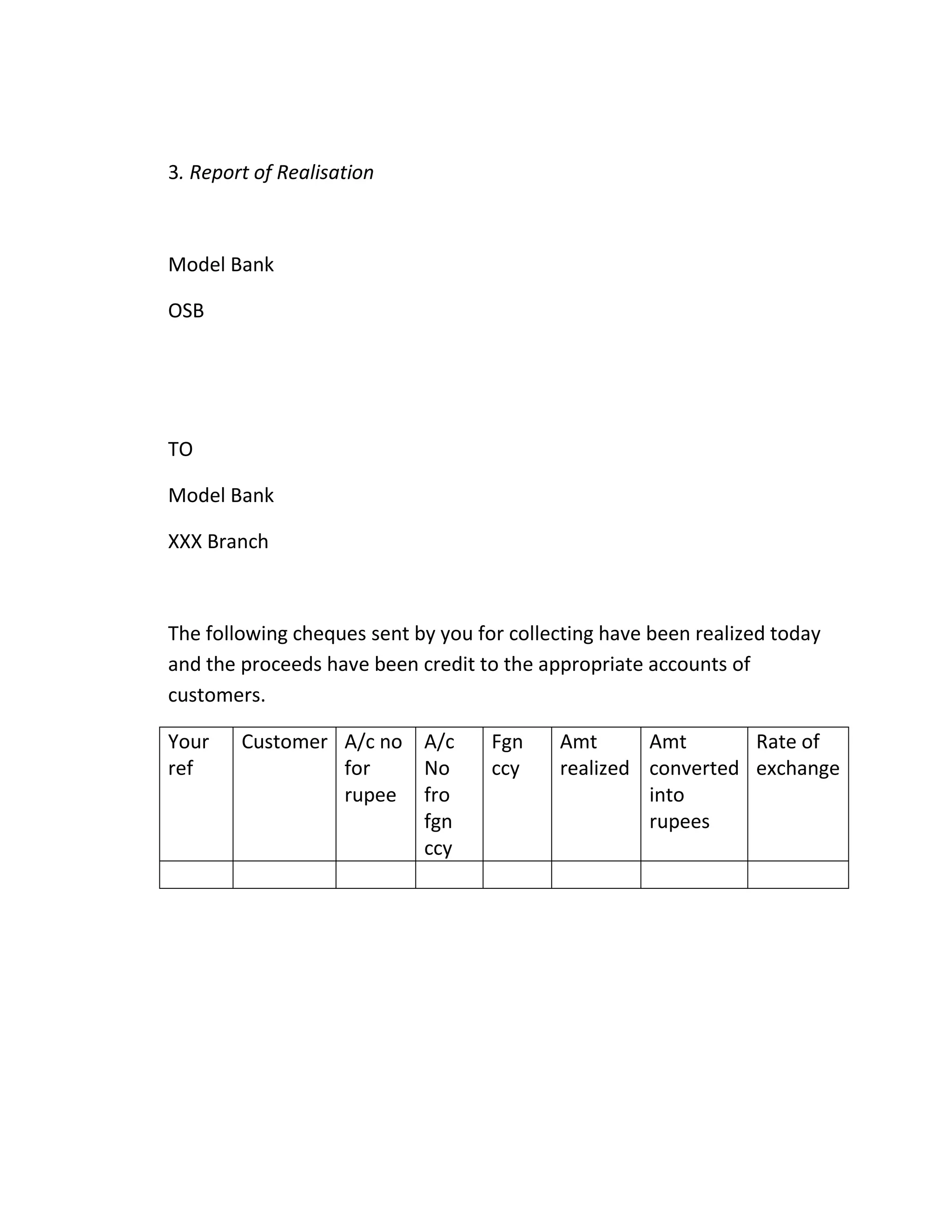

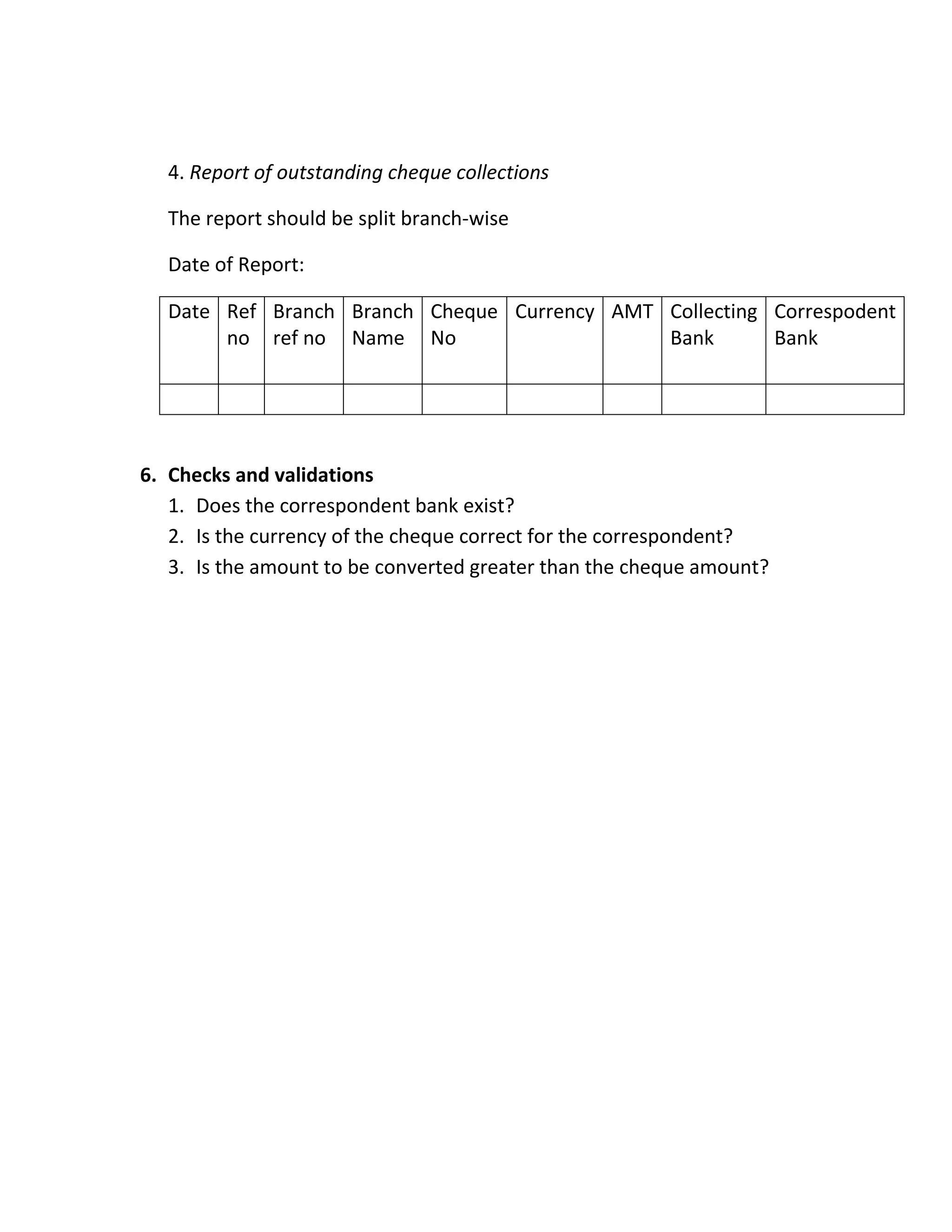

The document describes the foreign cheque collection process at Model Bank. It outlines the current manual process and issues with it. It proposes developing an automated system to computerize the process. Key reports needed include covering schedules for cheques sent to collecting banks, reports of cheques sent and realized sorted by collecting/correspondent bank and currency, and a report of outstanding cheque collections by branch. Validations in the new system would check that correspondent banks, currencies, and conversion amounts are correctly entered.