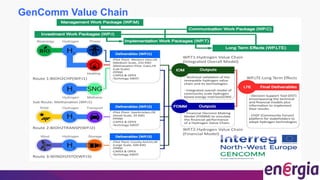

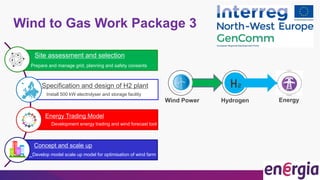

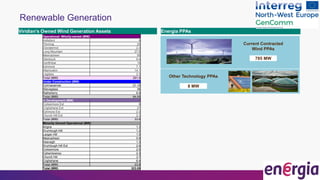

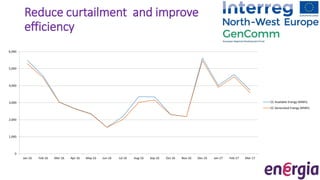

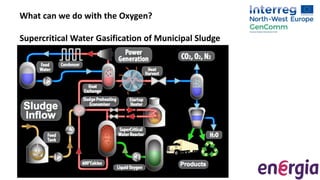

This document discusses the GENCOMM project which aims to improve energy security in remote communities through the generation and storage of hydrogen from renewable sources like wind and solar power. It outlines the objectives and work packages of the project which include developing an energy trading model, installing an electrolyzer and hydrogen storage facility, and exploring uses for hydrogen like fuel cells and power-to-gas applications. The overall goal is to create an energy system that utilizes hydrogen as an energy carrier to provide electricity, heating and transportation fuels from local renewable resources in order to reduce curtailment and improve efficiency.