The document outlines the functionality of the Tachvault pricing engine, a SaaS platform for option valuation supporting various asset classes and option types with a web service model that integrates easily with other tools. It highlights key features such as real-time market data access, user collections for organizing requests, and the ability to process option pricing requests via a web GUI. It also previews the upcoming sections on integrating the service with Excel VBA and Python.

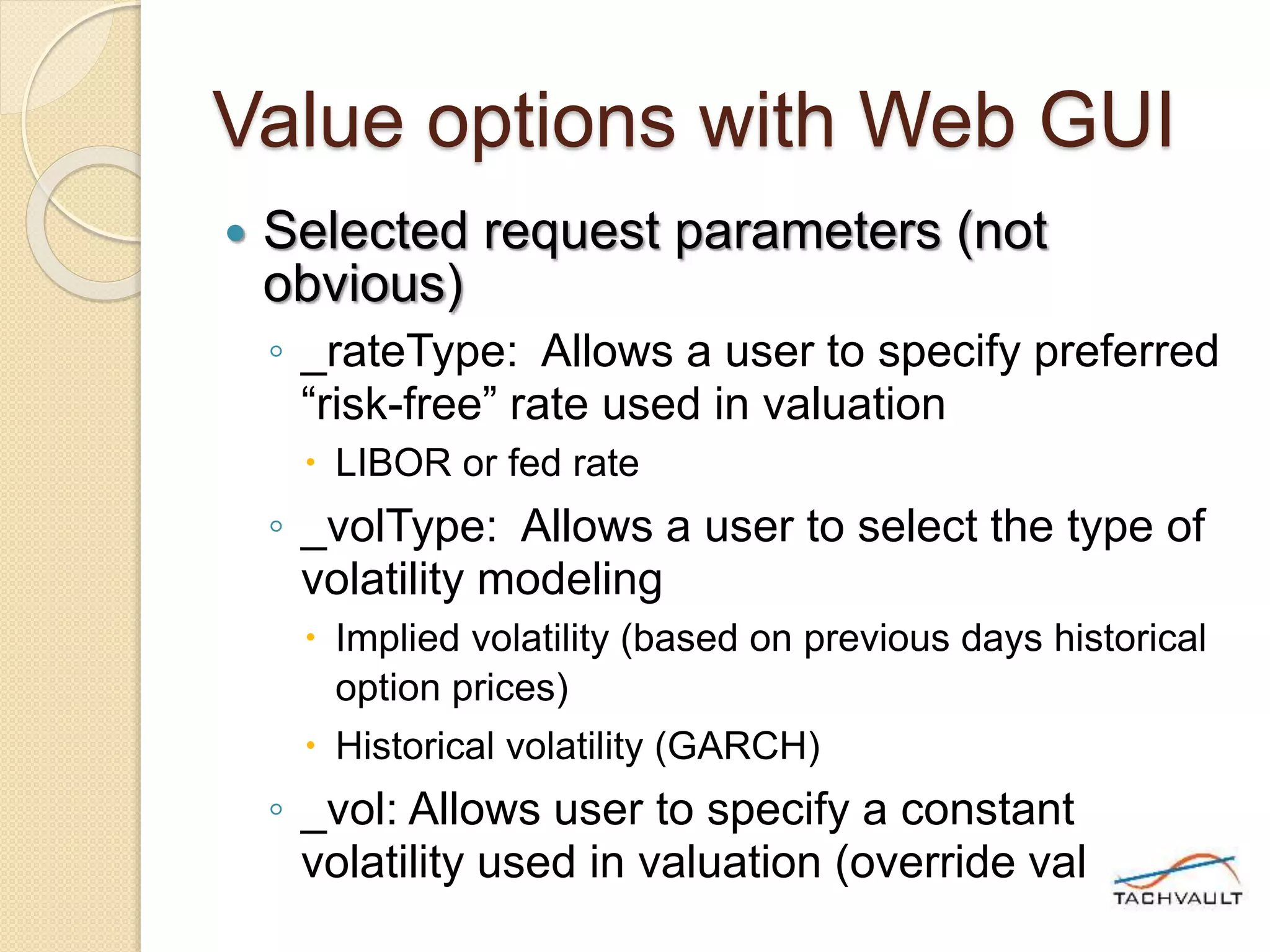

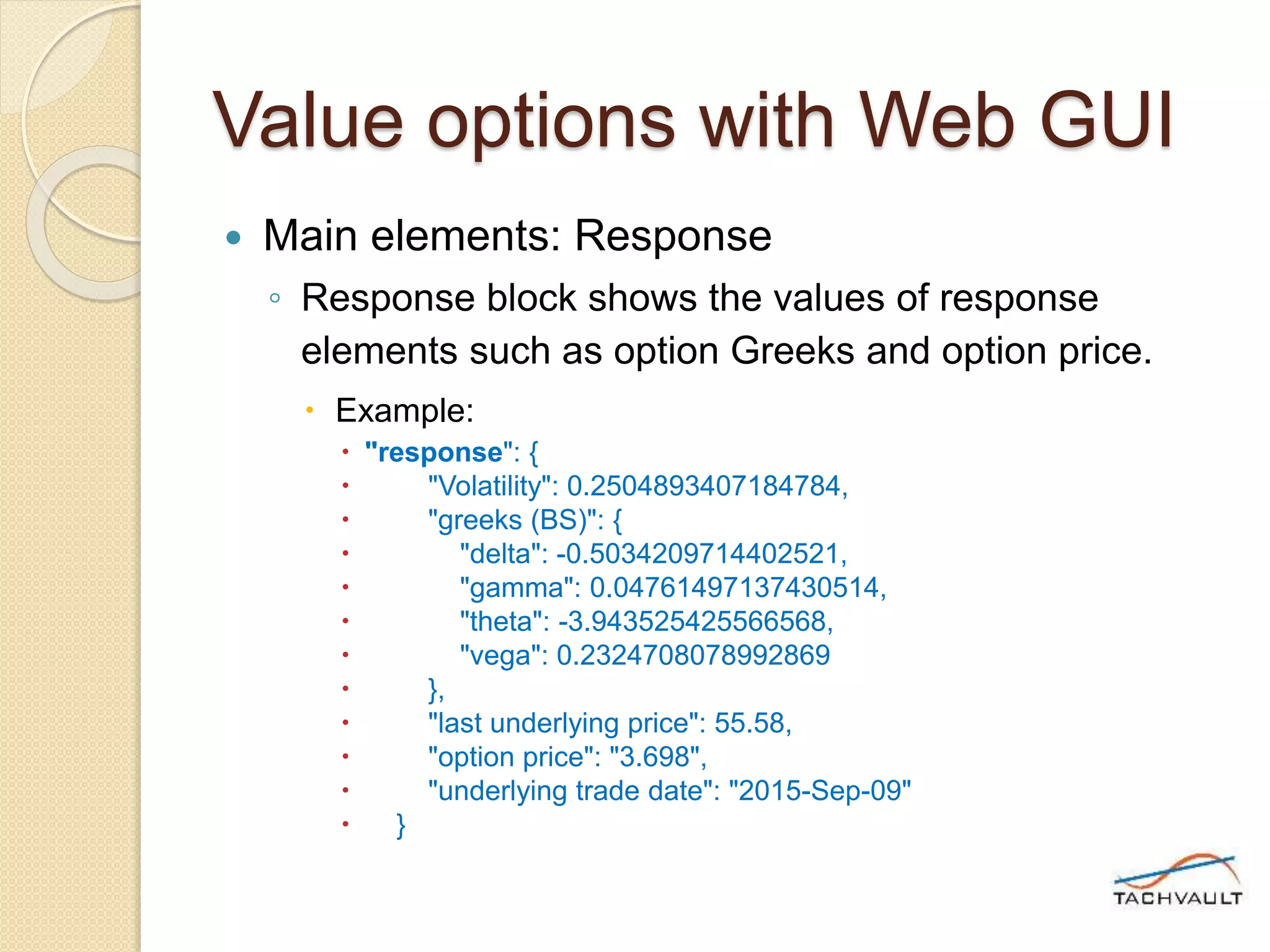

![Value options with Web GUI

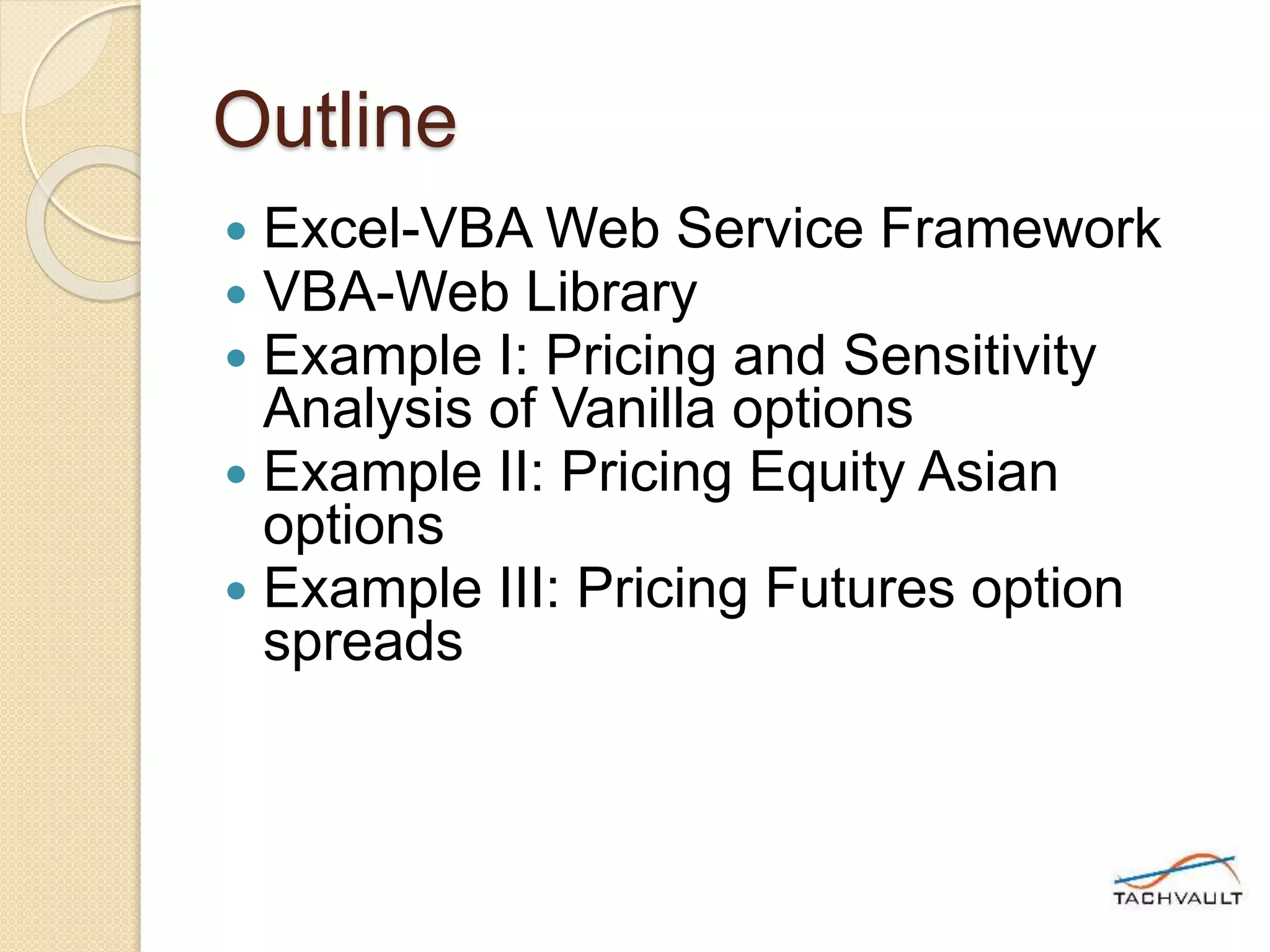

Option spread Response

◦ Main elements.

Legs: [leg, leg, leg]

Shows the option values of each leg as separate

blocks { }

greeks (BS) : {delta, omega, theta, vega}

Greek values for the option based on Black Scholes

last underlying price:

The price of underlying asset used in the option pricing

spread price

The value of spread

underlying trade date

The trade date of underlying asset.](https://image.slidesharecdn.com/gettingstartedwebserviceapi-150920225020-lva1-app6891/75/Free-Trial-How-to-access-Options-Pricing-23-2048.jpg)

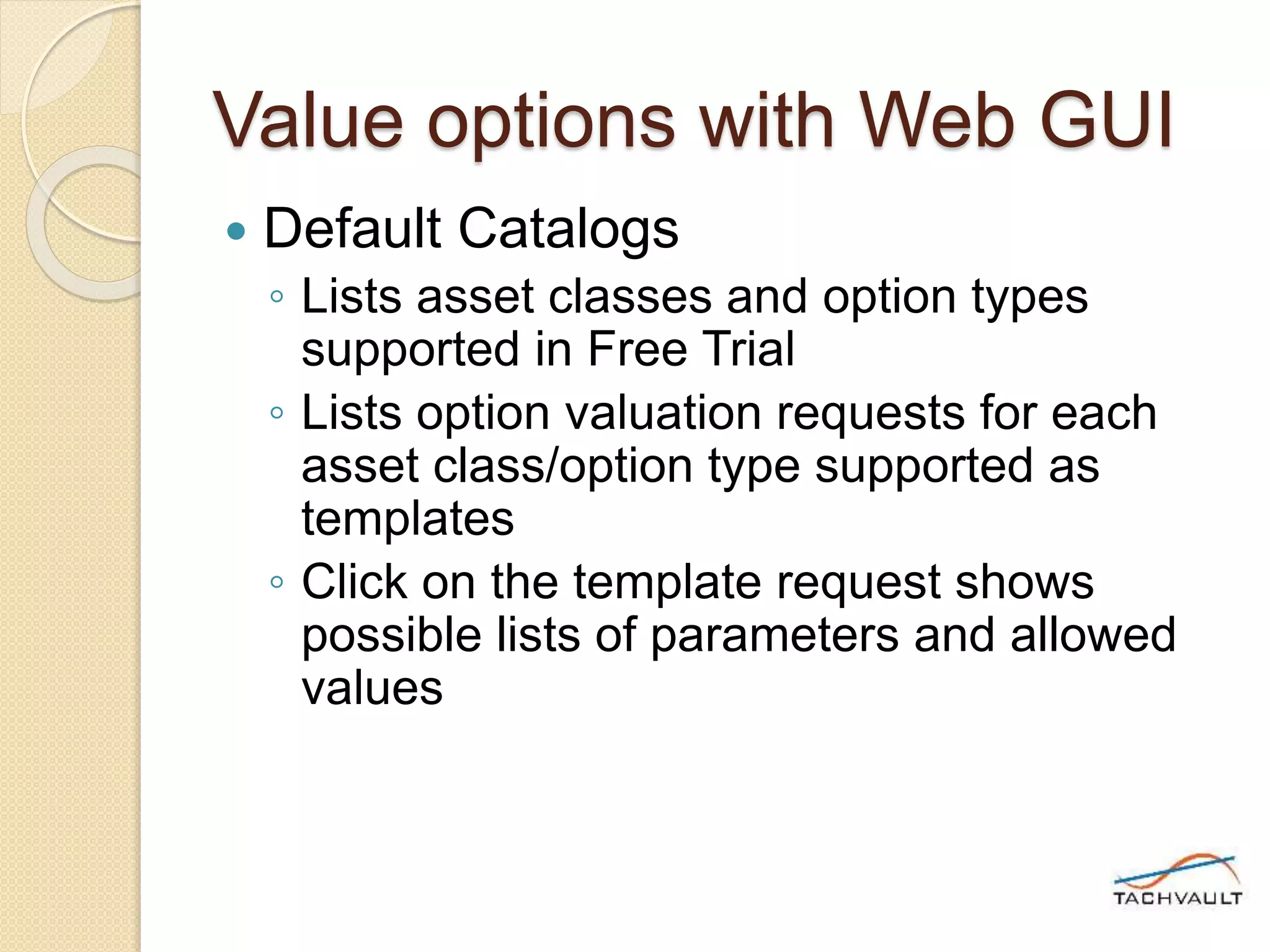

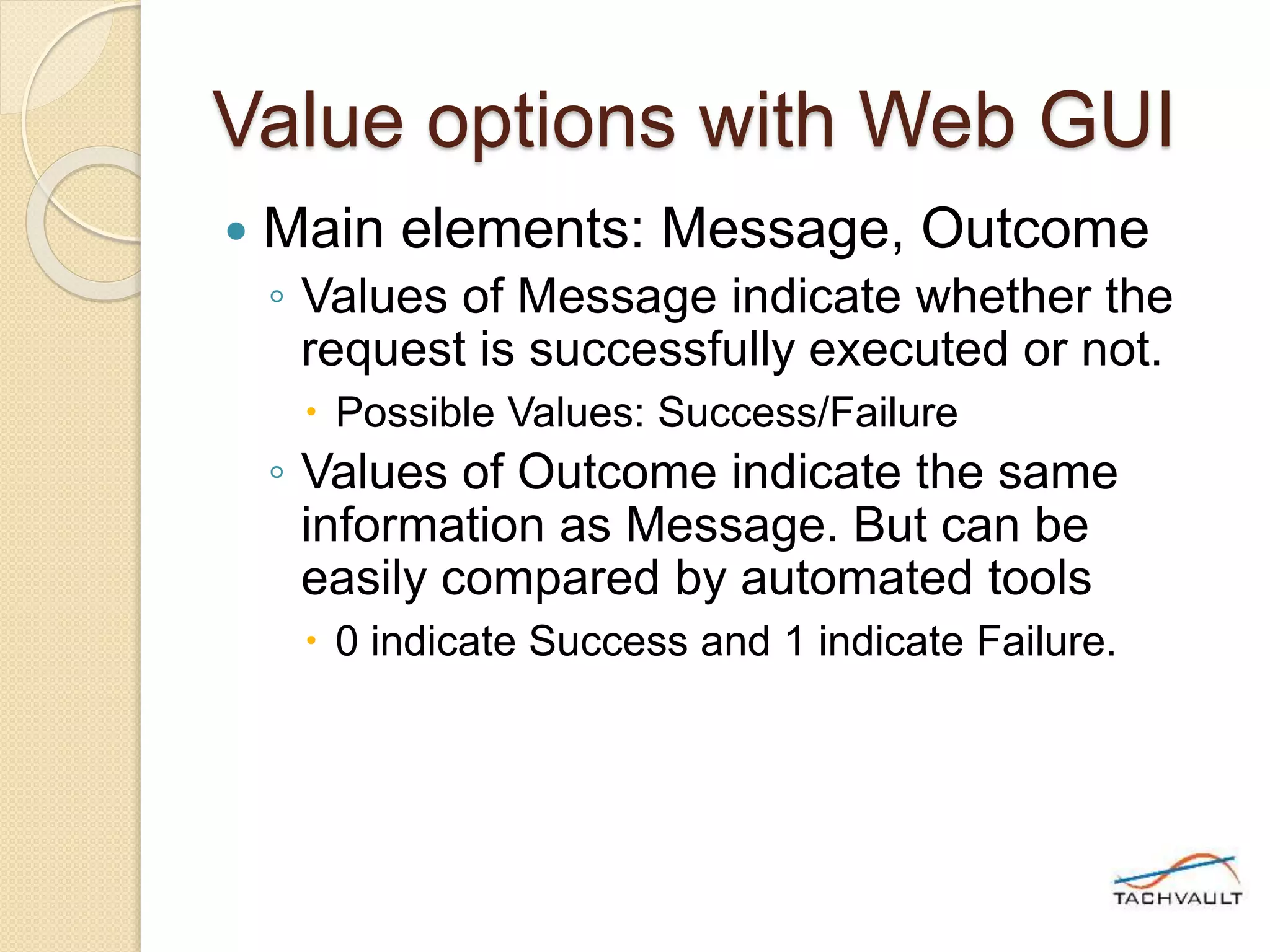

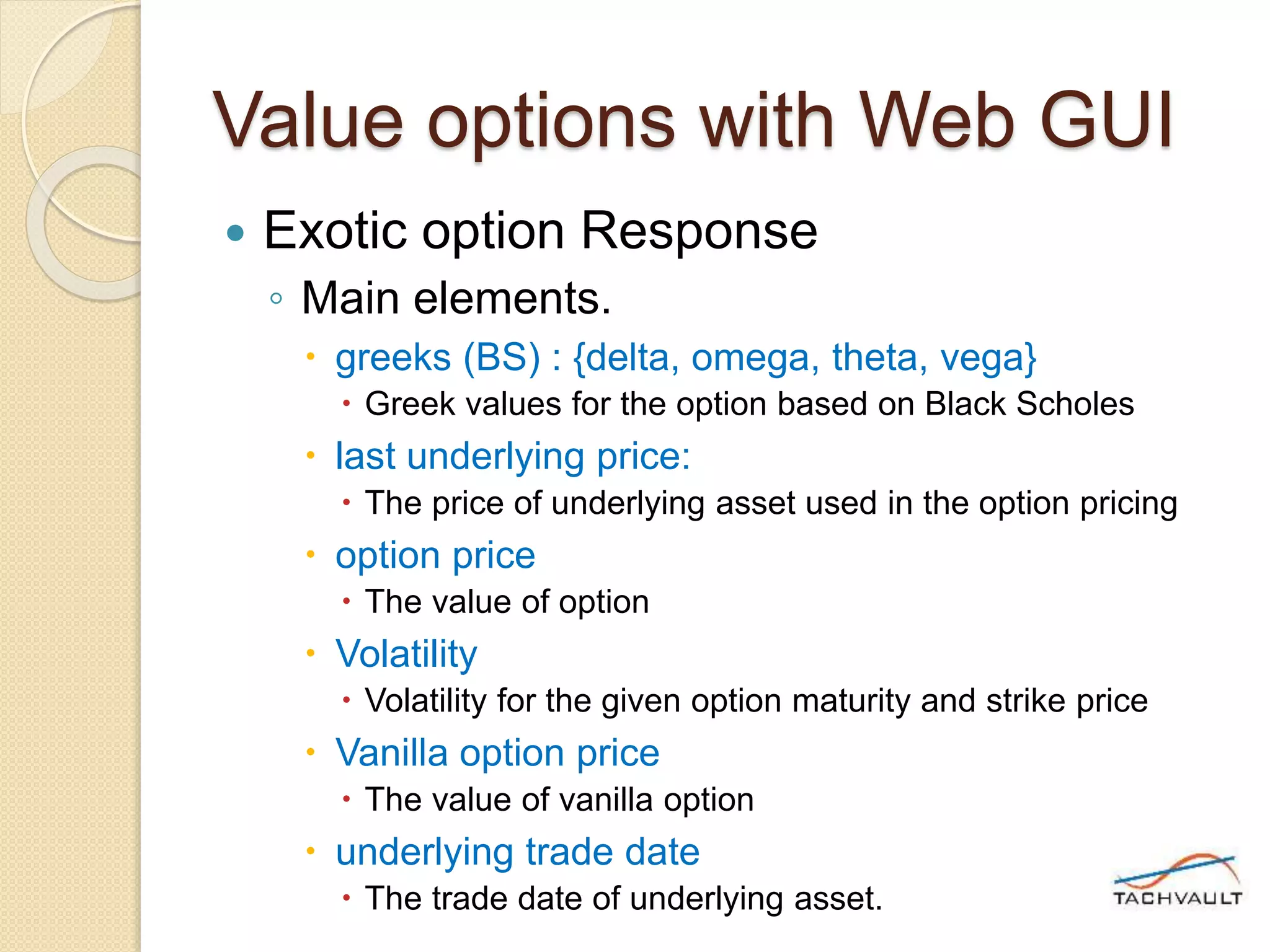

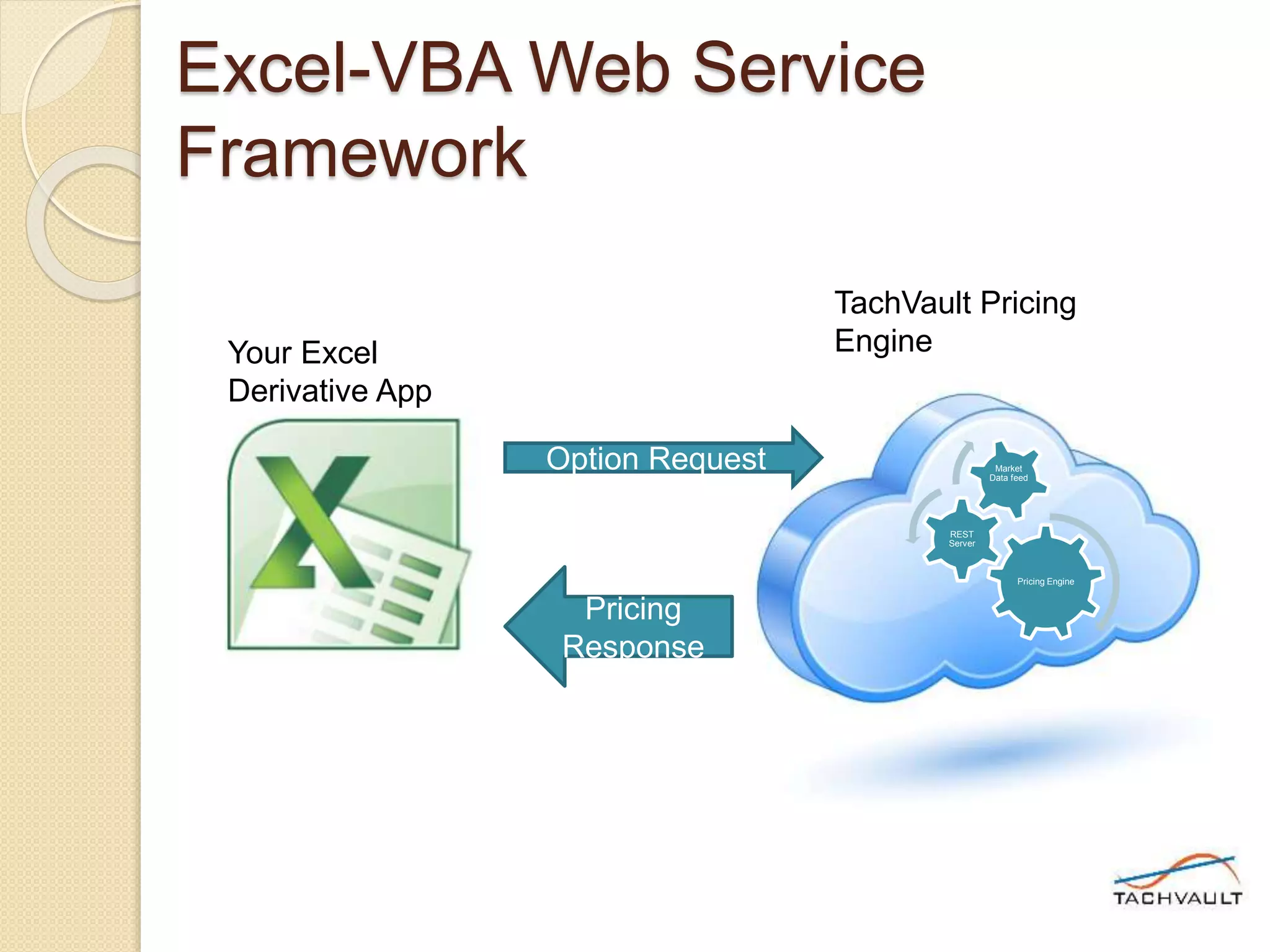

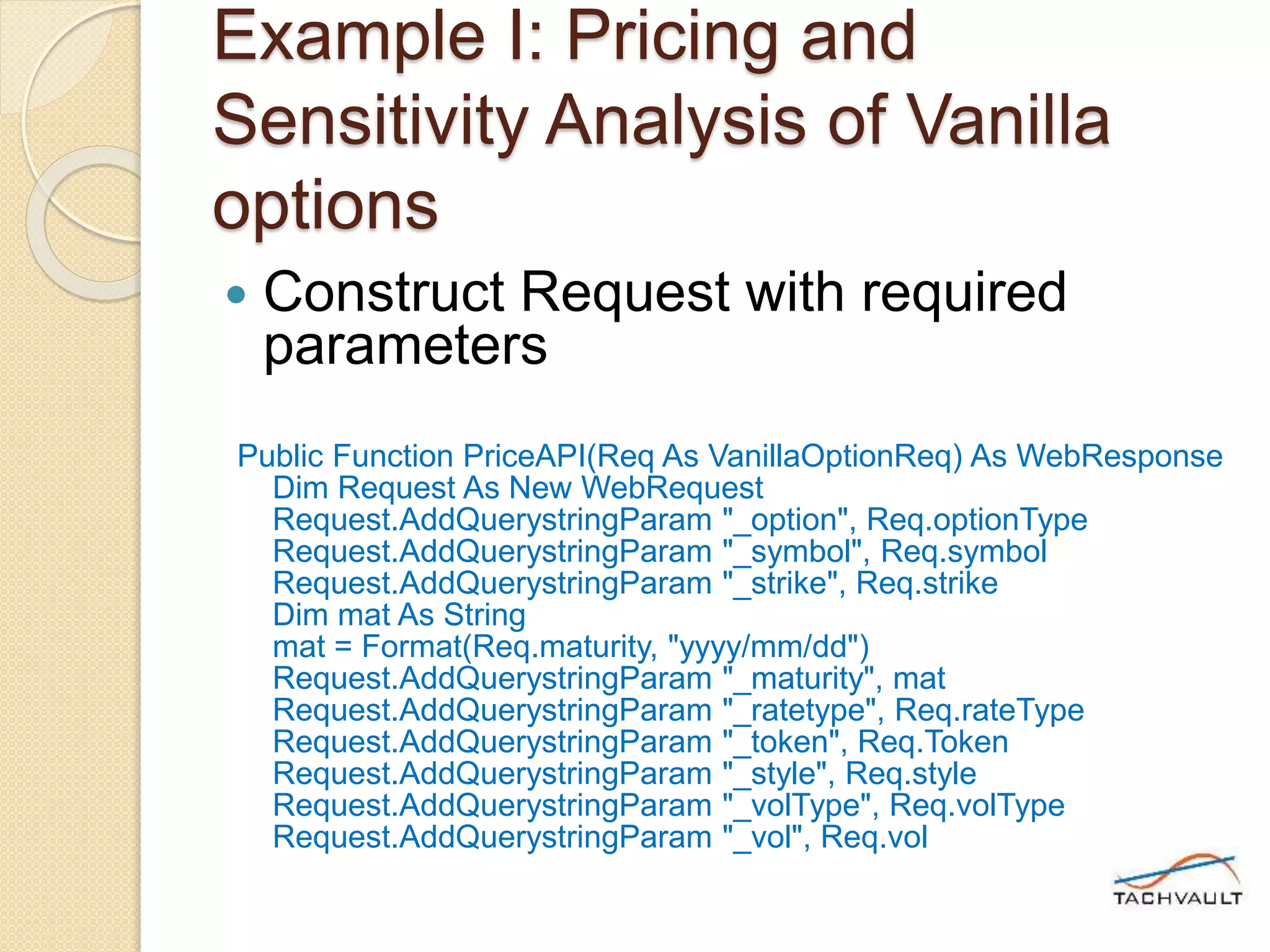

![Example I: Pricing and

Sensitivity Analysis of Vanilla

options

Process the response (in JSON

format)

Set Response = EquityVanilla.PriceAPI(Req)

If Response.StatusCode = WebStatusCode.Ok Then

Me.[Volatility] = Response.Data("response")("Volatility")

Me.[option_price] = Response.Data("response")("option price")

Me.[Underlying] = Response.Data("response")("last underlying

price")

Me.[OutStrike] = Req.strike

Me.[OutMaturity] = Req.maturity

Me.[Delta] = Response.Data("response")("greeks (BS)")("delta")

Me.[Gamma] = Response.Data("response")("greeks

(BS)")("gamma")

Me.[Theta] = Response.Data("response")("greeks (BS)")("theta")

Me.[Vega] = Response.Data("response")("greeks (BS)")("vega")

Me.[Message] = Response.Data("Message")

Else

Me.[Message] = "Error: " & Response.Data("Message")](https://image.slidesharecdn.com/gettingstartedwebserviceapi-150920225020-lva1-app6891/75/Free-Trial-How-to-access-Options-Pricing-33-2048.jpg)

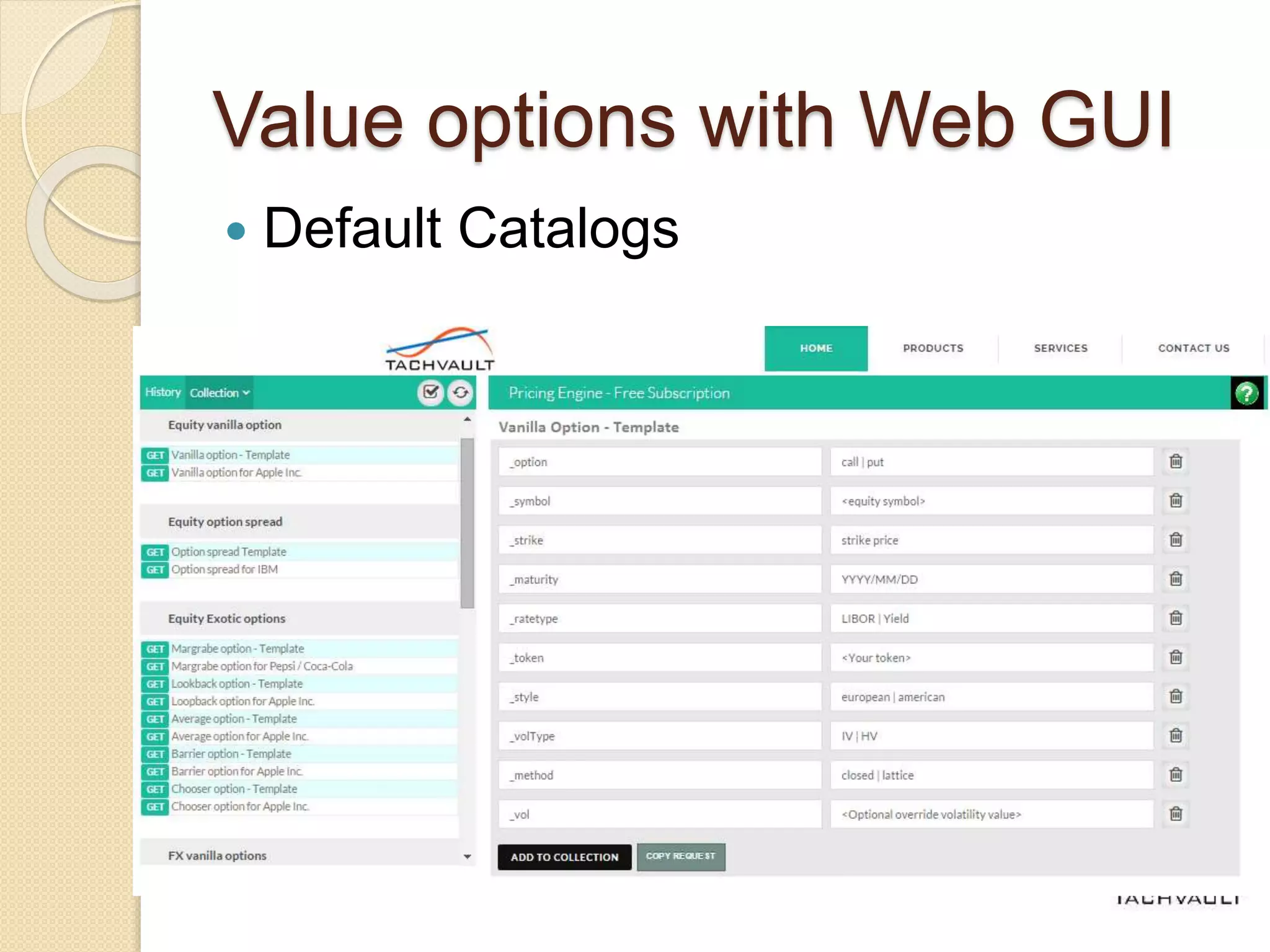

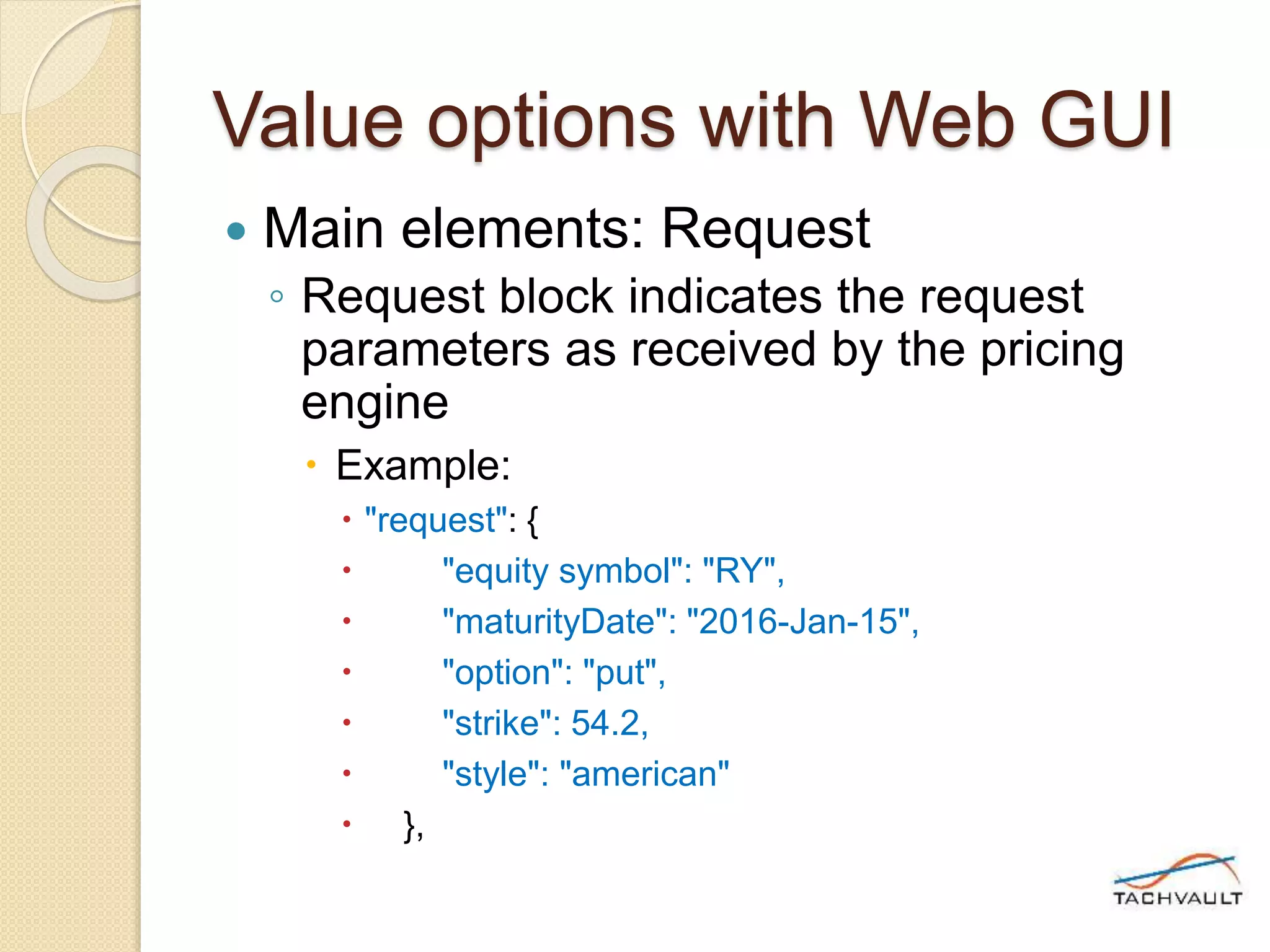

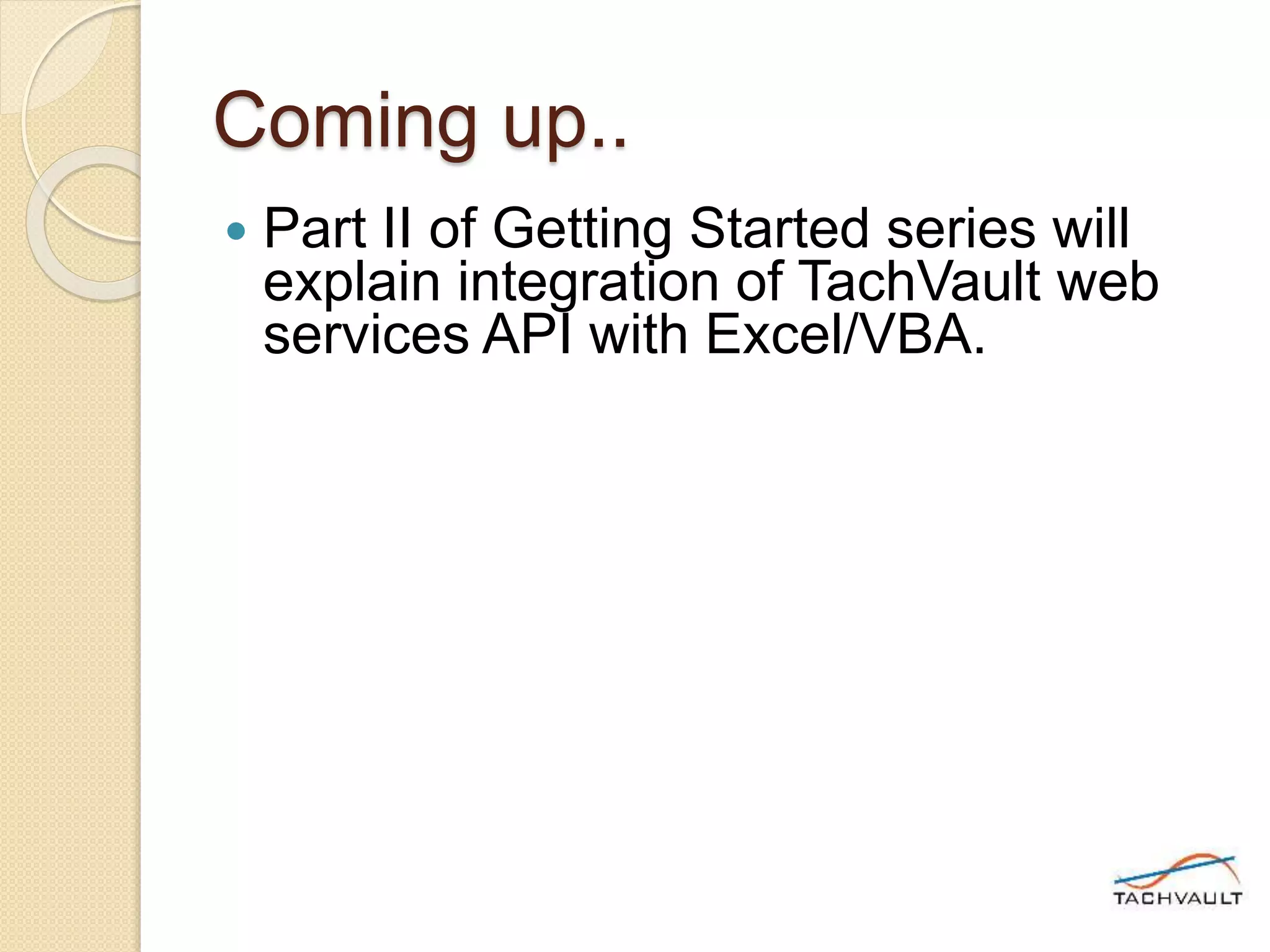

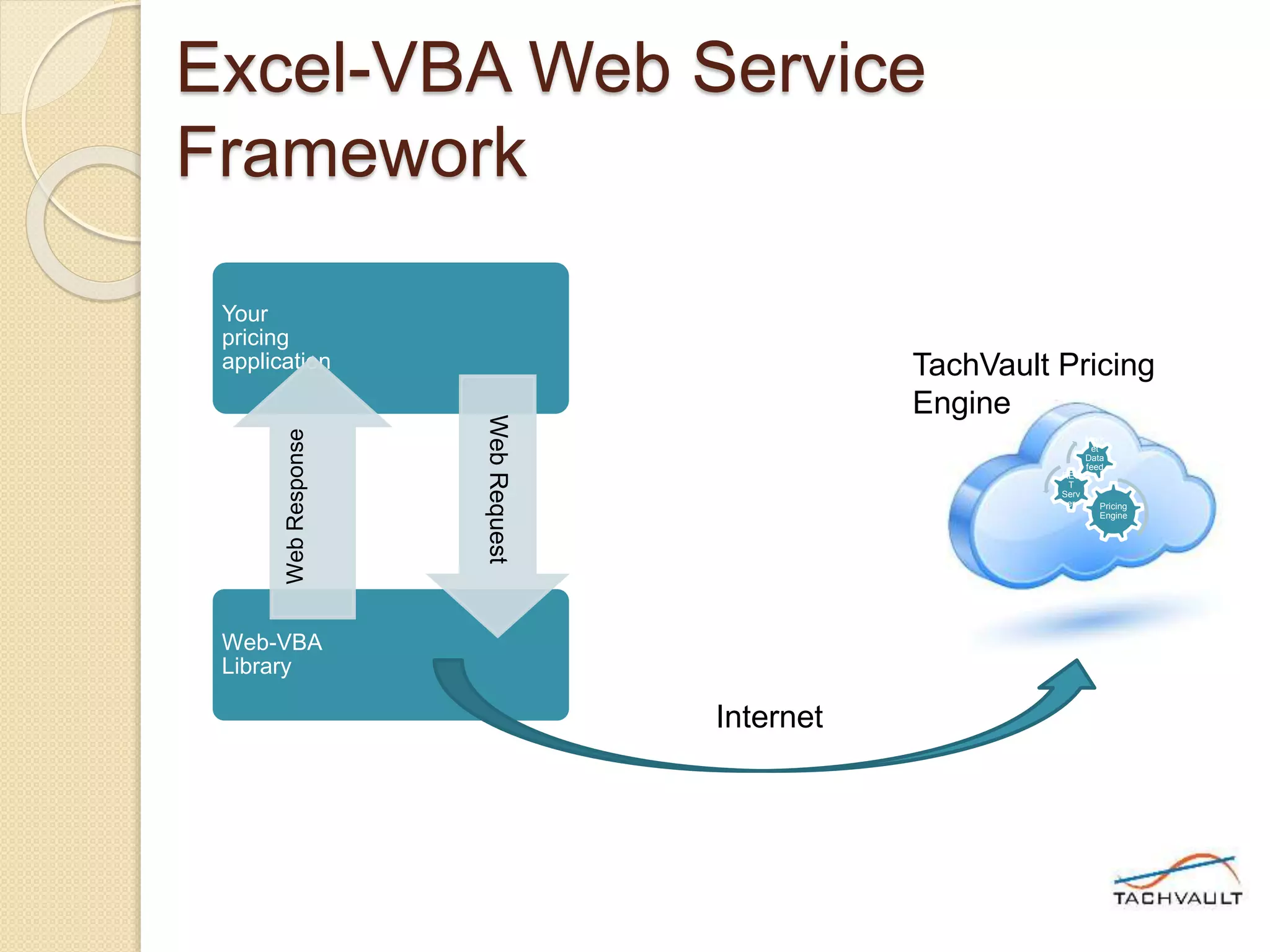

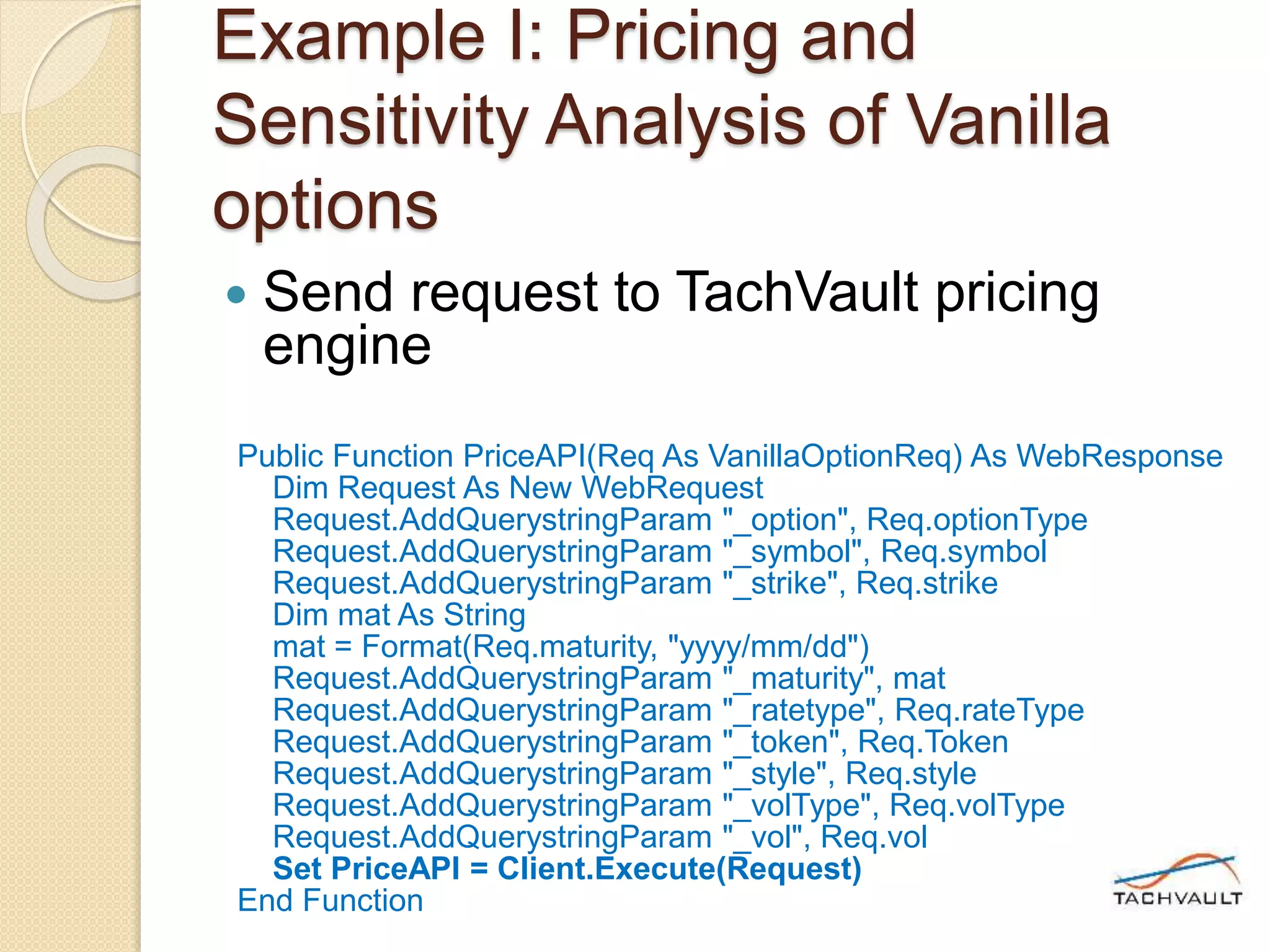

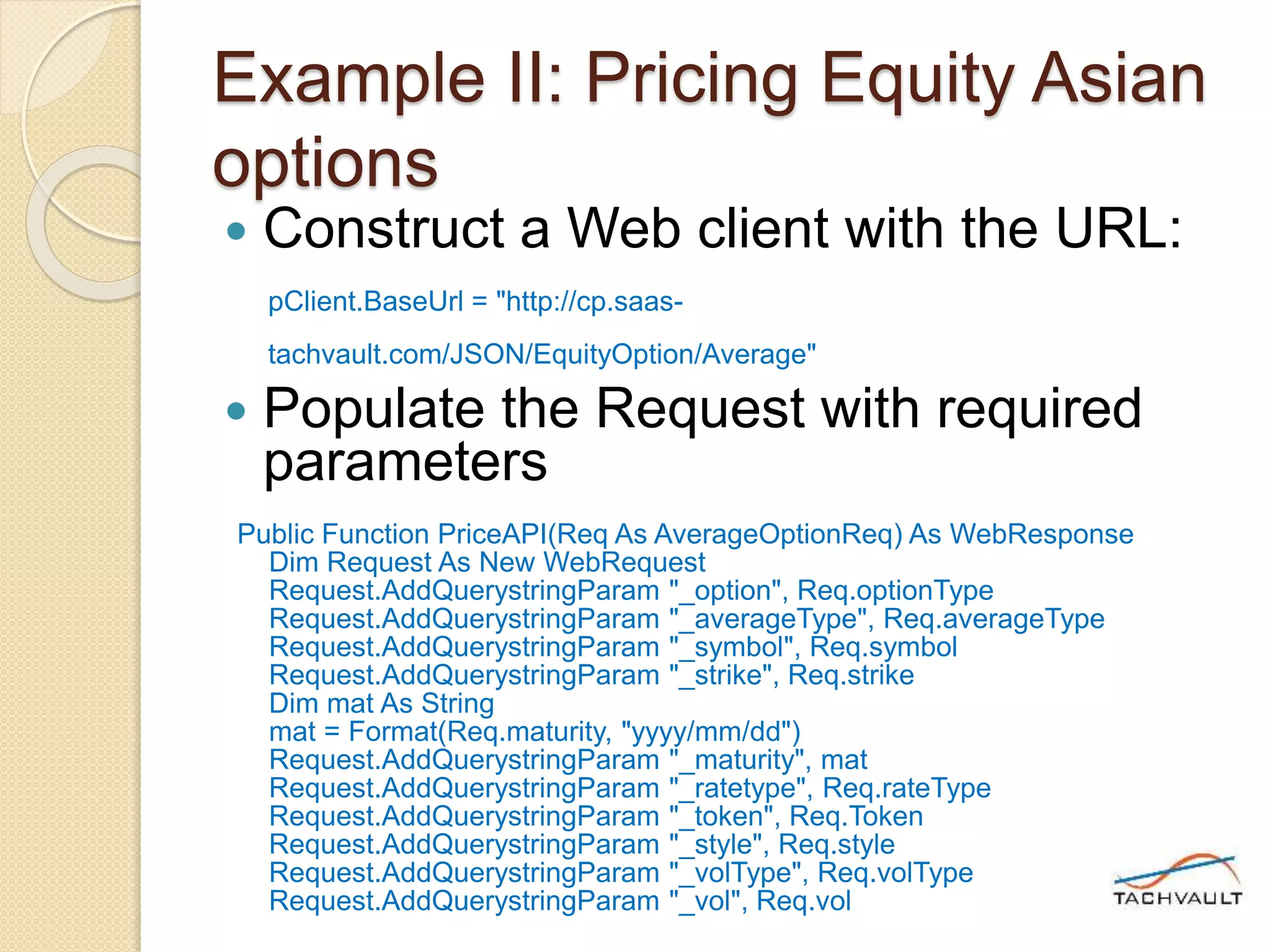

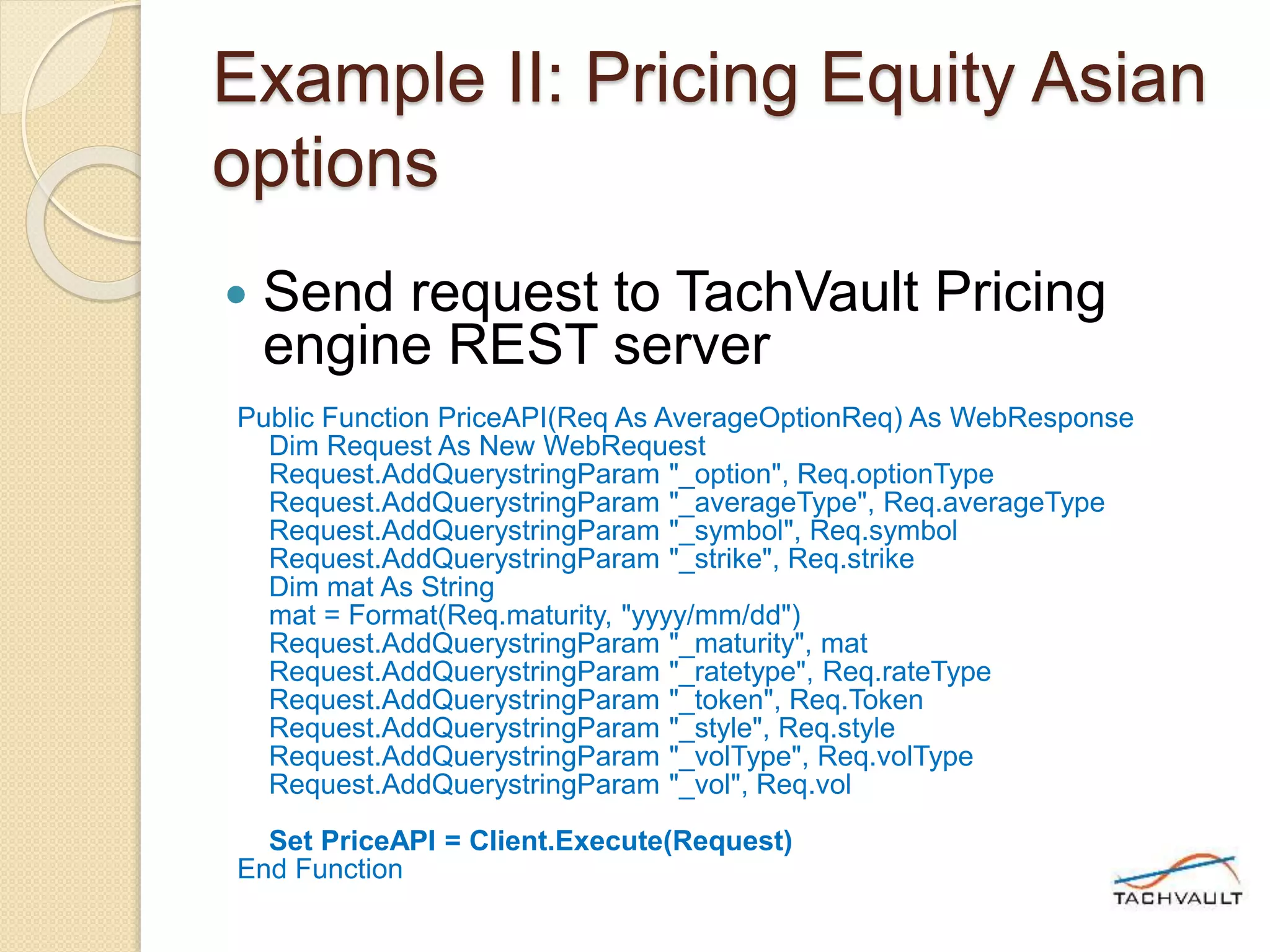

![Example II: Pricing Equity Asian

options

Process the Response (in JSON

format)

Set Response = EquityAverage.PriceAPI(Req)

If Response.StatusCode = WebStatusCode.Ok Then

Me.[aVolatility] = Response.Data("response")("Volatility")

Me.[aPrice] = Response.Data("response")("average option price")

Me.[aUnderlying] = Response.Data("response")("last underlying

price")

Me.[aOutStrike] = Req.strike

Me.[aMessage] = Response.Data("Message")

Else

Me.[aMessage] = "Error: " & Response.Data("Message")

End If](https://image.slidesharecdn.com/gettingstartedwebserviceapi-150920225020-lva1-app6891/75/Free-Trial-How-to-access-Options-Pricing-36-2048.jpg)