Embed presentation

Downloaded 22 times

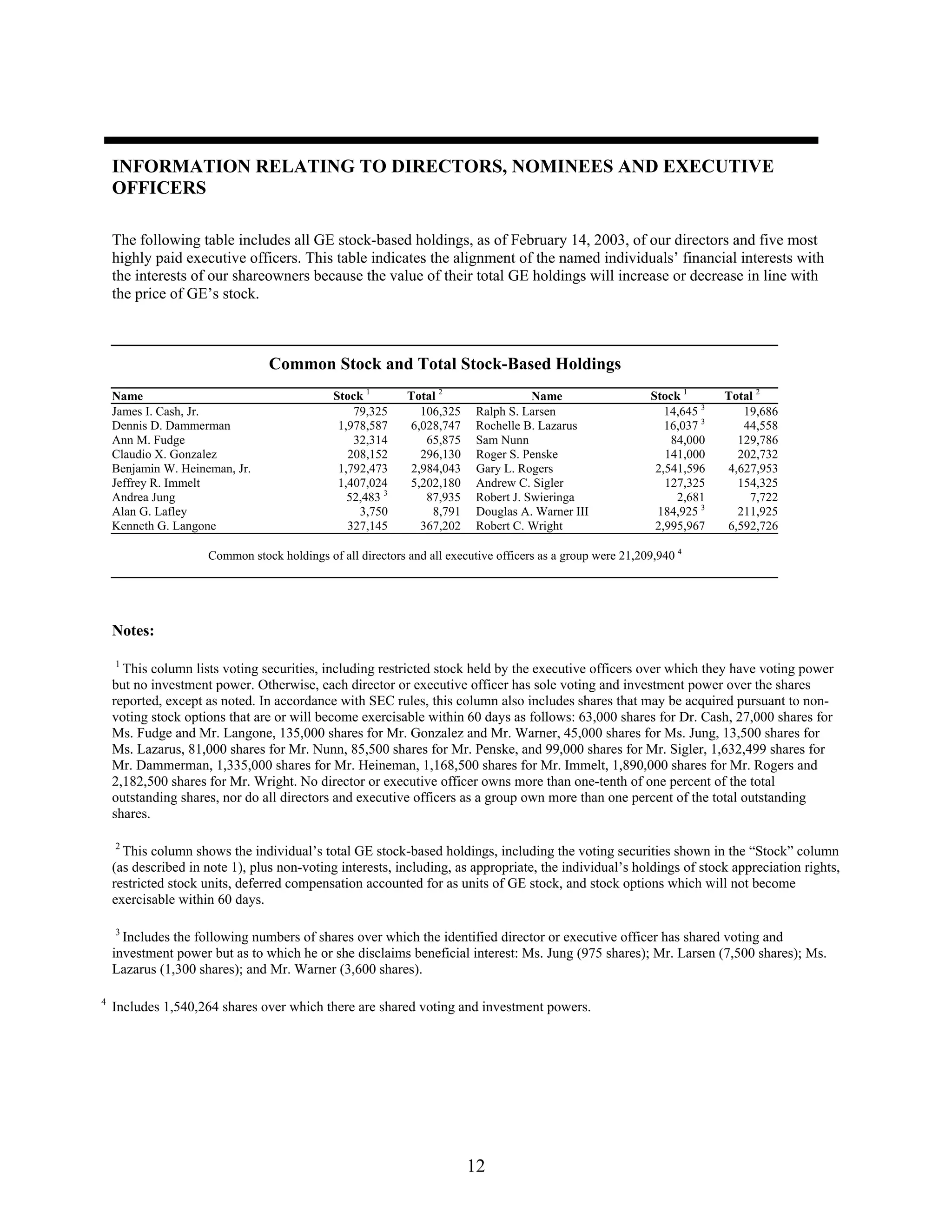

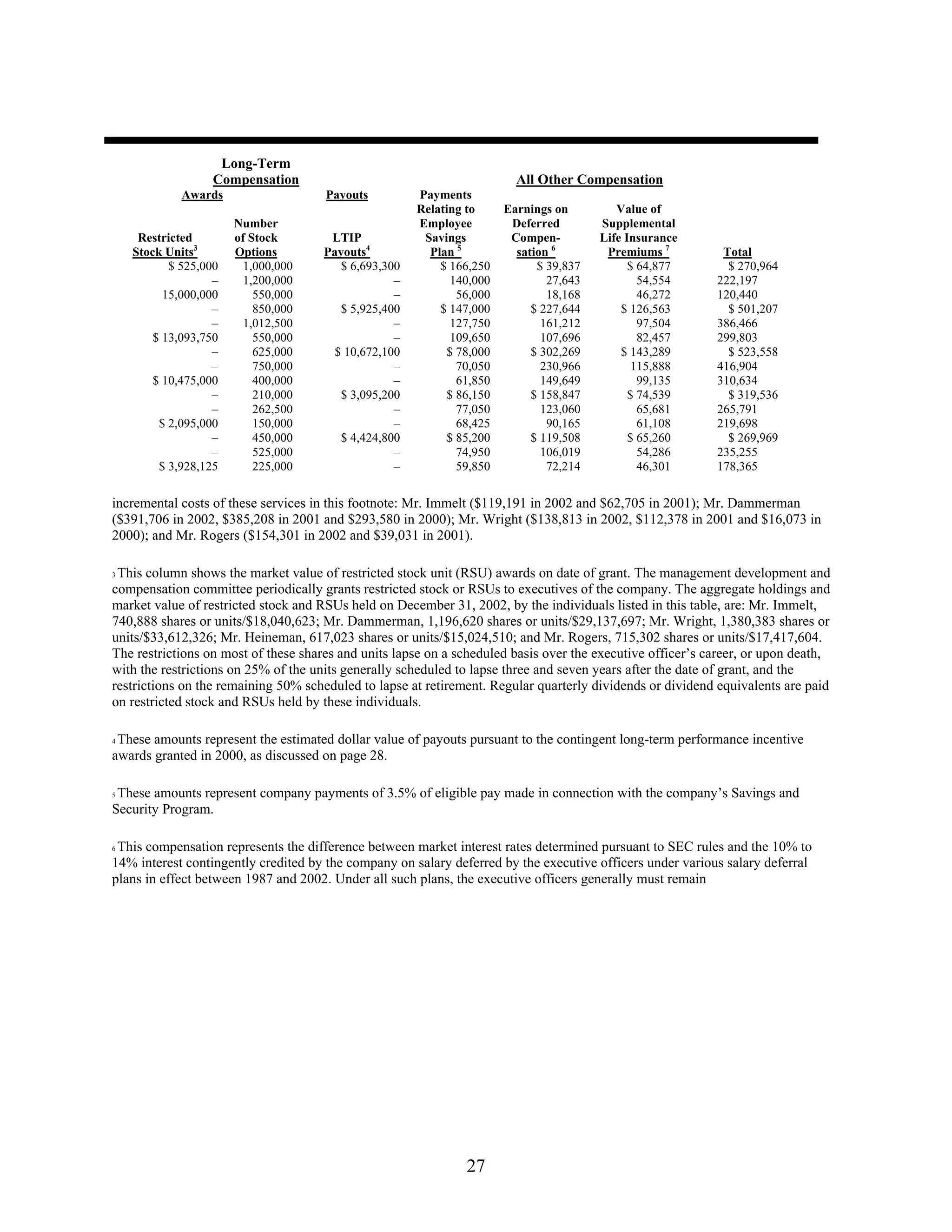

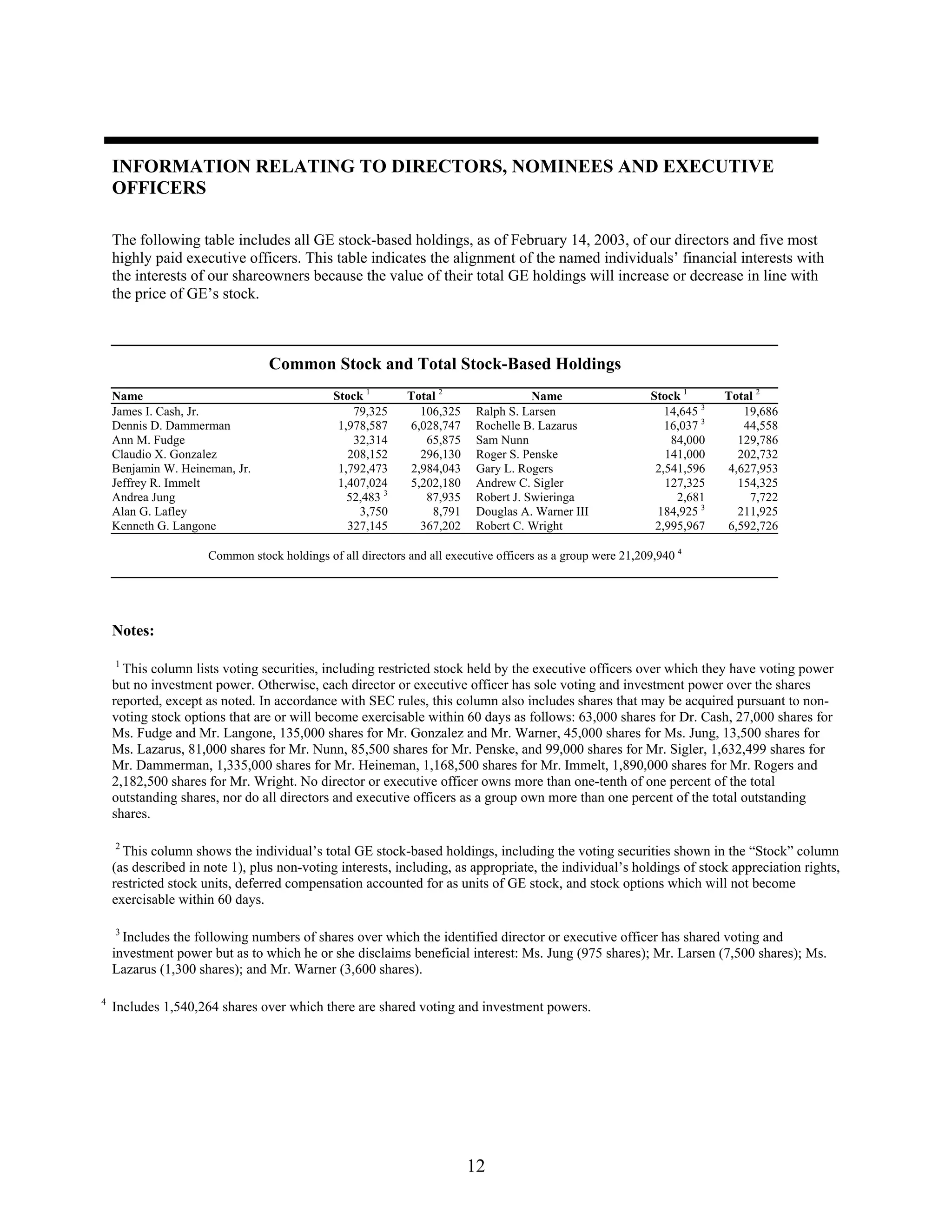

The document is a notice and proxy statement for General Electric's 2003 annual shareholder meeting. It provides details on the meeting such as date, time, location, and items to be voted on including election of directors and appointment of auditors. It also includes biographies of the 17 nominees for election to the board of directors.