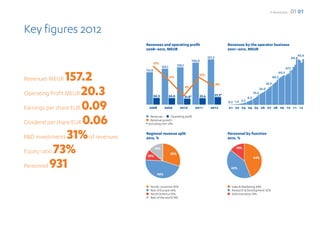

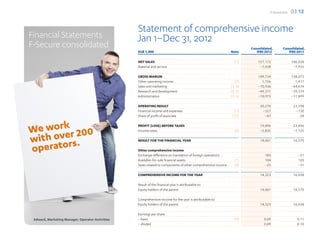

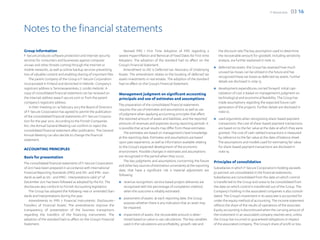

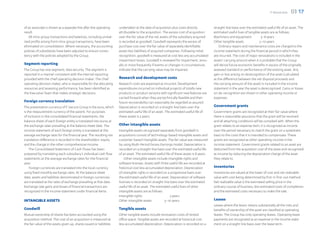

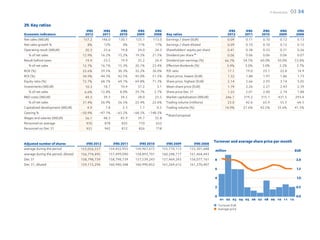

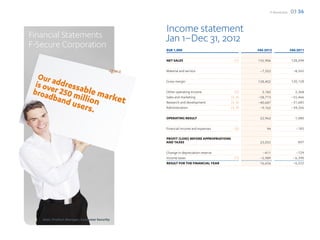

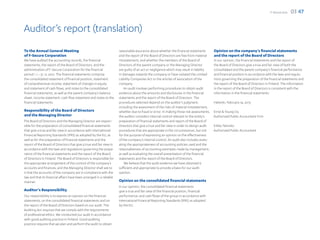

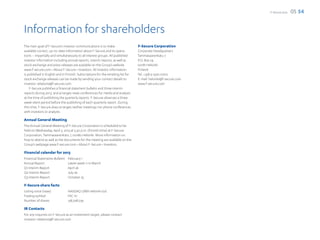

The F-Secure 2012 Annual Report highlights the company's commitment to protecting digital lives through its internet security and content cloud services over the past 25 years. In 2012, F-Secure reported revenues of EUR 157 million, showing an 8% growth along with solid performance through operator channels. The report emphasizes strategic growth through convergence of security and cloud services, alongside a focus on meeting the needs of the evolving digital consumer landscape.