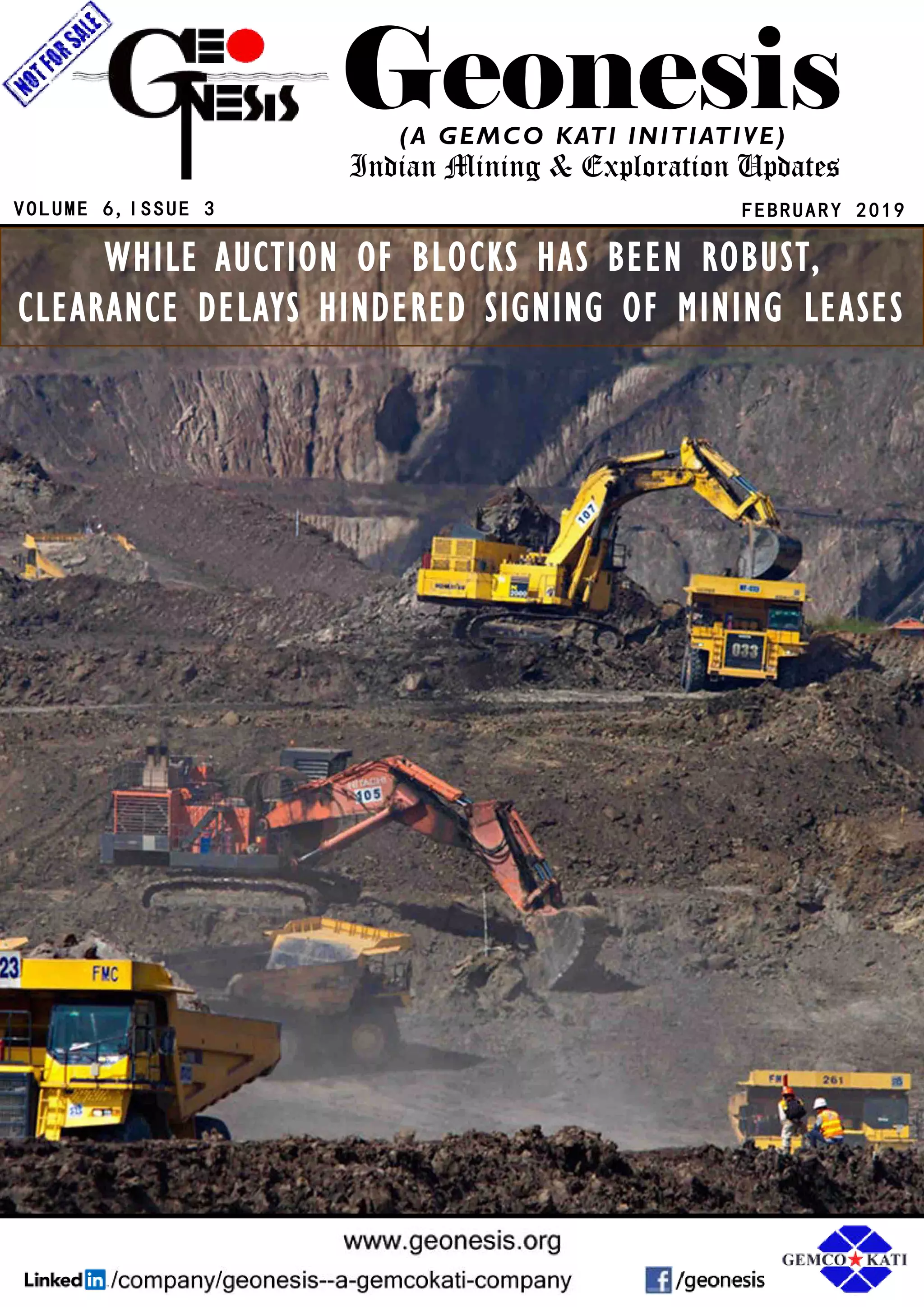

The document discusses delays in signing mining leases for mineral blocks that have been auctioned in India. While 53 mineral blocks have been successfully auctioned since 2015, bringing in significant revenues, only 2 blocks have actually been granted mining leases. The main issue causing delays is obtaining the necessary clearances from state governments, such as land, environment, and forest clearances. Unless these clearance issues are addressed, more delays are expected in signing leases and starting production from the already auctioned blocks. This could negatively impact mineral production and availability in India. The government is looking to implement measures like a single window clearance system to help expedite the clearance process.