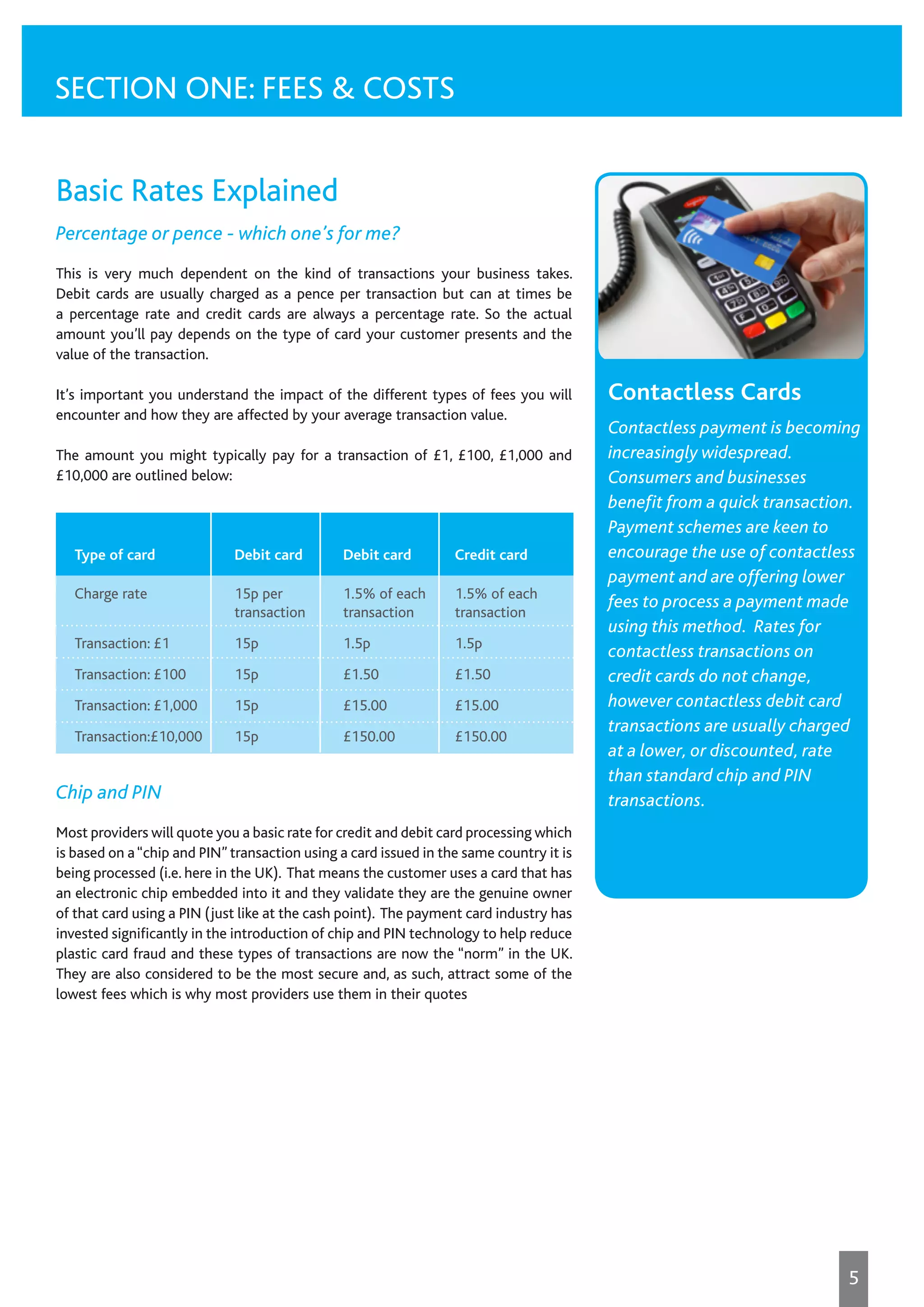

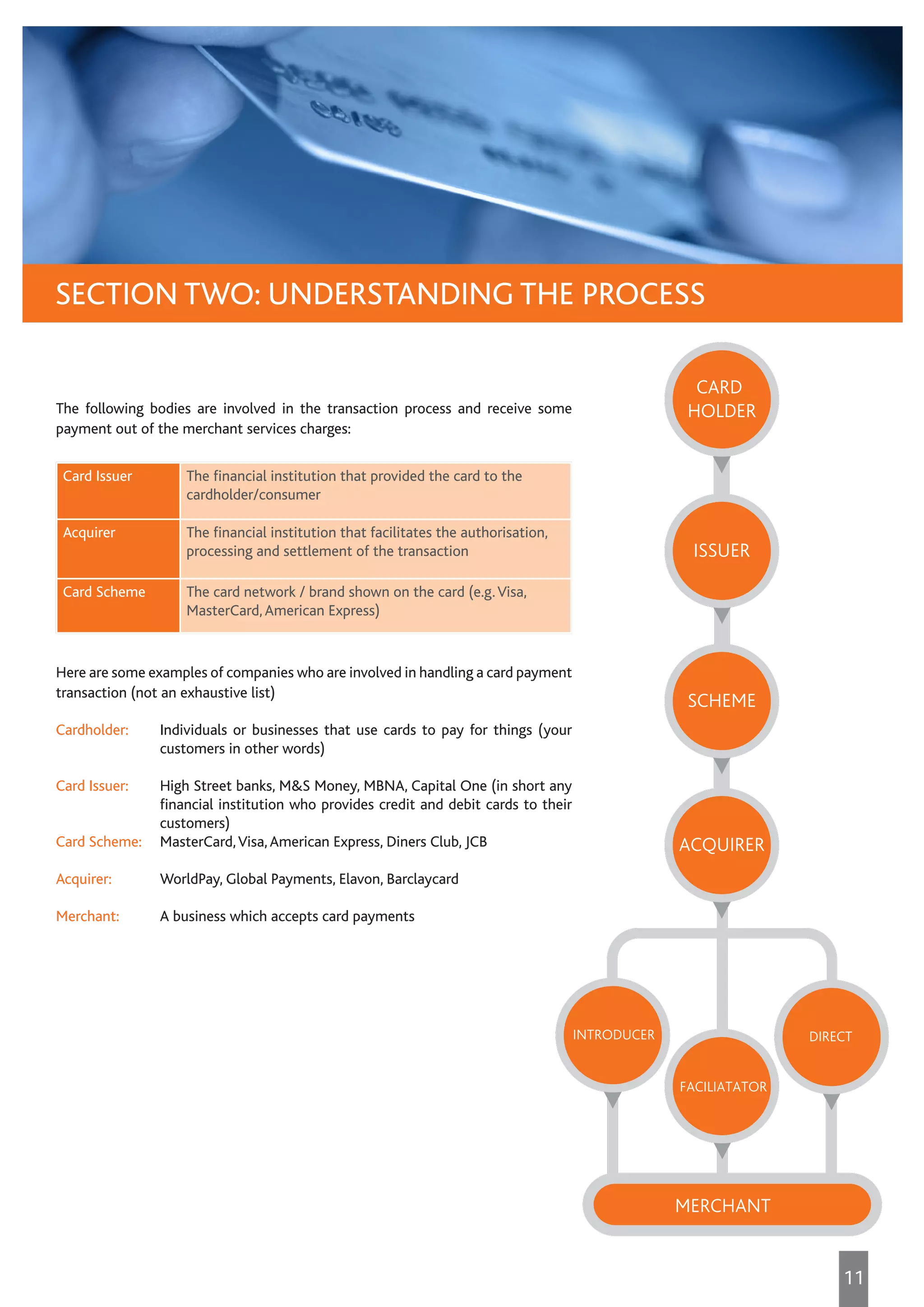

This guide assists small and medium-sized businesses in the UK with understanding the card payment acceptance process, including the fees and costs involved. It offers detailed sections on various payment methods, contracts, and potential pitfalls, providing practical examples to compare different service providers. Additionally, it outlines the benefits of accepting card payments and the importance of making informed decisions through clear and straightforward information.