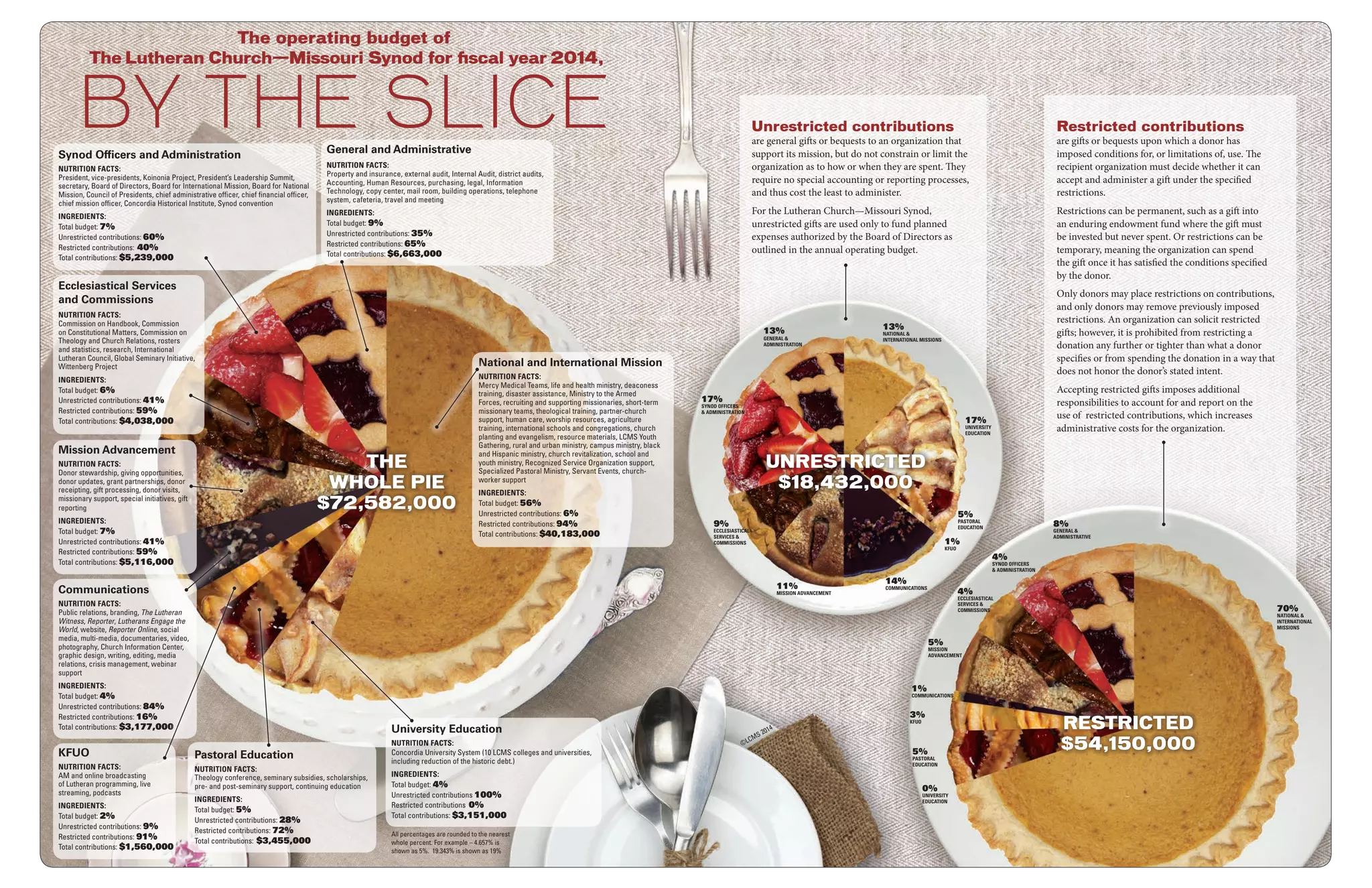

Restricted contributions are gifts with conditions or limitations imposed by the donor on how the funds can be used. Organizations must decide if they can accept restricted gifts and are responsible for properly accounting for and reporting on their use. Restrictions can be permanent, requiring the funds only be invested, or temporary, allowing spending once conditions are met. Only donors can place or remove restrictions on contributions. Unrestricted contributions have no constraints on their use and have lower administrative costs for organizations.