- Credit repair companies often make false promises through ads that they can quickly and easily remove accurate negative information from credit reports. However, there is no quick fix - you can only improve your credit report over time through making conscious efforts like sticking to a debt repayment plan.

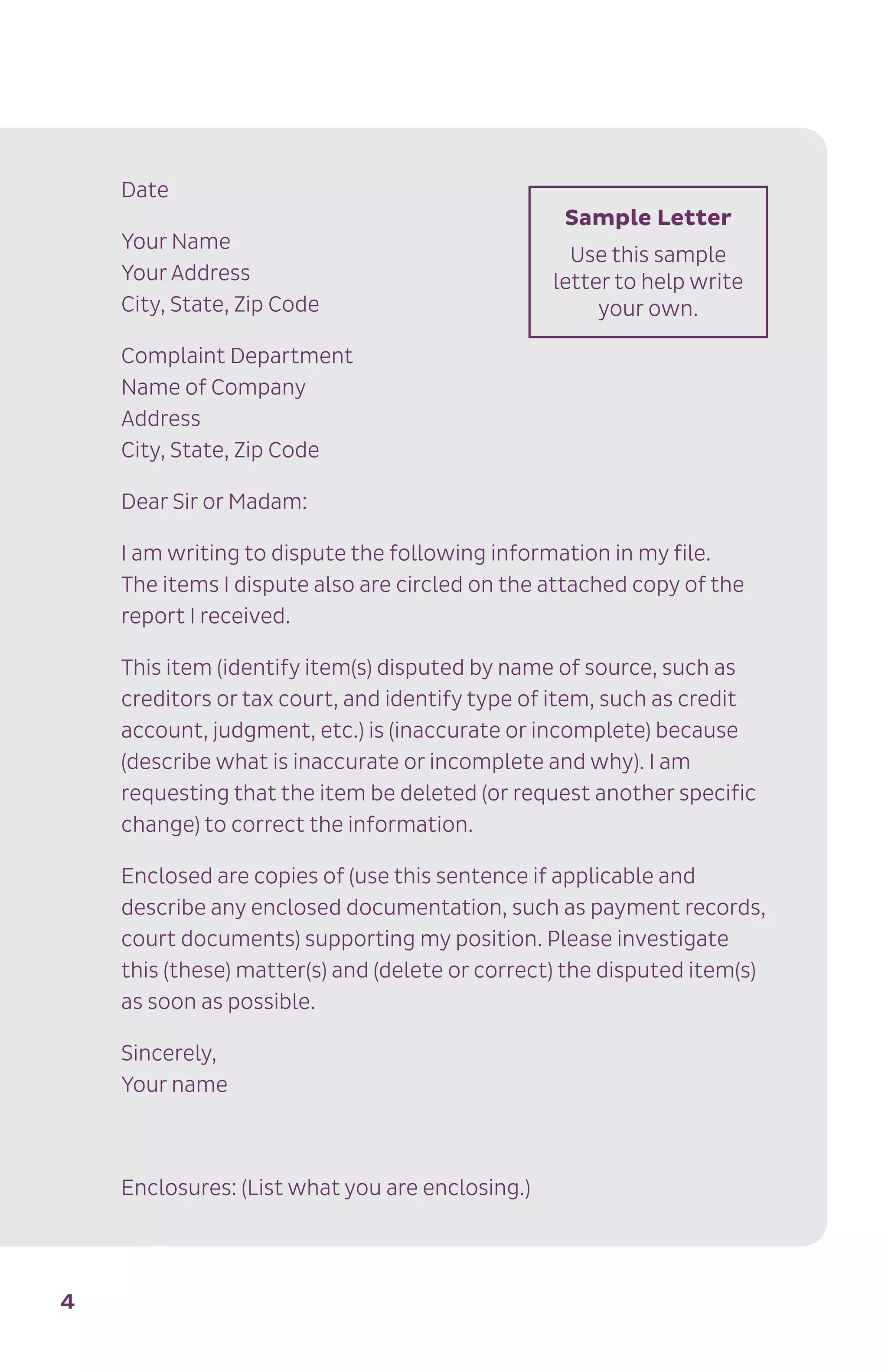

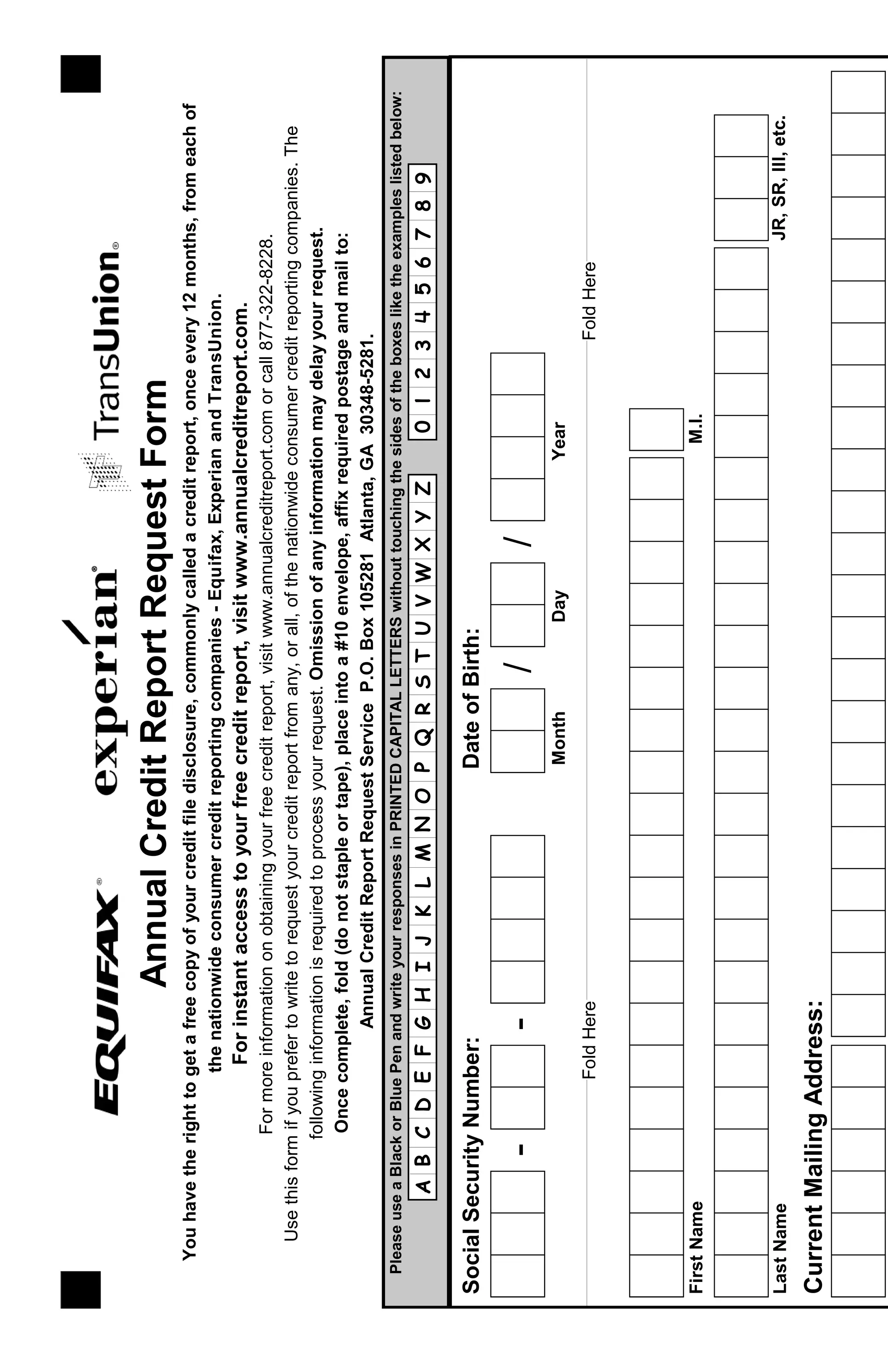

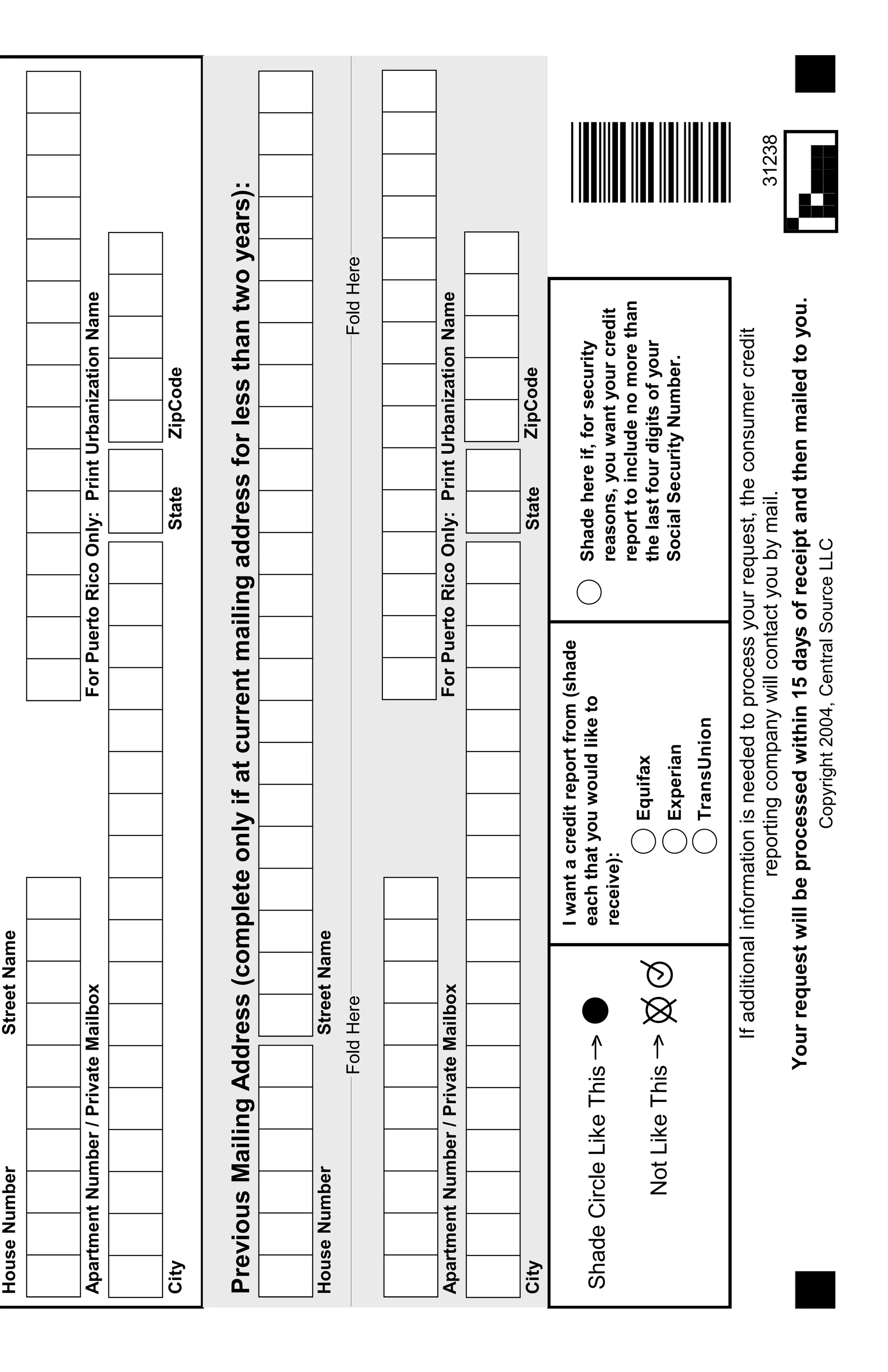

- Individuals have the right to obtain a free credit report once per year from each of the three major credit bureaus and dispute any inaccurate information directly with the credit bureaus and information providers. If information is inaccurate, it must be removed or corrected.

- Accurate negative information can only be removed from credit reports after 7-10 years, depending on the type of information. The Credit Repair Organizations Act regulates credit repair companies and prohibits them