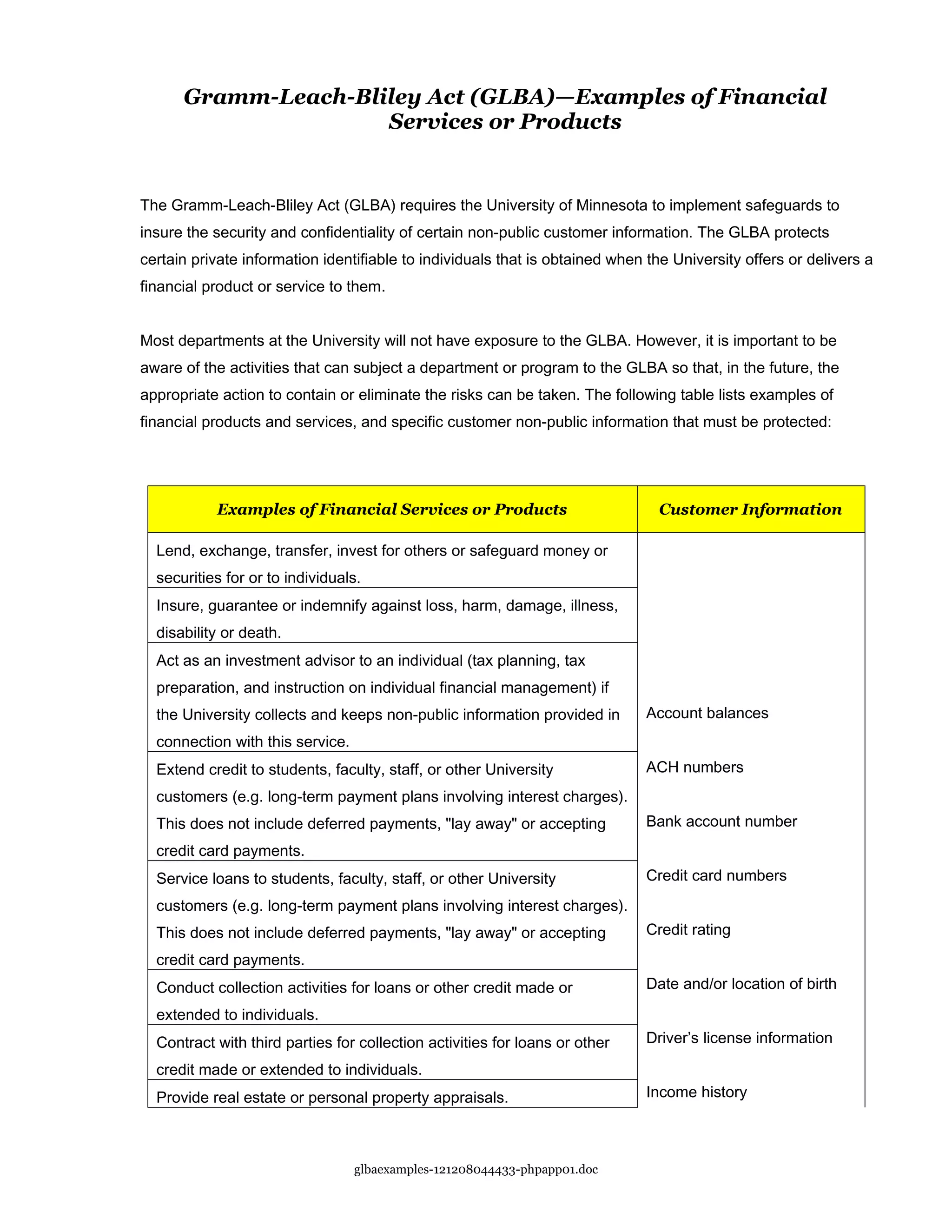

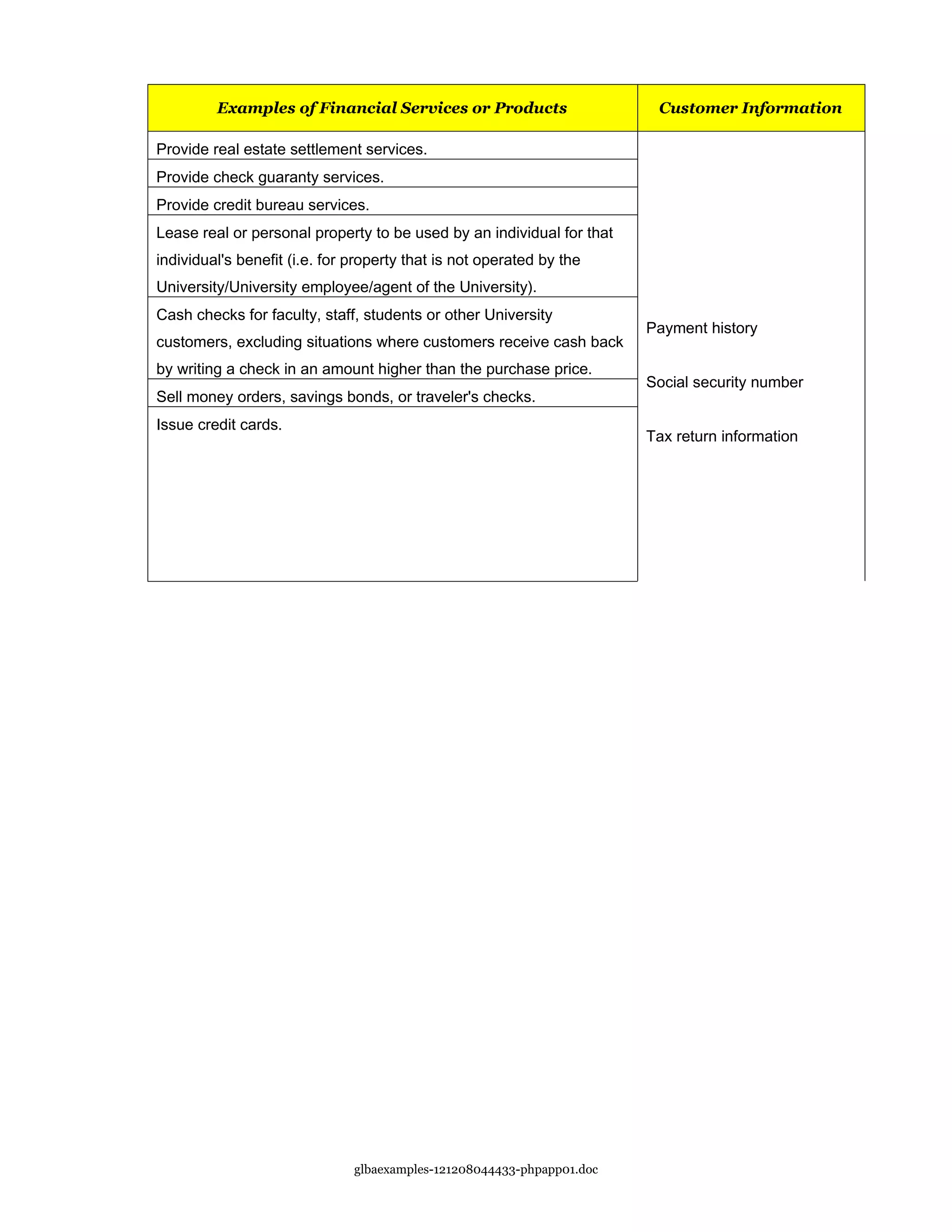

The Gramm-Leach-Bliley Act (GLBA) requires the University of Minnesota to protect customers' private financial information when offering financial services or products. While most university departments do not directly provide these services, the GLBA covers activities like lending money, insuring against losses, providing investment advice using personal financial data, and extending credit to students or staff. The GLBA regulates the use and sharing of customers' financial information, such as account balances, credit card numbers, income history, and social security numbers. Departments must be aware of GLBA compliance if engaging in any of these covered financial activities.