The document discusses the evolution of NASCAR's fan base and how it has expanded beyond its traditional demographic to reflect a more diverse American population, now attracting over 75 million fans. It highlights the importance of new media and location-based mobile technology as strategic tools to engage both new and existing fans while analyzing demographics, sponsorship strategies, and globalization efforts to enhance NASCAR's brand loyalty. The paper underscores the necessity for NASCAR to balance maintaining its regional identity with pursuing broader market opportunities through innovative digital initiatives.

![LOCATION, LOCATION, LOCATION 3

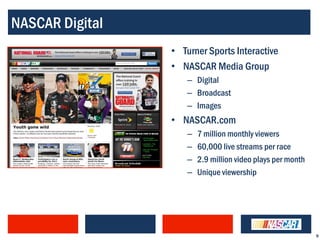

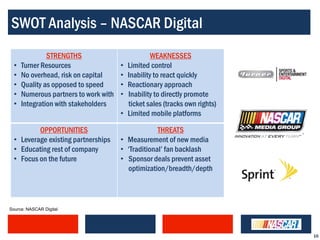

Examining the NASCAR Digital team and their collective efforts as part of NASCAR

Media Group and Turner Sports Interactive to create touch points that engage fans

and drive revenue streams.

Finally, the paper will offer an overview of location-based social networking with the aim

of growing the NASCAR brand in the digital and mobile spaces, and discuss applications of this

technology to NASCAR. The goal herein is to leverage NASCAR‟s unparalleled brand loyalty

by creating a new partnership with Foursquare, the leader in location-based social networking,

designed to enhance the race day experience and add value to NASCAR-affiliated sponsors.

INTRODUCTION/BRAND AUDIT

NASCAR has proven to be a brand that reaches and influences millions of fans and

consumers worldwide. In the 2009 NASCAR Brand Brochure, the auto racing is recognized as:

The #1 spectator sport, with 17 of the top 20 highest-attended sporting events in the

U.S. and an average of nearly 120,000 spectators attending each NASCAR Sprint

Cup Series event.

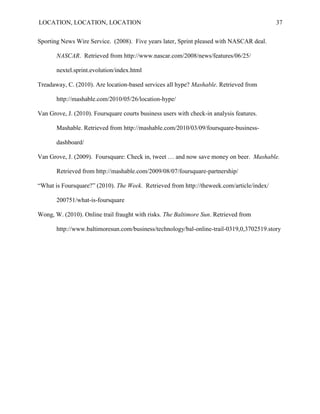

The #2-rated regular-season sport on television. NASCAR also ranks #2 in

viewership by women and youth. With broadcasts in more than 150 countries in 20

languages, NASCAR sanctions more than 1,200 races at 100 tracks in more than 30

U.S. states, Canada and Mexico [See Appendix 1].

The #1 sport in fan brand loyalty. NASCAR fans are three times as likely as non-fans

to try and purchase sponsors‘ products and services, and more Fortune 500®

companies (over 100) use NASCAR as an avenue to build their brands than any other

sport (Schwartz, 2009).](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-4-320.jpg)

![LOCATION, LOCATION, LOCATION 5

level of driver availability is a traditional cornerstone unmatched by any other major professional

sport that adds to the brand values of family, community, aspiration, and authenticity. One fan

noted after seeing about a dozen drivers signing autographs before a 2009 Sprint Cup Series race,

―you can‘t put a price tag on that‖ (Ryan, 2009).

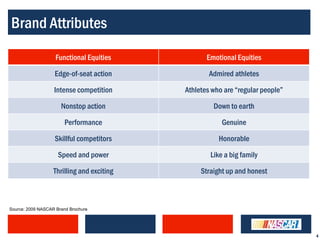

As indicated in the official 2009 NASCAR Brand Brochure, major brand attributes of the

sport can be broken down into two categories: functional equities (more tangible and associated

with quality) and emotional equities (emotional responses to the intangibles of the brand).

Functional Equities Emotional Equities

Edge-of-Seat Action Admired Athletes

Intense Competition Athletes who are ―Regular People‖

None-Stop Action Down to Earth

Performance Genuine

Skillful Competitors Honorable

Speed and Power Like a Big Family

Thrilling and Exciting Straight Up and Honest

DEMOGRAPHICS

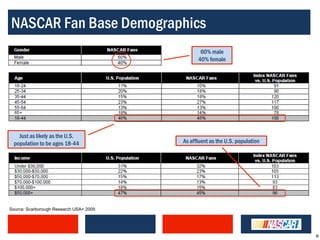

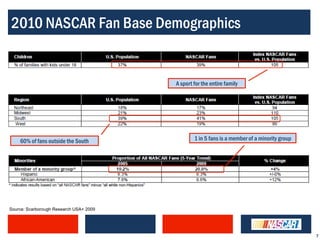

Scarborough Research (2010) indicates the newest set NASCAR fan base demographics

to follow the following statistics and trends, on average [See Appendix 2]:

Gender NASCAR fans are gender neutral – 60% male and 40% female.

Age NASCAR fans are just as likely as the U.S. population to be between the

Distribution ages of 18-44.

Income NASCAR fans are middle/working class, indexing to be just as affluent as

Distribution the U.S. population with 45% earning $50,000 or more.

Presence of NASCAR is a sport for the whole family. A reported 39% of fans have

Children children under the age of 18.

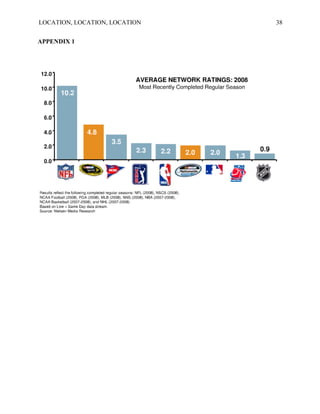

Geographic NASCAR fans are regionally distributed in a manner reflective of the U.S.

Distribution population to within 3 percentage points in each of four measured regions.

Minorities One out of five NASCAR fans is a member of a minority group.

While these measurable are largely indicative of the average American, NASCAR fans are

reporting higher incomes and education levels than ever before. The traditional white, southern,

‗redneck‘ male is no longer the predominant NASCAR fan. Scarborough data confirms that](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-6-320.jpg)

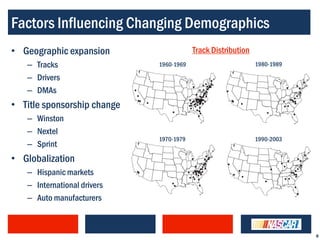

![LOCATION, LOCATION, LOCATION 7

(1994); Fontana, California (1997); Fort Worth (1997); Las Vegas (1998); Homestead- Miami

(1999); Chicago (2001); and Kansas City (2001). Furthermore, NASCAR has pursued a

―realignment‖ strategy that effectively weakens the traditional supremacy of southeastern tracks

and allows for newer, larger (and large-market) tracks to host more events in what amounts to

geographic redistribution of the Sprint Cup Series [See Appendix 3] (Hurt, 2005).

Geographic expansion has not only occurred with track locations, but drivers have come

from increasingly nationally distributed (and global) backgrounds. Joshua Newman (2009)

articulates how the geographic redistribution of tracks has affected the regional identity of

NASCAR drivers:

―Further, while between 1956 and 1980 every Winston Cup Champion was born in North

Carolina, South Carolina, or Virginia, just one of the past fourteen champions of

NASCAR‘s top division hailed from a state inside the geographic boundaries of the

American South. Moreover, 2007 marked the first time that a driver born in North

Carolina, long considered the birthplace of NASCAR, failed to record a single victory on

NASCAR‘s premier circuit. For the 2008 season, just eleven out of 46 full-time drivers in

NASCAR‘s Sprint Cup Series claimed hometowns in states lying in the American

South.‖

The geographic shift of drivers, track locations, and DMAs has contributed not only to a shift in

fan demographics, but in providing access to new sponsors and other revenue streams.

Sponsorship

It is well documented that more Fortune 500® companies activate sponsorship with

NASCAR than any other sport. Sponsorship accounts for 70% of all team revenues, which in

2009 were $92 million on average (Badenhausen, 2010). Over the years, no sponsor has been

more synonymous with the sport than the title sponsor of NASCAR‟s flagship series. Nextel](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-8-320.jpg)

![LOCATION, LOCATION, LOCATION 12

ESPN.com: 57% MLB.com: 85%

CBS Sports.com: 91% Fox Sports on MSN: 79%

The average NASCAR.com user is a 42-year-old white married male from the South or Midwest.

After completing some college education, he earns about $64,000 per year (mid-high income),

owns a home, and does not have children in the household [See Appendix 4] (―NASCAR.com

User Profile‖, 2010). NASCAR Digital is able to measure numerous relevant behavioral

patterns, including television and radio, free time, shopping behavior, tech behavior, reading, and

online habits to understand and target their online consumer.

NASCAR.com also was re-launched in 2007 with several critical new features.

TrackPass RaceView is a paid 3-D consumer interactive application that puts users in the middle

of the action, following along with live racing in a virtual ‗video game‘ style format. Exclusive

access to a variety of user-controlled live features, including multiple views of each car, in-car

audio, and instant race statistics, provides the sought-after access to drivers in a whole new way.

Fans can choose their favorite driver or follow the entire field. The re-launch also marked the

introduction of the NASCAR.com Infield Community, ―a social networking site within

NASCAR.com to connect race fans with shared interests.‖ Designed to be a ―track away from

the track,‖ this free feature allows fans to create their own personalized pages, upload photos and

videos, and join ‗crews‘ based on affiliations with drivers, teams, tracks, series, geography, or

otherwise. As outlined by EyeTraffic Media‟s Andrew Bates, the Infield Community caters to

the four C‟s of social velocity – content, connections, community, and conversations (personal

communication, June 7, 2010). Users provide content, connect with one another in meaningful

communities, and engage each other in conversation through NASCAR.com challenged between

crews throughout the season. One of the crews is “NASCAR Says,” the official blog of](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-13-320.jpg)

![LOCATION, LOCATION, LOCATION 13

NASCAR public relations. The Infield Community was positions not as a replacement to other

social networking sites, but as a destination for specific NASCAR-related social networking.

Advertisers are also able to host pages in the community as well as individual crews, tying into

other sponsored content on the website (“NASCAR site set for first…,” 2007).

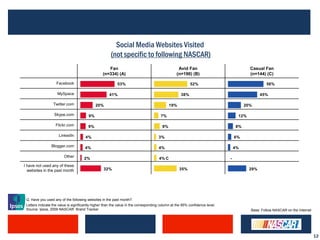

Social Media

Social Networking

NASCAR social media outlets have taken off in the last several years. NASCAR drivers,

teams, tracks, sponsors, and the league itself all maintain active presences in social media

platforms, including Facebook, Twitter, and MySpace. Some introductory statistics are below:

Facebook

NASCAR 573,483 fans

Miss Sprint Cup 99,781 fans

MySpace 375,692 friends

Twitter

@NASCAR 18,728 followers

@MissSprintCup 10,516 followers

@JPMontoya 149,128 followers

@KevinHarvick 41,134 followers

@KaseyKahne 35,113 followers

NASCAR‘s Facebook page generates over 70,000 page views per week. Highlights of

the site include regular discussion topics, exclusive videos, and weekly photo galleries.

Discussion topics posted by NASCAR are highly interactive, regularly yielding hundreds of

comments and ―likes‖ [See Appendix 5]. The page also links to the official Facebook pages of

all active drivers, teams, and tracks. To give an example of just how much new media is

changing the way people receive information, after a controversial wreck at Atlanta Motor

Speedway, Carl Edwards updated what essentially amounted to a public statement to Facebook.

―The update was quoted and referenced by media across the world in the days after the race.](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-14-320.jpg)

![LOCATION, LOCATION, LOCATION 14

Over 6,500 people commented on the status within the first 24 hours, with almost 15,000

commenting in the first week‖ (―Social Media in NASCAR,‖ 2009).

NASCAR‘s Twitter page is another key communications avenue to interact with fans,

drivers, and media. The page contains lists of personalities (owners, crew chiefs, and former

drivers), tracks (28), drivers (49), teams/team reps/sponsors (56), and league feeds (11). At least

ten drivers have followings of 15,000 or more. Twitter has been used by NASCAR officials as a

breaking news source, an outlet for promotions and giveaways, and even a platform for live

interviews.

Miss Sprint Cup, the Sprint-branded ambassador who travels to NASCAR races across

the country almost every weekend, has become a social media fixture for the Sprint Cup Series

since 2008. Miss Sprint Cup's Twitter account currently has over 10,000 followers, while her

Facebook page has attracted over 99,000 fans. Her blog, currently the most popular on the

community page of NASCAR.com, has generated 82,500 followers and more than 3.2 million

profile views. Whether it is interviewing drivers, hanging out in the garage area, or joining the

post-race celebration in the winner‘s circle, Miss Sprint Cup ―…enables [Sprint] to reach an

audience less endemic to [auto] racing,‖ said Tim Considine, general manager, NASCAR Sprint

Cup Series sponsorship (Schwartz, 2009). Considine goes on to elaborate on this strategy:

"We're not out there having Miss Sprint Cup talk about the latest sale price on the new

BlackBerry device. But, let's say Miss Sprint Cup takes a picture with her new

BlackBerry Tour, uploads it to Facebook and mentions the device in the photo caption.

The handset gets mentioned in a very real way, and we've shown some of the device's

capabilities without it feeling like a product pitch…What‘s amazing is the levels of](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-15-320.jpg)

![LOCATION, LOCATION, LOCATION 16

traditional media, incorporating the blogosphere into their media portfolio looks to be a strong

asset going forward (“NASCAR announces…,” 2009).

Fan Council

Embracing another trend first popularized by European soccer clubs, NASCAR took

great steps toward channeling the voice of the fan by beginning the 12,300 member NASCAR

Fan Council in 2008. With members from all 50 states and 20% of the membership consisting of

bloggers, NASCAR uses this “advisory board” as an efficient channel to connect with and better

understand some of its best consumers through online opinion surveys (Ryan, 2009). This tactic

seems one of the best ways to complete a two-fold objective: (1) engaging fans through new

media and (2) listening to the avid, traditional fans that helped build the sport into the spectacle it

has become. Regular consultations with this groundswell of supporters led to two important

strategic changes in 2009: the “double-file restart” rule following cautions as well as “earlier and

consistent TV start times” (“NASCAR honored with…, 2009). NASCAR‟s willingness to listen

to and implement fans suggestions as de facto consultants has led to the receipt of two national

awards: the Forrester Groundswell Award in the Business-to-Consumer Listening category and

the Vision Critical 2009 Panel of the Year Award (“NASCAR honored with…, 2009).

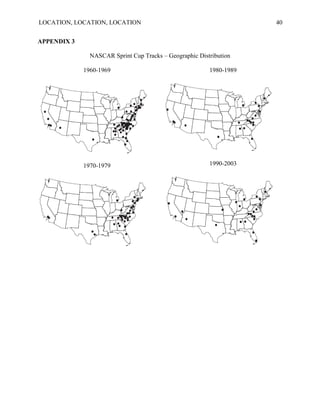

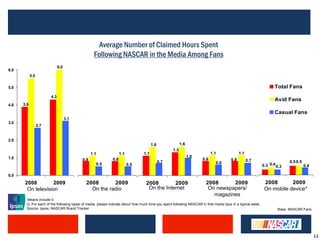

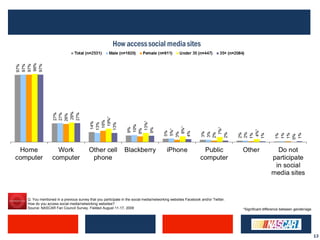

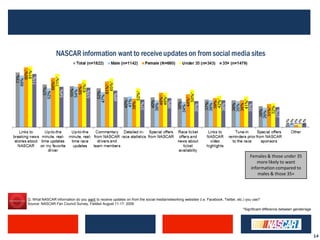

Digital and New Media User Research

The NASCAR Fan Council and the Ipsos NASCAR Brand Tracker have both provided

valuable research for the NASCAR Market and Media research team. According to a study from

the NASCAR Brand Tracker, fans spend an average of 80 minutes per week following NASCAR

on the internet and 30 minutes on mobile devices; 30% watch streaming race highlights, and

28% follow NASCAR online while watching NASCAR on TV, exhibiting second-screen

behavior [See Appendix 6]. One in five fans is active on Twitter, while over half use Facebook](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-17-320.jpg)

![LOCATION, LOCATION, LOCATION 22

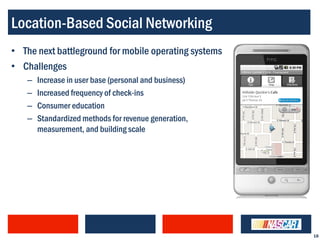

Usage Trends

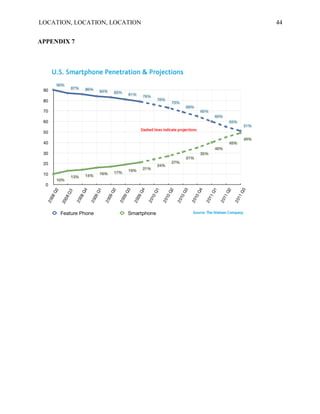

A recent Nielsen study indicates that, currently, “21% of American wireless subscribers

are using a smart phone as of the fourth quarter 2009 compared to…14% at the end of 2008.”

Almost half of the respondents (45%) indicated that their next device purchase will be a smart

phone. Roger Entner, Senior Vice President, Research and Insights, Telecom Practice, further

comments that “with falling prices and increasing capabilities of these devices along with an

explosion of applications for devices, we are seeing the beginning of a groundswell. This

increase will be so rapid, that by the end of 2011, Nielsen expects more smart phones in the U.S.

market than feature phones” [See Appendix 7] (2010).

A 2010 survey conducted by research firm GroundTruth found that social networking

sites maintain a 60% share of U.S. mobile traffic (with the next closest category garnering only

13.65%) (Dredge, 2010). The Mobile Marketing Association‟s latest Mobile Consumer Briefing

survey also found that while only 10% of those surveyed use mobile location services at least

once a week, this number spikes to 63% among smart phone users (Betancourt, 2010). A new

report from eMarketer extrapolates that by 2013, there will be 56.2 million mobile social

networkers in the U.S. alone of an estimated 607.5 million worldwide (“Location-based social

networks…,” 2010). Furthermore, a 2009 report from Gartner, Inc. indicates the expectation that

mobile advertising will grow exponentially from about $500 million in 2009 to $13.5 billion in

2013 (Moore, 2010).

One important consideration for would be location-based social networking providers is

that should Facebook or Twitter find a valuable entry point into the location-based market, they

will benefit from their already built-up networks of mobile users. Facebook‟s status as a

looming category killer is the location-based battlefield is evident; with more than 100 million](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-23-320.jpg)

![LOCATION, LOCATION, LOCATION 26

How often do people check in? Is this figure improving or declining?

What is the average time spent per day using the application (per user)?

How does a check-in turn into revenue for the LBSN application provider,

advertisers, and/or businesses?

In early 2010, Foursquare rolled out an analytics dashboard to business users in order to

track who is coming into their stores. Some of the data available includes total check-ins, unique

visitors, male-to-female ratio, social media-sharing (i.e. how many users send check-ins to

Twitter/Facebook), top visitors, and check-in time breakdown [See Appendix 8]. Possible future

opportunities could include tying purchase information (on top of check-ins) to customer

rewards. For large-scale businesses, this would be a valuable tool (providing increased scale of

user base) to determine what works on a location-by-location basis as well as a source of

consumer behavioral information (Van Grove, 2010). As of now, Foursquare is mostly looking

to build its business analytics dashboard with the best features possible in order to build its

business client base.

The prevailing metric for monetizing Foursquare is thought by many to be a new model:

cost per check-in. Foursquare users can receive promotions, coupons, or other rewards by

checking in to a business. The premise of cost per check-in is that “the business owner would

pay for that check-in if, and only if, the consumer redeems that offer…The performance-based

model would better align incentives – encouraging businesses to offer special deals to

Foursquare users – and value – as businesses only pay for actual conversions” (Goldman, 2010).

Furthermore, cost per-check-in “[differs] from the click-through model that only directs an

online user to visit a web site, check-ins actually get real „live‟ bodies to walk through a

[business‟s] door where they are more than likely going to spend money, solving the age-old](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-27-320.jpg)

![LOCATION, LOCATION, LOCATION 28

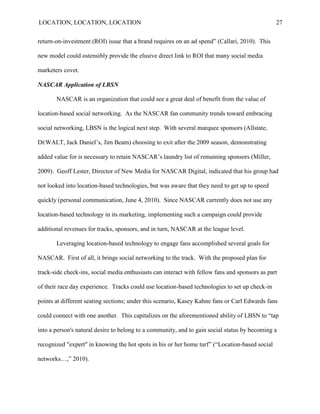

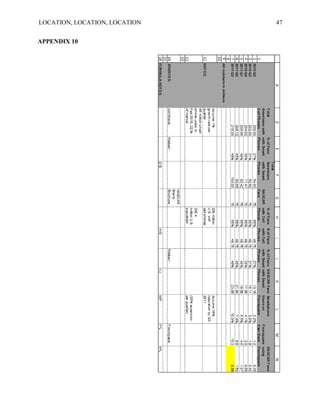

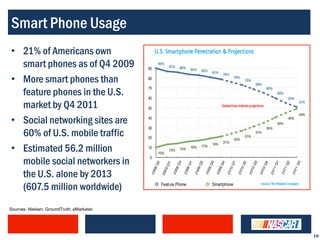

Another recent sports-centered Foursquare partnership with the NBA focuses on the

classic rivalry between the Los Angeles Lakers and Boston Celtics. Fans are encouraged to

shout “Go Lakers!” or “Go Celtics!” upon checking in to any location, and receive a custom

team badge indicating their association. This is somewhat of a different value proposition in that

the game is based on content, rather than location, but initial fan feedback has been extremely

positive [See Appendix 10] (Spoon, 2010). NASCAR could adopt this „shout-out‟ game to

encourage fans to earn badges from their favorite drivers, teams, or sponsors. This could be yet

another way to encourage social community among NASCAR Foursquare users and connect

rewards from sponsors to driver loyalty/association.

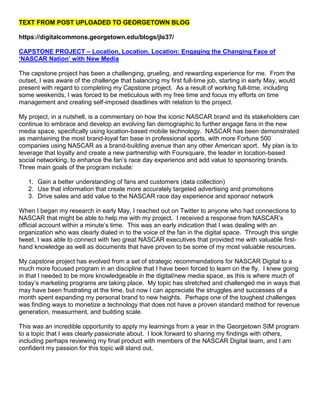

Perhaps more importantly would be using location-based social networking to tap into

NASCAR fans extreme brand loyalty. The use of an application such as Foursquare would be

ideal to this end. In a NASCAR race day setting, where dozens of sponsors activate experiential

marketing programs and teams sell merchandise outside the track, there are numerous potential

check-in points available [See Appendix 9]. A map of Michigan International Speedway‟s Fan

Plaza reveals a myriad of opportunities. For example, a fan could visit activation displays from

brands such as McDonald‟s, Heluva Good, Best Buy and Ford, while also visiting merchandise

trailers for drivers #14 Tony Stewart and #11 Denny Hamlin.

As listed on his personal website, Stewart alone has sponsorship deals with Office Depot,

Burger King, Old Spice, Chevrolet, Coca-Cola, ArmorAll, Bass Pro Shops, Oreo Cookies, Ritz

Crackers, and Oakley. Research has shown NASCAR fans to be loyal customers of the brands

that sponsor their favorite driver. Therefore, location-based technology provides the opportunity

to capitalize on this brand affinity. Through Foursquare, just by checking in to Tony Stewart‟s

merchandise trailer, a fan could automatically receive bar-coded coupons for a percentage off](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-29-320.jpg)

![LOCATION, LOCATION, LOCATION 30

Sponsors or partners that engage in this campaign, as well as NASCAR on a corporate

level, receive several key benefits from this proposed program. First of all, Foursquare user data

provides a better understanding of their consumers, especially those in the mobile space – who

they are, what they like, where they go, etc. Users could update geo-tagged photos to Facebook

or Twitter that capture the NASCAR race day experience and leave feedback about the various

locations they visit, offering further intelligence to NASCAR partners. Secondly, companies are

able to offer more accurately targeted promotions and advertising to their most loyal customers.

Away from the track, fans could add sponsors as friends on Foursquare and receive tips or

notifications if they are close to a participating location. Finally, and likely most important to

NASCAR and sponsors, is the element of revenue generation. For companies partnering with

NASCAR, the game gets some of their most brand-loyal users to the point of sale (or to the point

of brand interaction) both at the track and, later, away from the track. Sales in conjunction with

Foursquare promotions could be tracked and noted for each retail location (take Burger King, for

example). And of course, intangible elements such as brand loyalty tied to future purchase

decisions could be an indirect revenue consideration.

Measurement and data collection are two key elements of this proposed framework.

Foursquare can let NASCAR know who is attending races, where they go before and after the

race and their thoughts on the overall experience. This could lead to partnerships with in-market

hotels, restaurants, or even gas stations (Shell is an official NASCAR sponsor) providing

additional fan touch points. Based on the earlier assertions that the NASCAR fan base

demographics is, in fact, a microcosm of the American population, comparative calculations

have led to an estimated 2.38 million NASCAR fans using the Foursquare application by Q3

2011 [See Appendix 10]. This is a group that, simply, cannot be ignored. Operating under the](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-31-320.jpg)

![LOCATION, LOCATION, LOCATION 33

Entner, R. (2010). Smartphones to overtake feature phones in U.S. by 2011. Nielsen Wire.

Retrieved from http://blog.nielsen.com/nielsenwire/consumer/smartphones-to-overtake-

feature-phones-in-u-s-by-2011/

Fisher, E. (2008). Turner signs Roush Fenway Racing as part of digital push. Sports Business

Journal. Retrieved from http://www.sportsbusinessjournal.com/article/58027

Fisher, E. (2006). Crossing media borders. Sports Business Journal. Retrieved from

http://www.sportsbusinessjournal.com/article/50066

Giangola, Andrew. (2009). Social media in NASCAR. [PowerPoint slides]. Retrieved from

NASCAR, Inc.

Giangola, Andrew. (2009). Social networking-NASCAR for media. [PDF document]. Retrieved

from NASCAR, Inc.

Goldman, A. (2010). Will Foursquare cash in on those check-ins? Connectual [coporate blog].

Retrieved from http://connectual.com/blog/full/foursquare-ads/

Hispanic PR Wire. (2009). New Study Finds 38% of Hispanics are NASCAR Fans, but

Engagement is the Opportunity. HispanicBusiness.com. Retrieved from

http://www.hispanicbusiness.com/news/newsbyid.asp?idx=145310&cat1=news

Hurt, D.A. (2005). Dialed in? Geographic expansion and regional identity in NASCAR.

Southeastern Geographer, 45(1). Retrieved from http://muse.jhu.edu/content/z3950/

journals/southeastern_geographer/v045/45.1hurt.pdf

“Location-based social networks come out swinging.” (2010). The Where Business. Retrieved

from http://news.thewherebusiness.com/content/location-based-social-networks-come-

out-swinging](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-34-320.jpg)

![LOCATION, LOCATION, LOCATION 34

Knowledge@Wharton. (2010). How to generate buzz on social networks. Forbes. Retrieved

from http://www.forbes.com/2010/04/23/foursquare-facebook-yahoo-entrepreneurs-

technology-wharton.html

Marshall, D., & Tice, D.C. (2009). Engage Hispanic race fans through speed, success,

community. Sports Business Journal. Retrieved from

http://www.sportsbusinessjournal.com/article/61513

Metrics: NASCAR.com. (2010). Turner Sports and Entertainment Digital. Retrieved from

http://tsed.turner.com/nascar/metrics

Miller, G. (2009). Sponsor loss a problem for NASCAR. AOL Fanhouse. Retrieved from

http://motorsports.fanhouse.com/2009/09/24/sponsor-loss-a-problem-for-nascar/

Moore, G. (2010). Foursquare leads new mobile advertising model. Mass High Tech: The

Journal of New England Technology. Retrieved from http://www.masshightech.com/

stories/2010/04/26/daily10-Foursquare-leads-new-mobile-advertising-model.html

Nakao, K. (2010). 5 things you need to know about location-based social media. Mashable.

Retrieved from http://mashable.com/2010/03/19/location-based-strategy/

NASCAR. (2010). About NASCAR.com. NASCAR. Retrieved from http://www.nascar.com/

guides/about/

NASCAR. (2010). NASCAR.com user profile. NASCAR. Retrieved from NASCAR, Inc.

NASCAR. (2009). Brand Brochure [PDF Document]. Retrieved from NASCAR, Inc.

NASCAR. (2009, November 2). NASCAR honored with two major awards for listening to fans.

[Press Release]. Retrieved from http://www.catchfence.com/2009/sprintcup/11/02/

nascar-honored-with-two-major-awards-for-listening-to-fans/](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-35-320.jpg)

![LOCATION, LOCATION, LOCATION 35

NASCAR. (2009). NASCAR announces citizen journalists media corps. [Press Release].

Retrieved from http://www.nascar.com/2009/news/headlines/official/07/17/

citizen.journalists.announced/index.html

NASCAR. (2007). NASCAR.com launches Spanish-centric web site. [Press Release]. Retrieved

from http://www.nascar.com/2007/news/headlines/official/09/13/ en.espanol/

NASCAR. (2007). NASCAR site set for first change in 5 years. [Press Release]. Retrieved

from http://www.nascar.com/2007/news/headlines/cup/01/22/nascar.com.

improvements/story_single.html#page2

NASCAR Market & Media Research. (2009). NASCAR Fans and Digital / Social Media.

[PowerPoint slides]. Retrieved from NASCAR, Inc.

Newman, J.I. (2007). A detour through `NASCAR nation': Ethnographic articulations of a

neoliberal sporting spectacle. International Review for the Sociology of Sport, 42(3),

Retrieved from http://irs.sagepub.com/cgi/content/abstract/42/3/289 doi:

10.1177/1012690207088113

Newman, J.I., & Beissel, A.S. (2009). The limits to “NASCAR nation”: Sport and the “recovery

movement” in disjunctural times. Sociology of Sport Journal, 26(4), Retrieved from

http://hk.humankinetics.com.proxy-um.researchport.umd.edu/eJournalMedia/pdfs/

17691.pdf

Online computer viewers: professional - market research/demographics. (2009). SBRnet Sports

Business Research, Retrieved from https://campus.georgetown.edu/webapps/portal/

frameset.jsp?tab_tab_group_id=_2_1&url=%2Fwebapps%2Fblackboard%2Fexecute%2F

launcher%3Ftype%3DCourse%26id%3D_126195_1%26url%3D](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-36-320.jpg)

![LOCATION, LOCATION, LOCATION 36

Online mobile viewers: professional - market research/demographics. (2009). SBRnet Sports

Business Research, Retrieved from https://campus.georgetown.edu/webapps/portal/

frameset.jsp?tab_tab_group_id=_2_1&url=%2Fwebapps%2Fblackboard%2Fexecute%2F

launcher%3Ftype%3DCourse%26id%3D_126195_1%26url%3D

Ryan, N. (2009). Identity crisis: can NASCAR reach old, new fans effectively? USA Today.

Retrieved from http://www.usatoday.com/sports/motor/nascar/2009-07-01-nascar-

identity-crisis_N.htm

Scarborough research examines NASCAR fan demographics. (2009). Sports Business Journal.

Retrieved from http://www.sportsbusinessdaily.com/article/127802

Scarborough research examines NASCAR fan demographics. (2007). Sports Business Journal.

Retrieved from http://www.sportsbusinessdaily.com/article/109622

Scarborough Research USA. (2010). 2010 NASCAR fan base demographics [Press Release].

Retrieved from https://nascar-assets.americaneagle.com/assets/1/Page/2010%20

NASCAR%20Fan%20Base%20Demographics.pdf

Schwartz, M. (2009). NASCAR: Driving social media. Ad Age. Retrieved from

http://brandedcontent.adage.com/integratedmedia09/news.php?id=111&pid=17

Smith, M. (2009). Facility a media hub for all things NASCAR. Sports Business Journal.

Retrieved from http://www.sportsbusinessjournal.com/article/62474

Spoon, R. (2010, June 3). Foursquare teams up with NBA for Lakers / Celtics Final. [Web log

comment]. Retrieved from http://ryanspoon.com/blog/2010/06/03/foursquare-teams-up-

with-nba-for-lakers-celtics-finals/](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-37-320.jpg)

![NASCAR Foursquare at the Track

Check in and connect ADS

with your favorite

NASCAR drivers and

sponsors this weekend

in Sonoma, CA at

Take a look a list of check-in locations for this FROM

weekend’s race http://nascar.com/foursquare

Infineon Raceway!

Get in on the action at Goodyear, the Official tire of NASCAR, becomes NASCAR

www.foursquare.com first sponsor to offer virtual check-in option [LINK]

COMMENTS

___ People Like This SPONSORS

To get in on the Foursquare at the Track

program, sign up for an account at

http://www.foursquare.com

Photos

What was your favorite check-in location at

Michigan International Speedway’s Fan Plaza this

past weekend?

COMMENTS

Events

(Upcoming races)](https://image.slidesharecdn.com/georgetownuniversitysimmasterscapstoneproject-laneerrington-110302150917-phpapp02/85/Location-Location-Location-Engaging-the-Changing-Face-of-NASCAR-Nation-with-New-Media-77-320.jpg)