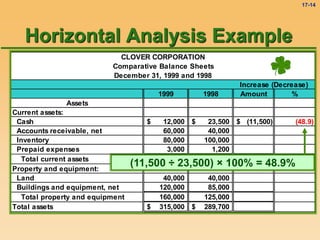

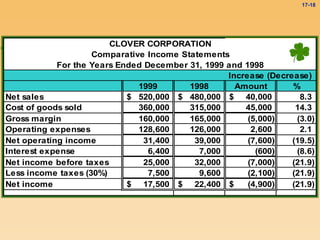

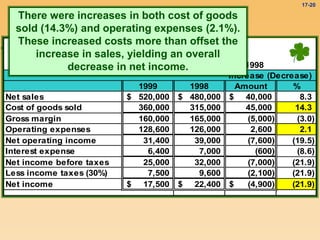

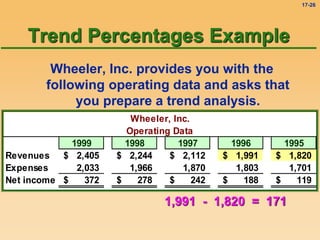

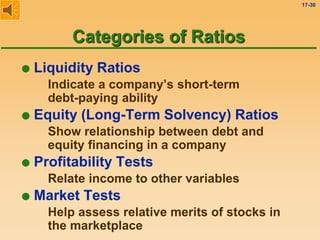

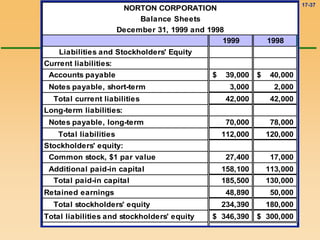

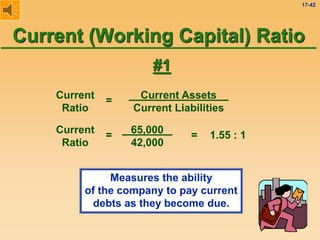

The document provides an overview of various methods for analyzing financial statements, including horizontal analysis, vertical analysis, common-size statements, trend percentages, and ratio analysis. It provides examples of each type of analysis using sample financial statement data from fictional companies. Horizontal analysis involves calculating dollar or percentage changes in items from one period to the next. Vertical analysis expresses each financial statement item as a percentage of a total. Trend percentages show changes over time. Ratio analysis expresses logical relationships between financial statement items.