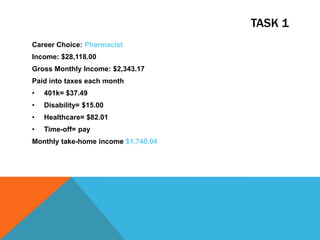

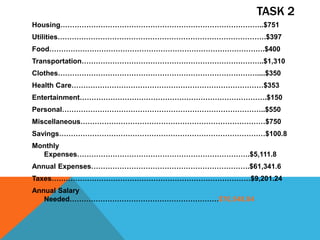

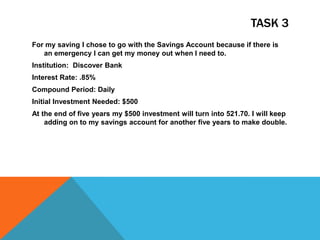

The document discusses a pharmacist's career choice and monthly finances. It outlines that the pharmacist earns a gross monthly income of $2,343.17 but takes home $1,740.04 after taxes, 401k, and other deductions. Monthly expenses total $5,111.80, exceeding take home pay. The document then analyzes savings and investment options, purchasing a TV on credit, and choices for buying a new or used car. In the final task, it notes monthly expenses are 61.02% of earnings and the pharmacist would put leftover money into savings and investigate other investment options.