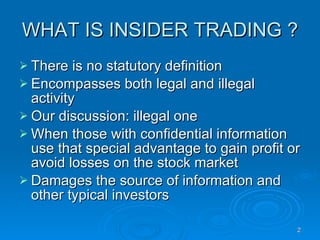

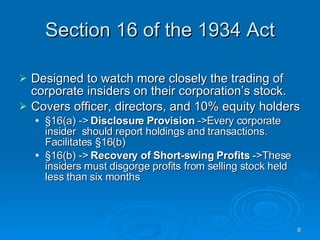

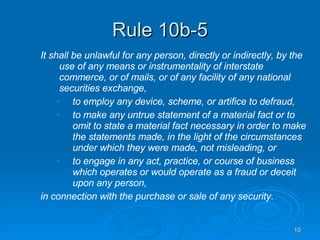

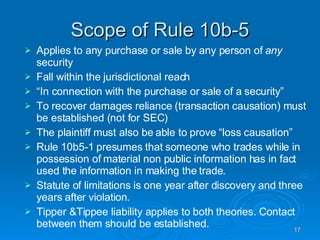

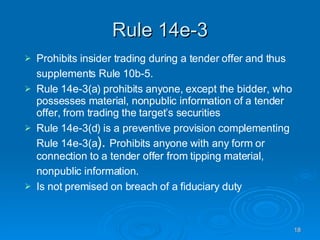

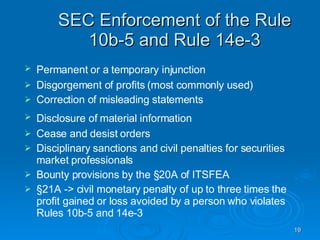

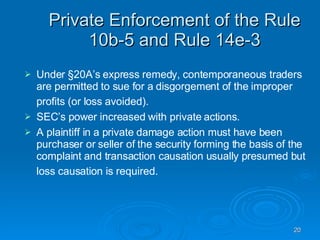

- Insider trading regulations aim to curb the unfair use of non-public information to gain profits in securities trading. The US has the most comprehensive regulations, including Section 16, Rule 10b-5, and Rule 14e-3.

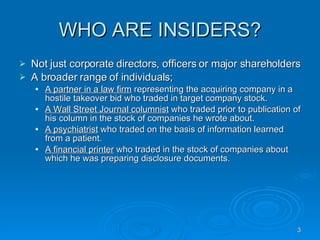

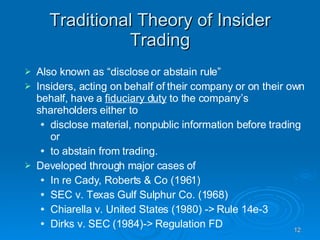

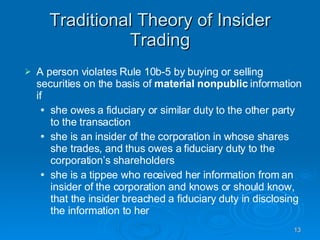

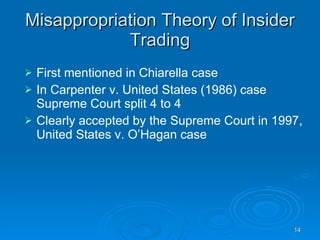

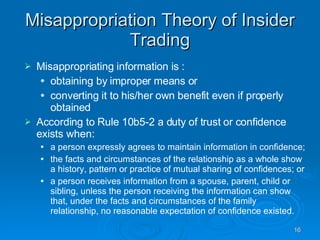

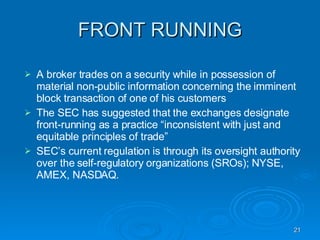

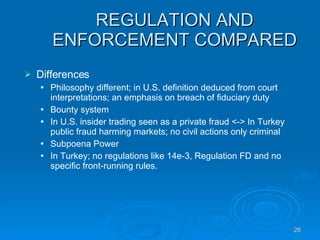

- Insider trading can be illegal under the "traditional" and "misappropriation" theories. The traditional theory prohibits trading based on a fiduciary duty breach, while the misappropriation theory prohibits improper use of information regardless of the source.

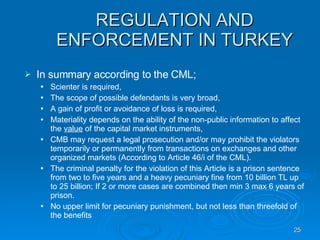

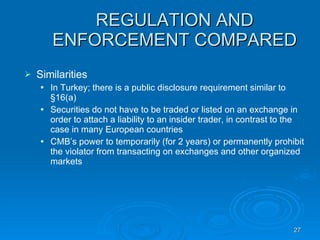

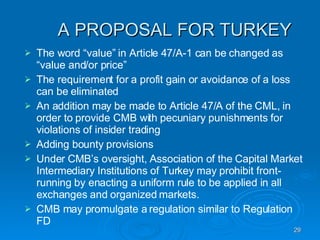

- Turkey has begun regulating insider trading but its laws and enforcement are less extensive than in the US. The document proposes expanding Turkey's regulations and enforcement efforts to further develop its capital markets.